Though the paperwork is intensive, it is important. Every clause can be impactful. Letting a pro take care of it for you can be more efficient and may help you avoid serious mistakes—at least with your first rodeo.

If they've been in the business for a while, bankers know the other players in the field. They know which companies may be looking to acquire what types of startups, who is really buying, the good buyers versus the bad ones, and so on.

They should also have connections to the right departments and decision-makers so they can get you through to some of your target buyers much faster than starting cold.

They Know How to Stretch to Help Get Deals Done

Bankers are also deep into corporate finance, so they know how to help buyers stretch to make acquisitions. They can help them raise capital and find loans to buy people out if they need it.

If you've made it this far, you already know the power of great advice. So how do you continue to get great advice through the M&A transaction? How do you pick the right investment banker for your deal?

Choosing the right banker is important. So is balancing their advice with input from your existing trusted advisors and your gut instincts.

This is not a service you want to play Yellow Pages roulette with or rely on Siri for. Look to your investors, advisors, and other founders who've recently exited for recommendations of trustworthy and capable investment bankers.

Just as your startup has no doubt involved years of trial and error and iterating, so does investment banking and M&A. You don't want to be one of the first guinea pigs for someone who is new to this role.

It can take years to encounter and master the nuances and gotchas in selling companies. Find someone who has been around long enough to be truly knowledgeable.

Investment bankers who have been involved in numerous transactions have probably developed not only the expertise but also the pattern recognition for how to handle certain situations they may have experienced in the past.

That pattern recognition ultimately optimizes your potential outcome.

Beyond the general sell-side M&A experience, you want a banker who has experience specific to your space and type of business—someone who knows health care or SaaS or marketplaces, or whatever your angle is.

They'll have experience dealing with the complications, and they'll know the nooks where value is hiding. They will have a strong Rolodex of contacts that are on your target buyer's list.

In addition, don't just look at company brand names. It is the individual you will be working with that matters most. That person should be an expert in the size of transaction you are hoping for. This is also important for ensuring fee scales align.

Not Just What You Want to Hear

You don't want to choose the banker who only tells you what you want to hear, makes it sound easier, or who promises you can sell for the highest, top-line price. That's a huge red flag for disaster later. In truth, you don't even have to really like your banker.

You need someone who will be straight with you, who will prepare you well for what's ahead, and someone who will be honest, even if that person knows you won't like it.

How much do investment bankers cost? What are their fees? Is it worth using them?

Some say they are too expensive. Others find they are a bargain and wouldn't consider ever taking the DIY route. There may be some scenarios in which you already have a strong M&A team or have a substantial head start in strategizing and preparing for an exit.

In other cases, taking the do-it-yourself approach to selling a large company is like someone without the right education or experience trying to put on his or her own legal defense in a life-or-death situation, or a non-physician hospital owner jumping in to perform open heart surgery. You can imagine the consequences and lawsuits.

