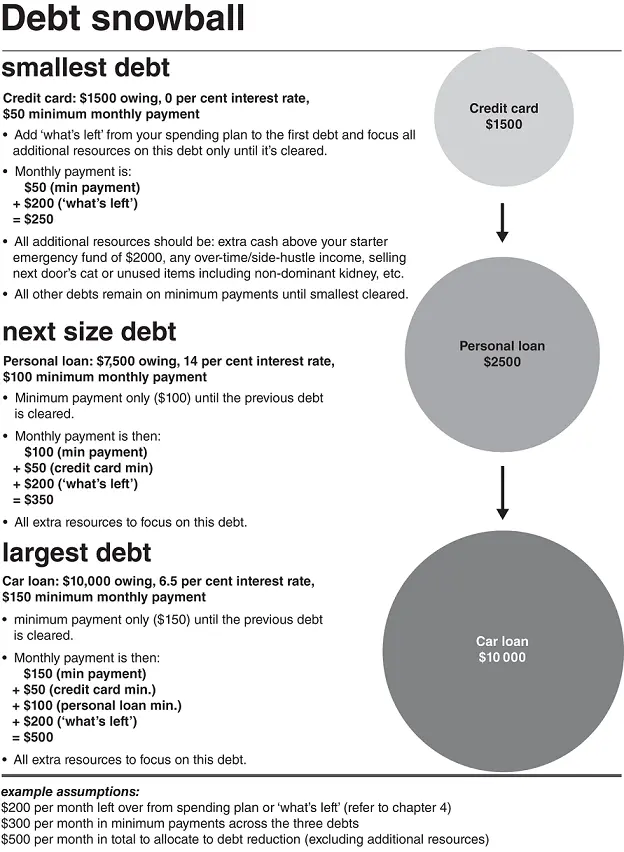

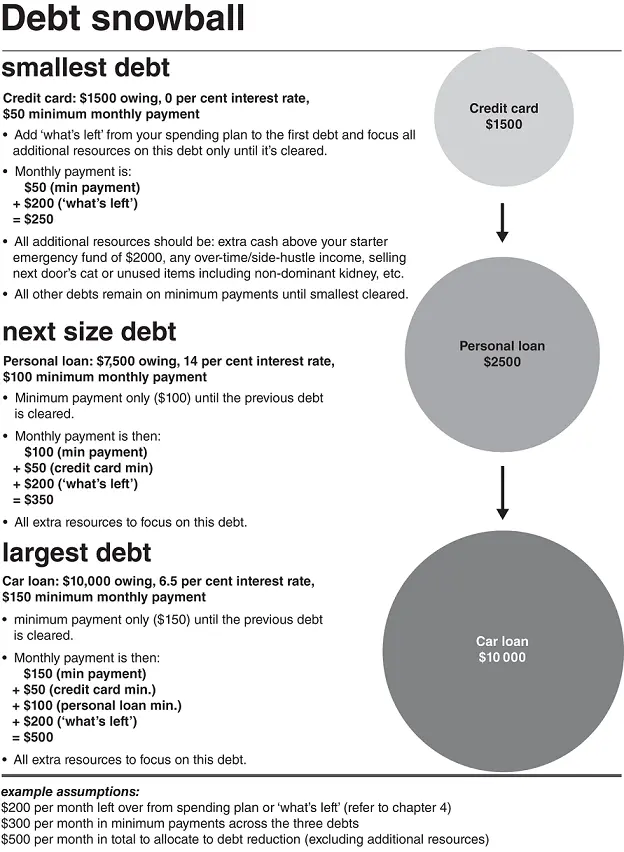

Now let's take a look at how to get out of debt using the debt snowball plan.

Here's a practical example.

Use this space to write your debts down from smallest to largest along with the minimum monthly repayment for each. If you have an ‘interest free, no-money-down’ debt, find out what the minimum payment is if you were to start paying it down now or what it will be when the payments are due to start. Remember, don't cheat and add this last because of the 0 per cent interest. Your way of managing money hasn't been great so far, so don't get cute with me now!

Step 5: know your financial reason for living — smash that debt

You have decided no more debt.

You have put a spending plan in place.

You have built your emergency fund of $2000.

You have got your debt snowball plan set up and ready to go.

Happy days!

I am not a morning person by any means. In fact, when I was growing up the hard-core kids who attended swimming practice at 5 am each day before school blew my mind. These are the types of kids who would end up joining the Australian swim squad. Swimming was their reason for living during that season of their life — sometimes a very long season. They worked hard, were intentional and achieved results. You need to have the same focus and intensity regarding your consumer debts.

Once you have your emergency fund at $2000, your financial reason for living is to clear debt. This is why the mindset part is so important. You need to be strategic and only focus on paying down debt.

