11 Chapter 16Exhibit 16.1 Framework for Values.

12 Chapter 18Exhibit 18.2 Sample Data Room Folders.Exhibit 18.3 GPs view of LP Behavioral Challenges.Exhibit 18.4 Key Risks in Fund Raise.

13 Chapter 20Exhibit 20.2 Sources of investment opportunity.Exhibit 20.5 The Exponential Growth of Techstars.

14 Chapter 21Exhibit 21.1 Due Diligence — Key Criteria.

15 Chapter 22Exhibit 22.2 Due Diligence Checklist.Exhibit 22.3 Key Due Diligence Questions for Consideration by Stage.

16 Chapter 23Exhibit 23.1 Due-Diligence Approaches

17 Chapter 25Exhibit 25.1 Differing Goals of Entrepreneur and Investor.Exhibit 25.2 Summary of Key Investment Terms: Preferred Stock.

18 Chapter 26Exhibit 26.1 Convertible Loan and Preferred Equity.Exhibit 26.2 Impact of Capped Conversion.

19 Chapter 27Exhibit 27.3 Enterprise Value Based on Future Projections.Exhibit 27.4 Sample Comparable Method (Private Companies).Exhibit 27.5 Sample Comparable Method (Publicly Traded Companies).Exhibit 27.6 Survival Rate of Firms.Exhibit 27.7 Liquidation Preference Stack and Its Impact on IRR.Exhibit 27.8 Impact of Antidilution Provisions on Ownership.Exhibit 27.9 Key Economic Terms and the Middle Path.Exhibit 27.10 Springing Warrants Can Be an Effective Way to Diffu...Exhibit 27.11 Key Governance Terms — Those That Impact Cont....

20 Chapter 29Exhibit 29.1 Attributes of Board Members Across Stages of Company.

21 Chapter 32Exhibit 32.1 Impact on Valuation When CEOs Gave Up Both Board Co...Exhibit 32.2 CEO Changes over Series of Investments.Exhibit 32.3 Triggers of Change and CEO Transition.

22 Chapter 33Exhibit 33.1 Frequency of portfolio outcomes.Exhibit 33.2 Returns: Or why an IPO is better.Exhibit 33.4 Exit methods.Exhibit 33.5 Preconditions for an exit.

23 Chapter 34Exhibit 34.1 Exit drivers.

1 Chapter 1 Exhibit 1.1 Venture capital business model. Exhibit 1.2 Limited partners. Exhibit 1.3 Fund organization chart.

2 Chapter 2 Exhibit 2.1 The perks of being a VC in Silicon Valley — reserved parking....

3 Chapter 8 Exhibit 8.1 Major asset classes in an investor portfolio. Exhibit 8.2 Typical mix of LPs in venture fund.Exhibit 8.6 (a) Average sovereign wealth fund size.Exhibit 8.6 (b) Asset Allocation - The shift to Private Equity.Exhibit 8.7 Asset allocation by mandate.

4 Chapter 9Exhibit 9.1 Fund of funds business model.

5 Chapter 10Exhibit 10.1 Limited partner investment criteria.

6 Chapter 11Exhibit 11.3 Midcontinent US attracts 12% of total VC spend. Mercury Fund's ...Exhibit 11.4 The power law of venture returns.

7 Chapter 12Exhibit 12.1 GP expertise.

8 Chapter 16Exhibit 16.2 Sequoia goes the extra mile to recruit a partner.Exhibit 16.3 Operational elements of a well-governed venture firm.

9 Chapter 17Exhibit 17.1 LP outlay varies by type of fund.Exhibit 17.2 What's hot and what's not — LP view of opportunities.Exhibit 17.3 LP portfolio — much more than VC.

10 Chapter 18Exhibit 18.1 Fundraising process.

11 Chapter 19Exhibit 19.1 Emerging managers — a pecking order.Exhibit 19.2 LPs' preference for investing in first-time funds.Exhibit 19.3 Fund-of-funds allocation for an emerging manager portfolio....Exhibit 19.4 Concentrating capital with top performers.

12 Chapter 20Exhibit 20.1 A venture fund's investment process.Exhibit 20.3 Sourcing funnel.Exhibit 20.4 Sourcing channels.