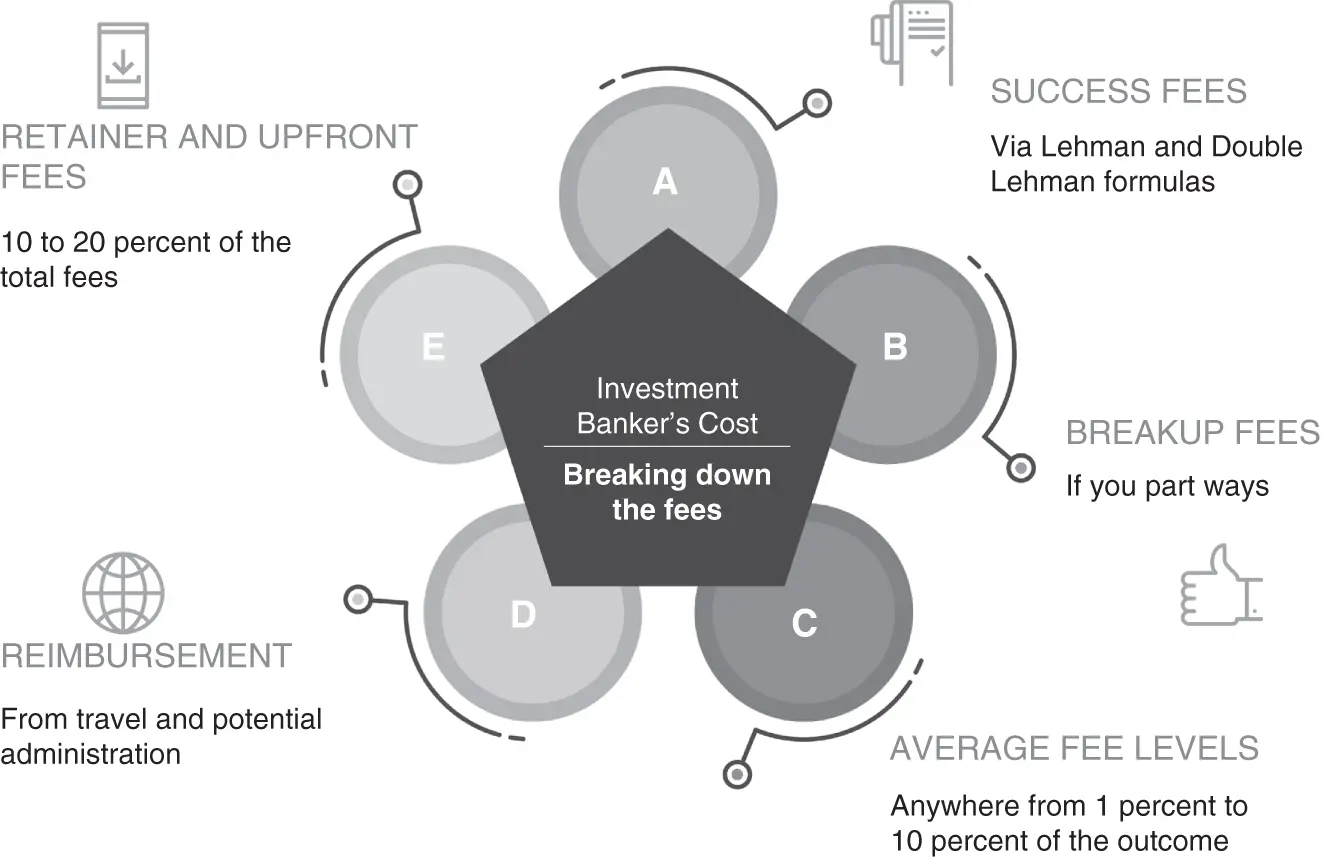

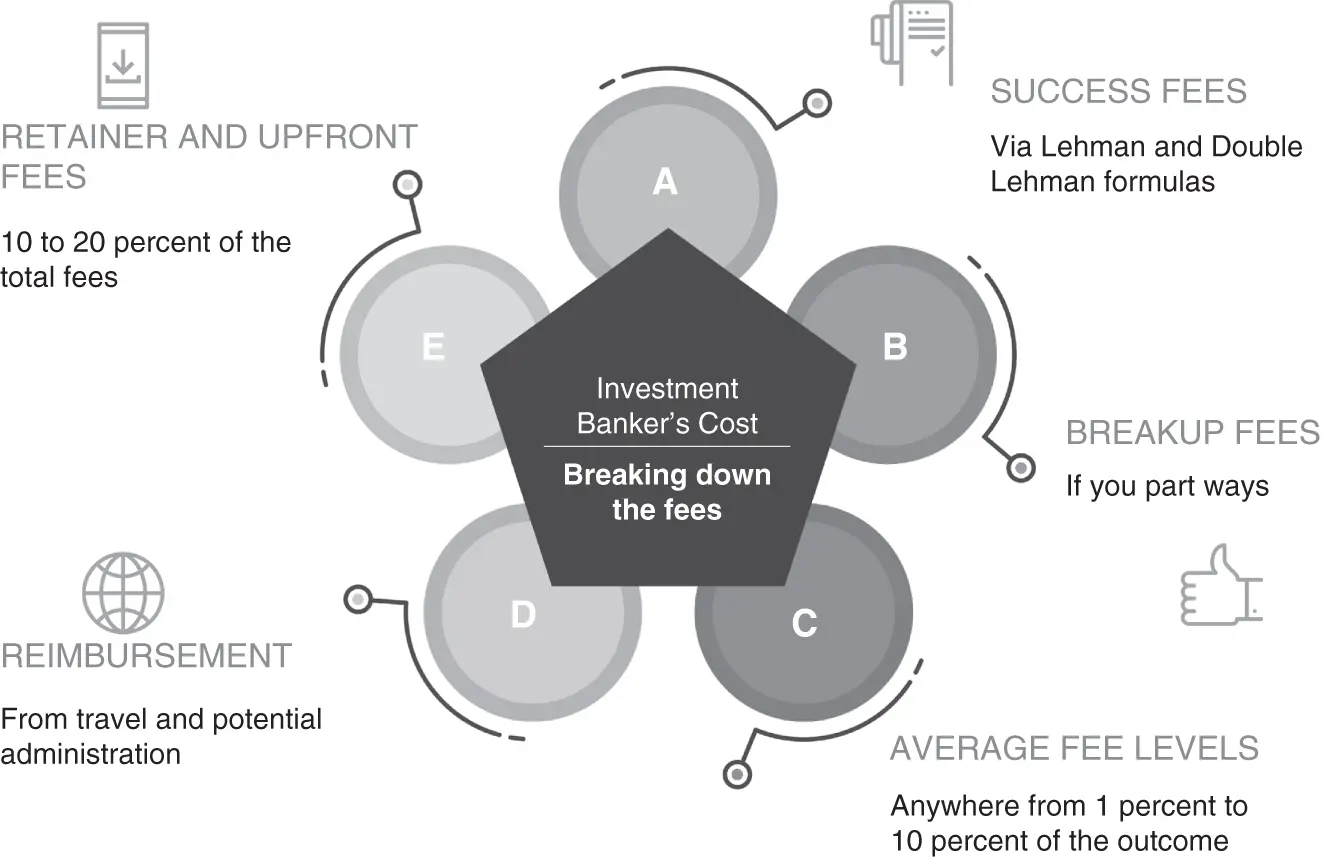

Investment bankers can charge a variety of types of fees, as shown in figure 3.1.

The following sections examine these fees in more detail.

Retainers and Up-Front Fees

Just like any good attorney, marketing agency, or consultant, you can expect a good banker to ask for a retainer. This ensures you are serious and ensures the banker gets paid for his or her time.

Figure 3.1Banker Fees

Retainers may represent anywhere from 10 percent to almost 20 percent of total fees. There should be a written agreement ahead of time stating how much monthly retainer fees can scale to, and the maximum caps for the total period of this process. Expect to put up a minimum of $5,000 to $15,000 as an initial monthly retainer.

On larger deals, retainers can be at least $100,000. Larger firms have more overhead and don't need to beg for deals. They often filter by which deals are going to be the most profitable or notable to engage in. Expect equally notable retainers.

In addition to covering their hourly work on the deal, you can expect to cover or reimburse investment banking companies for their out-of-pocket expenses associated with working your deal. This may include travel, hotels, and so on. Otherwise, they can end up spending a lot of money out-of-pocket up-front, without any guarantee of you coming through on closing the deal and recouping their hard costs.

Success fees are really like commissions. They are paid on the successful sale of your business and completed closing.

This is one of the best ways to ensure alignment. You only pay these fees when the deal is done and your company gets paid. Just always be sure to read the fine print and understand what the real distributions are for your investors, your team, and yourself.

There are several structures for success fees, like flat fees. This may especially apply on smaller, more work-intensive deals in which bankers want to make sure they cover their costs and needed margins.

Similarly, there can also be set percentages (for example, 10 percent). In this case, no matter how much or little your company is sold for, you pay the same percentage success fee.

There are also scaled percentage fees. Most common is the Lehman and Double Lehman.

The Double Lehman calls for the following fee structure:

10 percent on the first $1 million

8 percent on the second $1 million

6 percent on the third $1 million

4 percent on the fourth $1 million

2 percent on any additional proceeds

The regular Lehman scale is only half of these percentages.

There are also reverse-scaled percentage fees. So in contrast to the Lehman scale, business brokers or investment banking firms will earn an increasing percentage the more they sell your company for.

This may provide the most alignment and motivation for them to get you the highest price. How much you actually net and love the deal will still depend on the terms.

Keep in mind that on fundraising, anyone receiving a commission that is subject to the outcome of the transaction is required to be registered as a broker dealer with FINRA in order to comply with the rules of the SEC.

If you use a non-registered broker to facilitate a fundraise, and you pay that person a success fee, then in the event the company doesn't perform as investors expected, the company can literally sue you to get its money back for having used someone without the proper broker-dealer license.

Читать дальше