My point is that there's no sense simply paying down debt until you first decide that you're not going into any more debt (as we saw in step 1) and now you are going to work on yourself and the systems in place. I'll show you how to get a money system in place in chapter 4, but I want you to know that dealing with habits and behaviours takes time and that's totally fine because this time you are now serious about getting out of debt.

Step 3: focus on building an emergency fund

You've come a long way. Yes, it's been small steps — purchasing this book, being keen to change and hopefully being challenged by steps 1 and 2 — but you've decided that enough is enough, and it's time to do things differently.

That's if you have totally agreed with changing your mindset around debt. Remember, there is no rush here and I will celebrate with you on any movement you make. It can take time. It's okay.

You don't want to fall back into debt once the debt repayment campaign has started. The reason why steps 1 and 2 have to be completed before step 3 is because we're about to get drastic.

You are now going to move all your debt repayments (including your mortgage, car loan, personal loans — everything!) to minimum payments only and focus on getting $2000 saved as an emergency fund in a dedicated online savings account.

Once your money system is in place and your debt is on minimal repayments, the leftover money will be going to building your emergency fund of $2000.

It's okay if you're paying a bit of interest while you build your emergency fund as the first step to getting out of debt (step 1) is to not take on any more debt. This emergency fund, or cash buffer (or whatever cute puppy name you want to call it), will be the first line of defence to stop any more debt should unforeseen events arise while you're on the way to setting up your financial plan.

It may seem counterintuitive to slow down the debt repayments and pay a little bit more interest while you build your emergency fund, but believe it or not, interest is not your problem. The fact you have systematically overspent without any systems in place and without self-control is the actual cause of the problem. If you don't believe me, take a look at some of the inaccuracies people believe.

I need a credit card for emergencies.

I need a credit card for emergencies.

This is the worst excuse that someone might need to emotionally hang their little debt hat on. The worst time to go into debt is in an emergency. The people who use this excuse literally have no comeback when I say, ‘All you need is your own cash fund for emergencies’. Credit cards aren't the answer — they're a middle-class fallacy.

What if I need access to money quickly?

What if I need access to money quickly?

This one comes soon after I shoot down the ‘credit card for emergencies’ logic. I proceed to ask people, ‘When was the last time you needed, say, $1000 the same day for an emergency ?’ It just doesn't happen. ‘But it can take a day to transfer money from my savings!’ Nope, I won't buy that excuse either because the new payment platform that allows instant transfers between banking institutions killed it. If there was an emergency and you did need serious money over your usual daily spend, find some internet access and make a transfer. Call your parents or a good friend. There are many practical solutions to the fictitious emotional crutch of your credit card.

I am picking on credit cards here in particular as they are the usual suspect people hang onto when I talk about emergency funds.

If you're like me and you've reached a point where you find you either can't control yourself with your credit card ( hello! ) or you have debt that you can't shake, you know that credit cards are not a blessing and you don't give a crap about the ‘points’. Also, most people who play the points game aren't frequent flyers. If you go overseas once every two years, I've got news for you: you're not a frequent flyer.

Practical steps for your emergency fund

I don’t want you to have to use your credit card for emergencies that could disrupt your debt repayment strategy, such as car insurance excess or emergency dental work. If you use money in your emergency account for an emergency once your debt repayments have started (next step), press pause on paying down your debt (except for the minimum repayments) and work to top it back up to $2000. The cool thing here is getting an emergency fund in a separate account may be the first time ever that you have had some decent money saved.

You can find out more about the emergency fund, what counts as an emergency and all the other logistical questions about emergency funds in chapter 3.

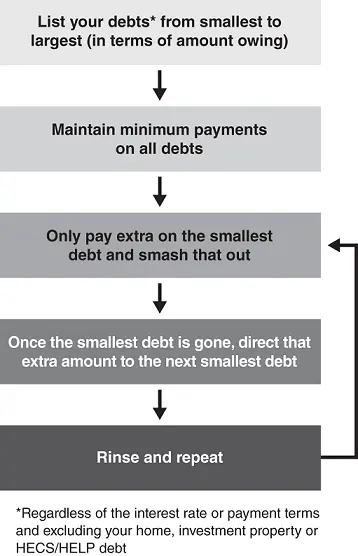

Step 4: commence the debt snowball

Did you know it's not your intelligence or logic that got you into debt to start with? It was your habits and behaviours. It's not smart or logical to have debt for stuff that you consume and then have the pleasure of paying interest on it while tying up your cash flow and adding extra financial stress to your life. I am aware that people can end up with debt due to a situation outside of their control. But I am about to have a go at the former category of people (intelligent and logical). I feel I need to be a bit brash when talking about the debt snowball strategy because it may feel like it conflicts with your own intelligence, logic and reason. So I need to get your attention.

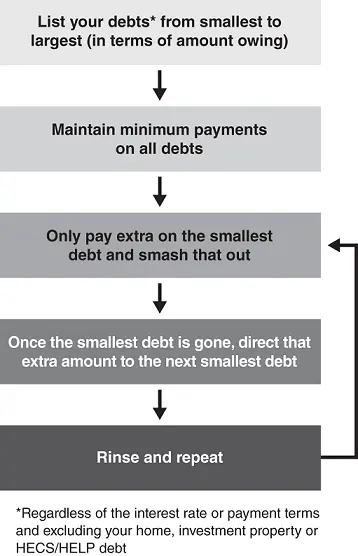

I am about to ask you to pay off your smallest debt first, regardless of the interest rate.

Now, you might be thinking that it doesn't make sense to pay off the smallest debt first if it has a lower interest rate than another debt. Truth is, it makes no sense to have debt and be paying interest on debt in the first place. Look at it this way: your way of managing money clearly hasn't worked so why not try my way … insert smiley face here, and so on … If you're offended, please film yourself burning this book and tag me. If you're not offended, I'll try harder next time. I need you to be encouraged so that you don't give up. That means getting some emotional wins along the way. Your (not-so-good) habits and behaviours likely got you into debt, so we need some (good) habits and behaviours to get you out of debt. Intelligence and/or logic clearly didn't get you into debt.

I know that other finance books and money people may tell you to arrange a credit card balance transfer to save interest, or to use a script to call companies and negotiate interest rates on loans. While that's cute and you're free to do this, I'm more interested in changing your underlying spending habits and behaviours. The danger with the balance transfer or negotiation approach is that you use energy and effort to make these changes thinking you've done something awesome when in fact all you've done is moved the debt. But you haven't addressed the underlying problem. You've either just moved the debt or tweaked an interest rate, but the debt is still there. It's not the interest rates and interest payments that are the problem. The problem is that you didn't have a good spending plan. Or, to put it simply, your overspending is the problem here. I know this sounds harsh because often our money habits and behaviours have been handed down to us during childhood. But while our financial past certainly doesn't define us or our future, we need to own our mistakes and take responsibility for learning and improving.

Читать дальше

I need a credit card for emergencies.

I need a credit card for emergencies.