13 Chapter 22Exhibit 22.1 Most important factors for selecting investments.

14 Chapter 24Exhibit 24.1 Diffusion of innovation.

15 Chapter 27Exhibit 27.1 Factors for setting valuation.Exhibit 27.2 Financial metrics to analyze investments: Cash-on-cash matters ...Exhibit 27.12 Terms that matter: Frequency with which terms are used.Exhibit 27.13 Flexibility on terms: VCs rank these terms as least flexible....Exhibit 27.14 Most important factors leading to syndication.Exhibit 27.15 Most important factors for choosing syndicate partners.

16 Chapter 30Exhibit 30.1 Interaction with portfolio companies.

17 Chapter 31Exhibit 31.1 Value creation: VC activities in portfolio companies. Exhibit 31.2 Effective Board Meeting — From Big Picture to Deep Dives.

18 Chapter 33Exhibit 33.3 Lemons ripen faster than pearls — or losses often come before p...Exhibit 33.6 Diffusion of innovations — and the best exit window.

19 Chapter 34Exhibit 34.2 Liquidity events of VC-backed companies.Exhibit 34.3 Acquisitions — Mean deal values.Exhibit 34.4 Average time to exit in years.Exhibit 34.5 Typical trade sale process.

20 Chapter 35Exhibit 35.1 Steps to an IPO.

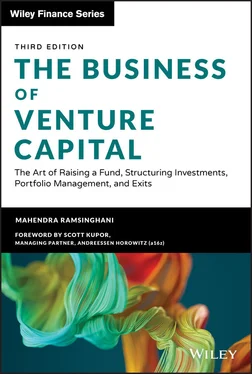

1 Cover Page

2 Table of Contents

3 Begin Reading

1 i

2 ii

3 iv

4 v

5 vi

6 vii

7 xiii

8 xiv

9 xv

10 xvi

11 xvii

12 xviii

13 xix

14 xx

15 xxi

16 xxii

17 xxiii

18 xxiv

19 xxv

20 xxvii

21 xxviii

22 1

23 2

24 3

25 4

26 5

27 6

28 7

29 8

30 9

31 10

32 11

33 12

34 13

35 14

36 15

37 16

38 17

39 18

40 19

41 20

42 21

43 22

44 23

45 24

46 25

47 26

48 27

49 28

50 29

51 30

52 31

53 32

54 33

55 34

56 35

57 36

58 37

59 38

60 39

61 41

62 42

63 43

64 44

65 45

66 46

67 47

68 48

69 49

70 50

71 51

72 52

73 53

74 54

75 55

76 56

77 57

78 58

79 59

80 60

81 61

82 62

83 63

84 64

85 65

86 66

87 67

88 68

89 69

90 71

91 72

92 73

93 74

94 75

95 76

96 77

97 78

98 79

99 80

100 81

101 82

102 83

103 84

104 85

105 86

106 87

107 88

108 89

109 90

110 91

111 92

112 93

113 94

114 95

115 96

116 97

117 98

118 99

119 100

120 101

121 102

122 103

123 104

124 105

125 106

126 107

127 108

128 109

129 110

130 111

131 112

132 113

133 114

134 115

135 116

136 117

137 119

138 120

139 121

140 122

141 123

142 124

143 125

144 126

145 127

146 128

147 129

148 130

149 131

150 132

151 133

152 134

153 135

154 137

155 138

156 139

157 140

158 141

159 142

160 143

161 144

162 145

163 146

164 147

165 148

166 149

167 150

168 151

169 152

170 153

171 155

172 156

173 157

174 158

175 159

176 160

177 161

178 162

179 163

180 164

181 165

182 166

183 167

184 168

185 169

186 170

187 171

188 172

189 173

190 174

191 175

192 176

193 177

194 178

195 179

196 180

197 181

198 182

199 183

200 184

201 185

202 186

203 187

204 188

205 189

206 190

207 191

208 193

209 194

210 195

211 196

212 197

213 198

214 199

215 200

216 201

217 202

218 203

219 205

220 206

221 207

222 208

223 209

224 210

225 211

226 212

227 213

228 214

229 215

230 216

231 217

232 218

233 219

234 220

235 221

236 222

237 223

238 224

239 225

240 226

241 227

Читать дальше