10 Part 6: Appendixes Appendix A: Resources for Gold and Silver Investors Websites and Blogs Newsletters and Advisories News and Commentary Sites for Gold and Silver Information Gold and Silver YouTube Channels Books about Gold and Silver Other Books of Interest to Gold and Silver Investors Trade Associations and Industry Sources Government Agencies Gold and Silver ETFs Gold and Silver Dealers Buying Services Futures and Options Resources Cryptocurrencies Related to Gold and Silver Technical Analysis Brokers Appendix B: Gold and Silver Investments Major Gold Mining Stocks Major Silver Mining Stocks Gold-Related ETFs Silver-Related ETFs Mutual Funds

11 Index

12 About the Author

13 Advertisement Page

14 Connect with Dummies

15 End User License Agreement

1 Chapter 4 TABLE 4-1 Risk Levels of Precious Metals Investments

2 Chapter 5 TABLE 5-1 Gold’s “Tale of the Tape”

3 Chapter 6TABLE 6-1 Silver’s “Tale of the Tape” in the First Part of 2020

4 Chapter 8TABLE 8-1 Precious Metals High-Profile Performers, 2000–2020 (In Alphabetical Or...TABLE 8-2 ETF Issuers

5 Chapter 9TABLE 9-1 Paper Assets and Potential Risks

6 Chapter 10TABLE 10-1 Sheldon Scale Rundown of Grades

7 Chapter 12TABLE 12-1 Precious Metals Futures ContractsTABLE 12-2 Delivery Month SymbolsTABLE 12-3 Mini-Futures ContractsTABLE 12-4 Calendar Spread Trade *

8 Chapter 13TABLE 13-1 Call Options: Rights and ObligationsTABLE 13-2 Put Options: Rights and ObligationsTABLE 13-3 The Zero-Cost Collar in ActionTABLE 13-4 The Straddle in ActionTABLE 13-5 Options on Regular FuturesTABLE 13-6 Options on Mini-Futures

9 Chapter 14TABLE 14-1 Possible Choices for Stock Trading with OptionsTABLE 14-2 Possible Choices for Futures Trading with Options

10 Chapter 17TABLE 17-1 Precious Metals Assets and Gains

11 Chapter 22TABLE B-1 Major Gold Mining Stocks on the NYSETABLE B-2 Major Silver Mining Stocks on the NYSETABLE B-3 Gold-Related ETFsTABLE B-4 Silver-Related ETFs

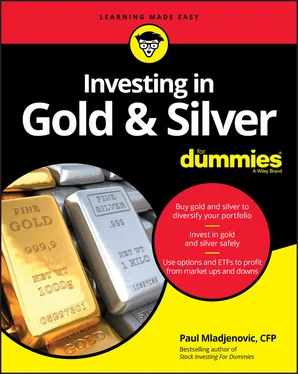

1 Chapter 1FIGURE 1-1: Unlike most other investments, you can hold gold and silver bars fo...

2 Chapter 5FIGURE 5-1: Gold’s price performance since the beginning of this century.

3 Chapter 6FIGURE 6-1: Silver’s performance for January 2000 to 2020.

4 Chapter 9FIGURE 9-1: Gold Eagle Coin. FIGURE 9-2: Krugerrand. FIGURE 9-3: Canadian Maple Leaf Coin. FIGURE 9-4: Gold bars. FIGURE 9-5: Silver Eagle Coin.

5 Chapter 10FIGURE 10-1: The ultra high relief $20 Saint-Gaudens double eagle gold coin iss...

6 Chapter 11FIGURE 11-1: JNUG chart December 2019 to February 2020. FIGURE 11-2: JNUG chart February 2020 to July 2020. FIGURE 11-3: Typical highs and lows include A start, B upleg, C downleg, and D ...

7 Chapter 12FIGURE 12-1: Chart of gold price as it ebbs and flows across 2019. FIGURE 12-2: Chart of gold from 2000 to 2020. It’s bullish and slopes upward.

