Climate action does not mean overlooking other areas of our work. This report demonstrates that, to be effective, climate action must operate within the spheres of cohesion, innovation, SMEs and infrastructure. If it fails to do so, quite simply it fails. Climate action, for example, also means job creation. Our Investment Report 2019-2020 forecasts that green energy specifically will create around 500 000 jobs in Europe over the coming decades.

The cohesion work that has been a central focus of the Bank since 1958 takes on a new dimension with our expanded climate ambitions. Throughout 2019, our experts supported the formulation of the Commission’s Just Transition Mechanism, which will facilitate the move to cleaner energy in regions and industries based on fossil fuels. Our unique position at the nexus of EU institutions, national governments and Europe’s cities and regions makes this a key mission for the EIB in the coming years.

In the same way, our development work has a focus on climate resilience and adaptation, because these save or safeguard lives – and because they build economic prosperity. Climate change is global, so we must step up our investments globally. Here we have the tools, too.Our experts marry experience in recognising true innovation with ground-level development work – we have 50 offices around the world and active operations in 43 fragile states. Over the last 10 years, those countries – the world’s least developed – have received over €5.5 billion from more than 100 EIB operations.

Commitment and accomplishment

With our new climate commitment and energy lending policy, it might be easy to focus only on the future and to forget what we have accomplished. Before climate became our central focus and before the COVID-19 emergency, the European Investment Bank was given the mammoth task of supporting the investment of half a trillion euros into the EU economy over five years, as part of the Juncker Plan. In 2020, we are comfortably on course to hit that €500 billion headline target. Most importantly, we already know that this great programme has had a structural impact on the European economy, boosting jobs and growth for decades to come.

It is our job to support the European project and sustainably invest in Europe’s future. This is what we did in 2019 and this is what we shall continue to deliver.

Werner Hoyer

European Investment Bank

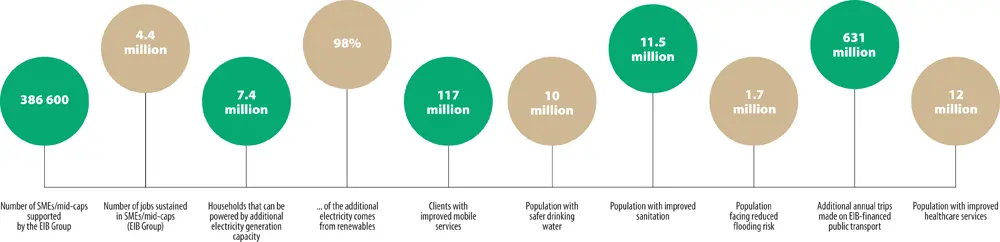

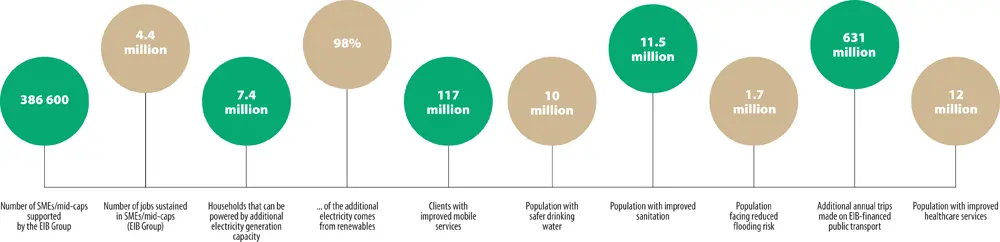

EIB Group impact

Figures are expected outcomes of new financed operations signed in 2019 for the first time. All figures are unaudited and provisional.

