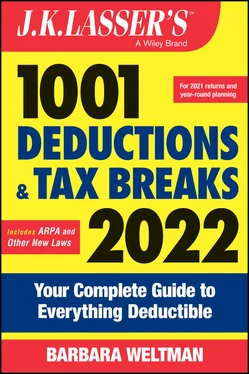

Barbara Weltman - J.K. Lasser's 1001 Deductions and Tax Breaks 2022

Здесь есть возможность читать онлайн «Barbara Weltman - J.K. Lasser's 1001 Deductions and Tax Breaks 2022» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:J.K. Lasser's 1001 Deductions and Tax Breaks 2022

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:3 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 60

- 1

- 2

- 3

- 4

- 5

J.K. Lasser's 1001 Deductions and Tax Breaks 2022: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «J.K. Lasser's 1001 Deductions and Tax Breaks 2022»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

J.K. Lasser's 1001 Deductions and Tax Breaks 2022: Your Complete Guide to Everything Deductible

1001 Deductions and Tax Breaks, 2022

J.K. Lasser's 1001 Deductions and Tax Breaks 2022 — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «J.K. Lasser's 1001 Deductions and Tax Breaks 2022», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

Casualty and theft losses in federally‐declared disaster areas

Gambling losses

Estate tax payments on income in respect of decedents

Generally, claim the standard deduction when it is greater than the total of your itemized deductions. However, it may save overall taxes to itemize, even when total deductions are less than the standard deduction, if you are subject to the alternative minimum tax (AMT). The reason:The standard deduction cannot be used to reduce income subject to the AMT, but certain itemized deductions can.

In the past there was an overall limit on itemized deductions for high‐income taxpayers. This limit does not apply for 2018 through 2025.

If a married couple files separate returns and one spouse itemizes deductions, the other must also itemize and cannot claim a standard deduction.

Impact of Deductions on Your Chances of Being Audited

Did you know that the IRS collects statistics from taxpayers to create profiles of average deductions? If you claim more than the average for your income range, the IRS's computer may select your return for further examination.

Tax experts agree that you should claim every deduction you are entitled to, even if your write‐offs exceed these statistical ranges. Just make sure to have the necessary proof of your eligibility and other records you are required to keep in case your return is examined.

How to Use This Book

This book is tied to Form 1040, U.S. Income Tax Return for Individuals . It can also be used for Form 1040‐SR, Income Tax Return for Seniors; a form specifically for seniors age 65 and older.

The chapters in this book are organized by subject matter so you can browse through them to find the subjects that apply to you or those in which you have an interest.

Each tax benefit is denoted by an icon to help you spot the type of benefit involved:

Exclusion

Above‐the‐line deduction

Itemized deduction (a deduction taken after figuring adjusted gross income)

Credit

Other benefit (e.g., a subtraction other than an above‐the‐line or itemized deduction that reduces income)

For each tax benefit you will find an explanation of what it is, starting with the maximum benefit or benefits you can claim if you meet all eligibility requirements. You'll learn the conditions or eligibility requirements for claiming or qualifying for the benefit. You'll find both planning tips to help you make the most of the benefit opportunity as well as pitfalls to help you avoid problems that can prevent your eligibility. You'll see where to claim the benefit (if reporting is required) on your tax return and what records you must retain to support your tax position.

You'll find dozens of examples to show you how other taxpayers have successfully taken advantage of the benefit. Over the years, taxpayers have been able to write off literally thousands of items; not every one is listed here because space does not allow it. And you'll learn what isn't allowed even though you might otherwise think so. There are references to free IRS publications on a variety of tax topics that you can download from the IRS website ( www.irs.gov) or obtain free of charge by calling 800‐829‐1040.

You'll also see key dates for various actions, such as filing returns, contributing to retirement plans, and reporting foreign financial accounts to the U.S. Treasury. For example, the deadline for filing 2021 federal income tax returns is April 18, 2022.

In the appendices, you'll find a listing of items that can be adjusted each year to reflect cost‐of‐living changes so you can plan ahead, as well as a checklist of items that are tax free, and a checklist of items that are not deductible.

Throughout the book you will find alerts to possible changes to come. For a free update on tax developments, look for the Supplement to this book in February 2022, by going to www.jklasser.com, as well as to my website, www.BigIdeasForSmallBusiness.com.

CHAPTER 1 You and Your Family

1 Marital Status

2 Dependents

3 Qualifying Child

4 Qualifying Relative

5 Child Tax Credit

6 Earned Income Credit

7 Dependent Care Expenses

8 Adoption Costs

9 Foster Care

10 Child Support

11 Alimony

12 ABLE Accounts

The nature of families is changing, and taxes have specific rules for them. Do the old clichés still ring true? Can two still live as cheaply as one? Are things really cheaper by the dozen? For tax purposes, there may be a penalty or bonus for being married versus single. And there are certain tax breaks for having a family.

This chapter explains family‐related tax benefits, such as tax credits related to your children and the consequences of marital dissolutions. Economic impact payments (EIPs) in 2021 to individuals and dependents are explained in Chapter 12. For more information on these topics, see IRS Publication 501, Dependents, Standard Deduction, and Filing Information ; IRS Publication 503, Child and Dependent Care Expenses ; IRS Publication 504, Divorced or Separated Individuals ; IRS Publication 596, Earned Income Credit ; and IRS Publication 972, Child Tax Credit .

Marital Status

Whether you are married or single has a significant impact on your taxes. In some cases, being married results in a “marriage bonus,” which means effectively averaging taxes when one spouse works and the other does not. In other cases, being married results in a “marriage penalty,” which means that two working spouses earning about the same likely will pay higher total tax than if they were single. For some tax rules, a married couple has the identical tax break as a single individual, such as the $3,000 capital loss deduction against ordinary income and the $10,000 limit on itemizing state and local taxes, which is a distinct disadvantage for those who are married. For some tax rules, a married couple has double the tax break for singles, such as the ordinary loss deduction for so‐called Section 1244 stock, so marital status makes no difference here.

Technically, there are a number of filing statuses that determine eligibility for various tax breaks:

Married filing jointly

Married filing separately

Head of household

Unmarried (single)

Qualifying widow(er) with a dependent child. This filing status is also referred to as a surviving spouse.

You need to know which term applies to you. The terms are not further defined here and often cause confusion, so check IRS Publication 501 if you are unsure. Note that under federal tax law, the terms “husband,” “wife,” and “spouse” are gender neutral. The term “husband and wife” means two individuals lawfully married to each other. However, those in a civil union or domestic partnership are not married for federal income tax purposes.

Dependents

No personal or dependency exemptions can be claimed in 2018 through 2025. So if you had 4 exemptions in 2017 and deducted $16,200 ($4,050 × 4) in that year, your deduction in 2021 is zero. The suspension of exemptions seriously reduces write‐offs for many taxpayers. Of course, because high‐income taxpayers were subject to a phaseout of exemptions, they are not greatly affected by the suspension in the deduction for exemptions.

However, the concept of dependents has not been eliminated and continues to apply for various purposes. For example, for purposes of a child tax credit that may be claimed for a qualifying child or a dependent who is not a qualifying child, the concept of dependents continues to apply. The definition of dependent varies for certain purposes and is explained in each relevant tax break in this book. For example, the amount of income for a qualifying relative taken into account in determining dependent status in 2021 is $4,300.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «J.K. Lasser's 1001 Deductions and Tax Breaks 2022»

Представляем Вашему вниманию похожие книги на «J.K. Lasser's 1001 Deductions and Tax Breaks 2022» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «J.K. Lasser's 1001 Deductions and Tax Breaks 2022» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.