8 Chapter 15FIGURE 15-1: Generic chart sloping in a definite downward direction. FIGURE 15-2: Generic chart showing a sideways pattern. FIGURE 15-3: Chart that simultaneously shows an uptrend, downtrend, and sideway...FIGURE 15-4: Chart that shows the jagged edge going upward along with the trend...FIGURE 15-5: Chart showing channel.

1 Cover

2 Title Page

3 Copyright

4 Table of Contents

5 Begin Reading

6 Index

7 About the Author

1 i

2 ii

3 1

4 2

5 3

6 5

7 6

8 7

9 8

10 9

11 10

12 11

13 12

14 13

15 14

16 15

17 16

18 17

19 18

20 19

21 21

22 22

23 23

24 24

25 25

26 26

27 27

28 28

29 29

30 30

31 31

32 32

33 33

34 34

35 35

36 36

37 37

38 38

39 39

40 40

41 41

42 42

43 43

44 44

45 45

46 46

47 47

48 48

49 49

50 50

51 51

52 52

53 53

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 69

68 70

69 71

70 72

71 73

72 74

73 75

74 76

75 77

76 78

77 79

78 80

79 81

80 82

81 83

82 84

83 85

84 86

85 87

86 88

87 89

88 90

89 91

90 92

91 93

92 94

93 95

94 96

95 97

96 98

97 99

98 100

99 101

100 102

101 103

102 104

103 105

104 106

105 107

106 108

107 109

108 110

109 111

110 112

111 113

112 114

113 115

114 116

115 117

116 119

117 120

118 121

119 122

120 123

121 124

122 125

123 126

124 127

125 128

126 129

127 130

128 131

129 133

130 134

131 135

132 136

133 137

134 138

135 139

136 140

137 141

138 142

139 143

140 145

141 146

142 147

143 148

144 149

145 150

146 151

147 152

148 153

149 154

150 155

151 156

152 157

153 158

154 159

155 160

156 161

157 162

158 163

159 164

160 165

161 166

162 167

163 168

164 169

165 170

166 171

167 172

168 173

169 174

170 175

171 176

172 177

173 178

174 179

175 180

176 181

177 182

178 183

179 184

180 185

181 186

182 187

183 188

184 189

185 190

186 191

187 192

188 193

189 194

190 195

191 196

192 197

193 198

194 199

195 201

196 202

197 203

198 204

199 205

200 206

201 207

202 208

203 209

204 210

205 211

206 212

207 213

208 214

209 215

210 216

211 217

212 218

213 219

214 220

215 221

216 222

217 223

218 224

219 225

220 226

221 227

222 228

223 229

224 230

225 231

226 232

227 233

228 234

229 235

230 236

231 237

232 238

233 239

234 240

235 241

236 243

237 244

238 245

239 246

240 247

241 248

242 249

243 250

244 251

245 252

246 253

247 254

248 255

249 256

250 257

251 258

252 259

253 260

254 261

255 262

256 263

257 265

258 266

259 267

260 268

261 269

262 270

263 271

264 272

265 273

266 274

267 275

268 276

269 277

270 278

271 279

272 280

273 281

274 282

275 283

276 284

277 285

278 286

279 287

280 288

281 289

282 290

283 291

284 292

285 293

286 294

287 295

288 296

289 297

290 298

291 299

292 300

293 301

294 302

295 303

296 304

297 305

298 306

299 307

300 308

301 309

302 310

303 311

304 312

305 313

306 314

307 315

308 316

309 317

310 318

311 319

The world economy and financial markets were hit with shock waves in 2020 that had lasting impacts and opened the door to many issues, challenges, and problems that we’re all facing now. One of the changes is that this profound year catapulted the prospects of gold and silver. Both have embarked on what is possibly their greatest bull market. This means historic potential gains for those who are positioned for them — hopefully, you, my reader! The public may catch on, but usually, they’re late. As you read this book, you have the chance to profit before the crowds come and witness the tail end of what is coming now.

Читать дальше