Dear Mr. Charnoble,

It appears that you are awake at this late hour. If so, might you be available for a meeting? You can come to my office in the Empire State Building. Let me know if I should expect you.

Thanks,

Mitchell Zukor

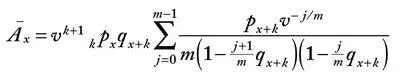

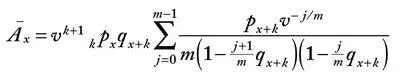

He clicked back to his spreadsheet. In two adjacent columns he’d listed every Fitzsimmons employee number and the annuity owed to them should they be killed on the job. To calculate this figure, he had written a formula that took into account age, marital status, health rating, number of dependents, professional standing, salary level, and vacation day usage. It looked like this:

Mitchell scrolled down to his own listing. He had no dependents or spouse and one of the lowest salaries on staff. So despite his young age, the value of his life to Fitzsimmons Sherman ($266,213) was significantly lower than the lives of most of his colleagues. He even came in below Lucy Fleishaker ($271,533), the assistant manager’s chubby, doe-eyed secretary, owing to the fact that she was the sole caretaker of her epileptic older sister and therefore listed a dependent on her tax form. He thought of how few people depended on him — of his slumlord father and his mother, a matriarchal tornado tearing across the midwestern plains — and he started to wonder whether $266,213 was much too high.

The e-mail icon illuminated.

Dear Mr. Zukor,

I agree. There is no time to lose.

Thanks,

Alec

Mitchell reread the note, the ginger ale going flat on his tongue. The intercom rang. It was the night guard at the desk downstairs. Mr. Zukor had a visitor.

3.

“Mitchell,” said Alec Charnoble, extending a long, bony arm. “If I may.”

It was not a bright idea, he realized now, inviting a maniac to his office at four in the morning. Even his most masochistic colleagues had gone home — even the tactical research analyst across the hall, who every night wandered the corridors repeating phrases that he seemed to find soothing, such as “Gaussian processes are stochastic processes, stochastic processes are Markov processes, and Markov processes are Gaussian processes.” The international market analysts — the BSE Bears, the Bolsa Bulls, the Hang Seng Sheep, the Micex Mice — they were on the clock all night, but they worked upstairs in the Penthouse. It had occurred to Mitchell, just before the elevator chimed, that he had blundered into a new type of worst-case scenario. The worst scenarios were always the ones you didn’t anticipate, at least not until too late, but now it was so plainly obvious that he couldn’t believe he hadn’t seen it coming: the madman would be very strong, he would have tools, large, dull steel tools, and a metal glint in his eye.

But when the elevator doors parted, Mitchell was surprised to see a man who seemed nothing like a killer, at least not the kind who committed the act in cold blood. Alec Charnoble more closely resembled the type of businessman who, with the press of a button, detonates mortgages or pension funds in some suburban hamlet on the other side of the country. He was tall but thin, with a weak, hollow chest, wheaten hair, and gray oval eyes. His navy pin-striped suit and yellow tie were cleanly pressed; despite the hour he seemed as alert as a bright bronze bell.

“Alec Charnoble,” said the man, his face creasing in a tight grin.

Without asking permission, Charnoble carried a chair into Mitchell’s cubicle, so that the two men had to share the space. Their knees grazed.

“I never listen to preambles,” said Charnoble, “so I won’t bore you with one.”

Mitchell shifted in his chair and his leg pressed against Charnoble’s. A tepid queasiness passed over him like a blush.

“Imagine something terrible happens,” said Charnoble.

“I do. Often.”

“Really.” Charnoble frowned, impressed. “It should not be difficult for you then. Well, say this building is destroyed. So-and-so many people die—”

“So-and-so?”

Charnoble pushed back his shirtsleeves as if he were preparing to conduct some serious bit of manual labor — to dig a grave, for instance. Mitchell noticed that Charnoble wore two watches, one on each slender wrist.

“You need an example? Take Seattle. You’ve seen what happens. It’s really not fair, is it. The victims’ families take out their anger on the corporations. The company’s investors, tallying their massive financial losses, are equally enraged. Why didn’t you move the office out of danger? Why didn’t you plan for this? The investors, like the families of the dead, also want money.”

Charnoble tapped his forefinger into his palm in somber emphasis of his point.

“Money,” he repeated. “Money. Money. Money—”

“Listen,” said Mitchell. “I’m just about to finish a project here. Can you leave me your card?”

Charnoble pretended not to hear. “The corporation,” he continued, “has only one response: We didn’t see it coming either . Unfortunately, as we’ve seen in Seattle, this response doesn’t hold up in court. And because they have no catastrophe coverage, they’re out, at the very minimum, several hundred million dollars.”

Mitchell saw that he was going to have to wait this through.

“Listen,” said Charnoble. “I’m not immoral or anything like that.”

“Of course not.”

“It’s only that disasters happen, no matter how much you prepare. Just because you build a bomb shelter doesn’t mean you’ll be inside when the bombs fall. And if it’s not a bombing, it’s a war, a tsunami, an envelope stuffed with ricin. An earthquake .”

He appeared to be a snake, this guy. But he wasn’t quite guileful enough. The real reptiles never look like reptiles — they’re too skilled at camouflage. Still, it made Mitchell wonder: When he went on about his worst-case scenarios, did he sound like Charnoble? He doubted it. He didn’t have the rank phoniness, the condescension, the folksy camaraderie. People like Charnoble — and Fitzsimmons was full of them, especially in Securities and Lender Finance — were interested in risk for purely financial reasons. They saw the wedges that risk offered, the way you could use risk to get between clients and their money. Mitchell’s fear, on the other hand, was real, hot, viral. Just the previous night he couldn’t sleep because he’d been trying to figure out why a global pandemic as severe as the influenza of 1918 hadn’t recurred, and whether one was imminent. He had read about a new superbug called New Delhi metallo-beta-lactamase, or NDM-1. This Indian bug was a product of the twenty-first century, resistant to antibiotics. In the last four decades, scientists had discovered nearly no new antibiotics; an airborne mutation of NDM-1 would be unvanquishable. It would quickly contaminate every hospital in the world. There would be no cancer treatment, transplants, care of preterm babies, even tonsillectomies or appendectomies, without the risk of fatal infection. NDM-1—this was the kind of thing that Mitchell pondered. Not just NDM-1, but also its inevitable heirs: NDM-2, NDM-3, NDM-4, each mutation more aggressive than the last. The youngest child always caused the most trouble. Until the next one came along.

“As we’ve learned,” Charnoble continued, “whenever there’s a catastrophe, Corporate is vulnerable. Corporate has to clean up the mess — in a manner of speaking. This is where FutureWorld comes in.”

“So FutureWorld protects the company against disaster? That’s impossible.”

“You’re right. We don’t protect. We advise . We predict catastrophes, calculate their costs, and help our clients avoid unnecessary risk.”

Читать дальше