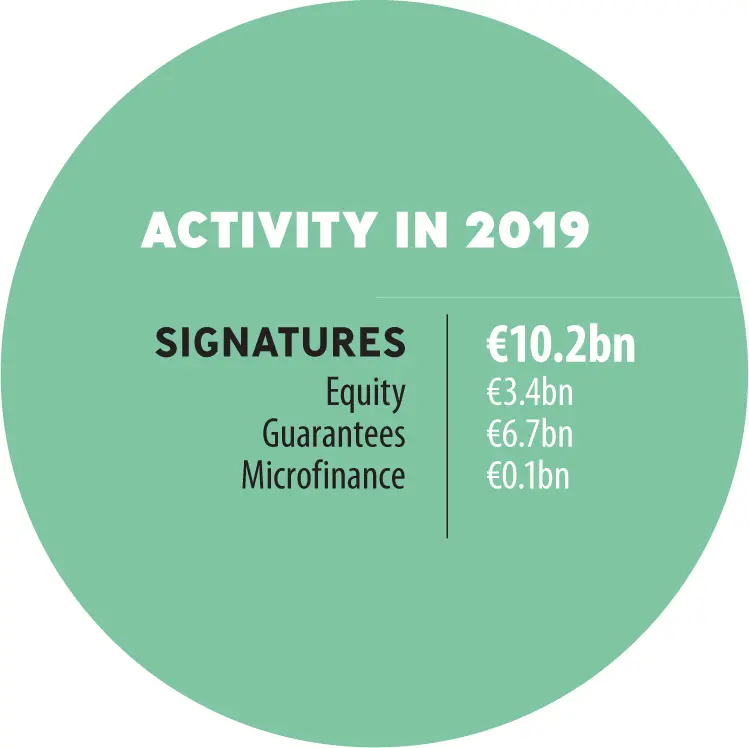

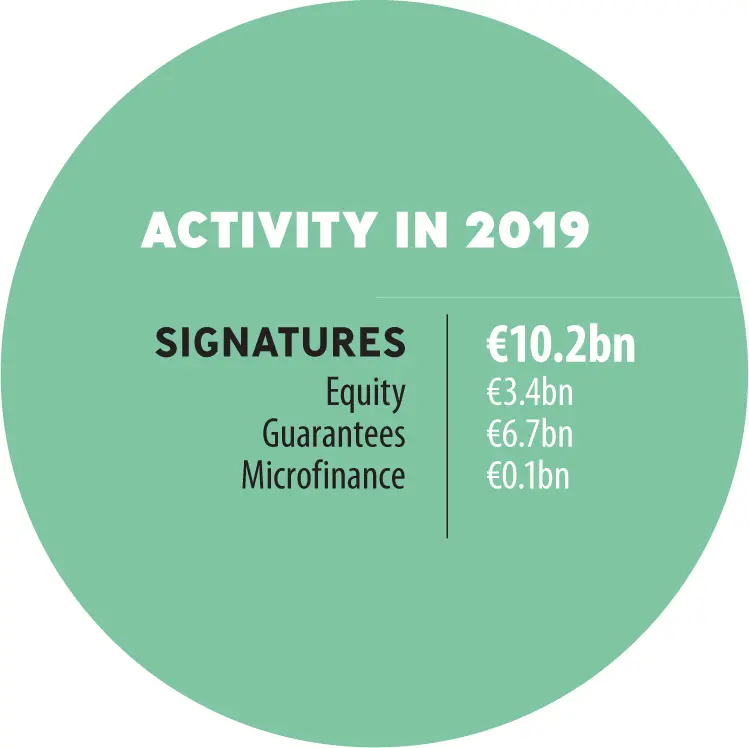

European Investment Fund

The European Investment Fund (EIF), part of the EIB Group, specialises in risk finance to support micro, small and medium-sized enterprises and stimulates growth and innovation across Europe. It provides financing and expertise for sound, sustainable investment and guarantee operations. EIF shareholders include the EIB, the European Commission, public and private banks and financial institutions.

THE EIB GROUP IN YOUR COUNTRY

MEDITERRANEAN €2.45 billion

ENLARGEMENT AND EFTA €1.4 billion

ACP, OCT AND SOUTH AFRICA €1.4 billion

ASIA, CENTRAL ASIA AND LATIN AMERICA €2.2 billion

EASTERN NEIGHBOURS €1.35 billion

EFTA: European Free Trade Association

ACP: Africa, Caribbean and Pacific

OCT: Overseas Countries and Territories

Darker colours signify higher investment as a percentage of GDP

TO 31 DECEMBER 2019

All figures presented are since the launch of EFSI. The darker the colour, the higher the EFSI-related investment mobilised compared to GDP (based on approvals).

The European Fund for Strategic Investments (EFSI) is an initiative launched jointly by the EIB Group and the European Commission to help overcome the investment gap in the EU. With a guarantee from the EU budget, EFSI aims to unlock additional investment of at least €500 billion by 2020. As at 31 December 2019, the additional investment stood at €458 billion.

OUR CLIMATE ROADMAP AND ENERGY LENDING POLICY

> €1 TRILLION FOR < 1.5°C

In 2019, the European Investment Bank laid out its climate and environmental ambitions for the next decade. Here’s our roadmap to meet the climate challenge.

To avoid many more big climate challenges, we need to decarbonise quickly. The next decade will be critical.

Under the Paris Agreement, nearly all governments across the world agreed to keep global warming below 2°C and to fight to limit it to 1.5°C. To reach these goals, we must emit less than 580 gigatonnes of carbon dioxide. At the current rate of about 37 gigatonnes per year, we will have passed this limit by 2032.

Picking up where the private sector left off

The private sector has not been shouldering the costs of stopping climate change. This is why the public sector is taking more action, increasing investment and encouraging people and companies to change their habits. In Europe, investment in energy systems, for example, needs to almost double over the next decade – reaching up to €400 billion per year.

Public banks can invest in long-term infrastructure projects and in the innovation required for the transition to a sustainable future. We can, for example, make investments in a large-scale battery that charges on windy or sunny days and discharges even when there’s no sun or wind. Public banks can help sectors where investment is slow, such as making homes more energy efficient.

What the European Investment Bank will do

31% of our financing supported climate action in 2019. We will increase our backing for climate environmental and sustainability to 50% by 2025 – that’s over €30 billion per year. But that will not be enough, and most of the new money to help the climate will have to come from the private sector. The European Investment Bank attracts extra financing for each project - from the private and public sectors. Our stamp of approval encourages other investors, especially private banks, to see that the project is sound.

We aim to support more than €1 trillion to fight climate change and help the environment in the decade 2030.

By the end of 2020, all our financing will be aligned with the Paris Agreement. Our financing will be consistent with a pathway to low emissions and climate-resilient development. In industries where reducing emissions is difficult, we will support projects that help companies shift to a low-carbon model. We will also ensure that all projects manage the future risks of climate change.

Читать дальше