3 Use the client's resources.There's an advantage in transferring skills to the client. Use client personnel to schedule, facilitate, interview, perform technical work, keep records, provide refreshments, and so on. In your proposal, which we'll discuss later on, there will be a section for “client accountabilities.”I learned to run strategy formulation programs by plastering the room with easel sheets, often 60 or more. They had to be placed in order, edited, transcribed, and circulated after the session, which was more work and harder work than the actual interactions.Finally, it occurred to me to require that a trusted client administrative person be present, take notes, retrieve the easel sheets, transcribe, and submit to me for final approval before dissemination. That saves me a week of work over the course of a 90‐day relationship. And it makes far more sense for client personnel to do this than someone you would hire.Today, I've created my own, one‐day strategic approach, Sentient Strategy®, and I (and the people I certify) can deliver it remotely in one day or two mornings.

4 Outsource and delegate.I outsource graphics, web design, printing, bookkeeping, accounting, and a host of other “tasks” that too many people do personally. I also subcontract so that others can do routine client tasks, such as observations, interviews, and facilitation. Unless it's part of the relationship of the business (i.e., marketing or asking for referrals), it can be outsourced at hourly rates or fixed prices.

5 Subcontract.There are a great many people who can't market but can deliver quite well, and they would be happy to work for you. Don't hire them as employees, but as situational subcontractors (metaphorically, a pair of hands). Consultants tend to overpay delivery people because they believe that methodology is king, but results are the ace that trumps the king. Your relationship and generation of results are the key to long‐term client projects and referrals.

The methodology and implementation are merely the engine room. You need stokers, not engineers. 2

Here are ideal reasons to use subcontractors for a day or a month:

There is legitimate high volume—focus groups, interviews, classroom sessions, customer visits, and so forth.

You need specialized expertise. Part of the project involves financial, or technical, or mystical powers that you don't possess.

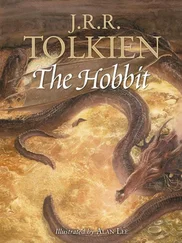

You are bored. You can do it, but you may fall asleep during the interviews. FIGURE 3.1Reach Out Versus Gravity

You have other priorities. It makes more sense for you to be marketing in a manner only you can do than to be delivering in a manner almost anyone can do. (Key: Just because you can do something faster or better doesn't mean that someone else can't do it just fine for the circumstances. You don't use a howitzer to swat a fly. At least I don't.)

You anticipate needing subcontracting in the future, and this is a good opportunity to acclimate and train your potential help.

Finally, as you build Market Gravity ®(which we'll discuss later), you'll be doing “reach out” and benefit from more attraction. The more buyers are drawn to you because of your brand and reputation, the less time you need to invest in finding them and educating them about your value.

You can see from the graphic shown in Figure 3.1that as your career progresses, you should require less and less time to find clients, because they are finding you. If you veterans who are reading this aren't experiencing that great benefit, then read on.

Case Study: The Manufacturing Star

A decade or more ago I was coaching a client who was brilliant in the manufacturing arena. He was making about $600,000 but was completely booked all year. I explained the principles above, but he said that “no one else can do what I do.”

That was true in its entirely, but not in part. When I finally convinced him to try subcontractors, his revenues grew and his labor declined.

Today, he has three full‐time employees, a half‐dozen part‐time, he takes six major vacations globally, and he's making about $10 million annually.

The true buyer is that individual whom I've named the economic buyer . I've chosen this to differentiate this person from feasibility buyers , who may evaluate an approach in terms of culture, or methodology, or need, but who cannot make the decision to buy .

In other words, never be satisfied by or stop at gatekeepers .

And then there are the non‐buyers. We mentioned the ability to say “no” and the inability to say “yes.”

What this amounts to is your steadfastness to reject acceptance and accept rejection. That is, you must reject the acceptance of those who cannot help you (they can't sign a check or introduce you to someone who can sign a check) and accept the occasional rejection that is inevitable in this business as you deal with powerful, true buyers. Don't forget the illustration in Figure 3.1, which eases this dynamic by demonstrating that as you become more successful, buyers will come to you, making credibility and fees virtually moot, and reducing rejection substantially.

You can't afford to develop relationships with and be associated with low‐level non‐buyers, because that collegiality will be as tough to remove as gum on Texas asphalt in August. You can descend from buyer heights to work with virtually anyone in the organization, but you can't ascend to work with significant buyers if you're seen as a peer of human resources, or training, or lower‐level management in general .

An economic buyer can, metaphorically, sign a check. That is, he or she can cause the computer to spit out a check. You don't deal with purchasing, procurement, or accounts payable, and you don't adhere to their rather arbitrary and unilateral payment practices. They deal with the terms that you and your buyer have agreed upon. (Buyers can also require manual checks when there has been an error or undue delay. Remember, when anyone says that payment takes, say, 30 days, it means that for 29 days the request sits on someone's desk, because computers can produce checks anytime at all.)

Case Study: The Pathetic Payment Policy

Some technology companies have instituted at times 120‐day payment to all venders. Aside from the unethical and despicable policy of penalizing small businesses in order to achieve a four‐month “float” on their money, it's simply unacceptable from a cash flow standpoint.

This is where the buyer comes in. You ensure that your payment terms supercede the policy in place through the buyer's clout. Of course, someone will say, “It's company policy.” Sure it is. But you're allowed to have policies, too, such as more favorable payment terms for you.

If the company “policy” were to loot and pillage, would that be acceptable also?

So how do you tell who the economic buyers are? I say “buyers” because in larger organizations there are scores or even hundreds. I dealt with a dozen different buyers in Merck alone over 12 years. You can't always tell them by title. One of my most significant buyers—he spent $250,000 per year for several years—had the title “International Director of Management Development.” Conversely, some vice presidents can't buy a toothbrush in some organizations (find someone in a bank who is not a vice president).

In smaller organizations, the owner, or CEO, or president will be the buyer. In nonprofits, usually the executive director or managing director is the buyer. However, in most cases, most of the time, you can find the true buyer by asking these 10 questions of the person with whom you're dealing at the moment:

Questions to Determine the Economic Buyer

Читать дальше