This could take many months, so it is important to be ready for this long journey. The harder you work and the more you sacrifice, the sooner you will be out of debt.

Want to go on a holiday with friends? No — your reason for living is to pay down debt.

Keen for that new lounge? No — your reason for living is to pay down debt.

‘Let's continue to eat out four times a week?’ No — your reason for living is to pay down debt.

‘I am saving for a house!’ No — your reason for living is to pay down debt.

‘I invest into ETFs monthly!’ No — your reason for living is to pay down debt.

Need I go on?

You know exactly what your sacrifice will be — and there will need to be some sacrifice. Not only do you first need to be living on less than you earn, you also need to have a surplus to pay down debt. It isn't going to be easy and you know it.

The person in the mirror is the only one who can change your situation.

It's easy to walk into debt, but so much harder to get out of it. You are about to enter a period of cleaning up your mess. In fact, you can tell people your job is now a ‘debt cleaner’. You see, you must own this and know that your financial reason for living is to pay down debt. Apathy and debt reduction don't go hand in hand.

For some reason I always thought someone else would come along and save me from my debt and that debt was just a normal part of adult life, but it had become apparent that I had to take responsibility for my own situation. Though I had accumulated some savings, I had a scarcity mindset and was fearful of paying off debt in case I needed those savings. Dumb.

I decided to give the debt snowball a go, starting with my smallest credit card debt. I had held this for a whopping 15 years without ever paying the $2000 balance off fully. The success feeling worked … and I booked a 15-minute call with a financial adviser to keep working through my debts (embarrassingly, $25 000 worth of credit card debt over five cards, thanks to multiple balance transfers and just getting stuck; and a car loan with about $7000 left).

I kept using the snowball method on my debts and it felt bloody good. I was working weekends and nights to continue being able to get on top of it all. One after the other I paid off my car loan and credit cards, while still being able to save a lot of money. I paused the repayments during COVID as a ‘just in case’, but it soon became apparent that I wasn't going to be affected and was actually saving an extra $900 per month by not going into the office and buying lunches, transport costs and dinners/brunches out. So I paid off my last $10 000 limit credit card.

Fast forward and I just got approved for my construction loan to build a house on land I bought. So while paying off my debts I had also managed to save around $60 000 as a deposit.

One way of focusing on paying down debt is to have a goal that's greater than the debt itself. A useful goal is to add up all your debt and the total monthly repayments, plus the amount that is ‘left over’ from your spending plan (which I am going to show you in chapter 4). Then, do a basic calculation to work out how many months it will take to clear your debt.

As a challenge, let's try to halve that time period.

An example might be:

$2000 credit card with a $50 minimum monthly payment

$7000 personal loan with a $100 minimum monthly payment

$100 per month left over from your cash flow to go towards debt repayment, goals or investing.

In this example, there is $9000 in total debt with $250 a month to allocate to debt reduction (minimum repayments plus left over cash flow). The $9000 total is divided by $250, which equals 36 months. This doesn't take into account the accruing interest, but it gives you a guide. Your goal is to pay the debt off in half that time — 18 months. The question is, for the next 18 months, can you get intentional and determined about trying to smash that debt out of your life? You will need to consider whether you can cut expenses, get more work and/or sell something (everything, lol) because your financial reason for living is to get out of debt.

As we want to throw everything at your debt-clearing campaign, you should think of some things you'd like to do — either financial or non-financial — after you pay off each debt and you should also celebrate once you're completely out of debt.

Use the space below to write down a few reward goals. Anecdotally, in my career as a financial adviser the people I have worked with who had goals have generally been more motivated to complete various financial steps — such as paying off debt or saving a lump sum faster — than those who didn't have a goal.

Pull a budget lever, temporarily

There are four levers you can pull on a budget or spending plan to make changes so that you have more money to throw at your debt.

Increase income. How can you increase your income either temporarily or permanently? Maybe it's time for a pay rise, or you could ask for some overtime or get a second job while your financial reason for living is to smash your debt.

Decrease savings. You really should not be saving while you're trying to get out of debt. Anything above your $2000 emergency fund would be like borrowing on a personal loan just to have money in your account. Make sure you're focusing all your money and energy on paying off your debt. Remember, this is not forever — it's just for a season.

Reduce costs. We all have categories in our budget that we need to review regularly. But when you have a hard-core goal (like getting out of debt) you need to be ruthless because you have to make some sacrifices with your time (like taking on extra work) or with some budget items. For example, if you pay for a gym membership and also a personal trainer you may need to make the call on dropping one or the other — or swap them both out for a less expensive group training session in a local park. I still want you to have line items in your budget that are of benefit, but you may need to review what can be reduced in your life.

Читать дальше