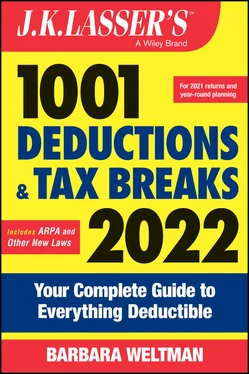

Barbara Weltman - J.K. Lasser's 1001 Deductions and Tax Breaks 2022

Здесь есть возможность читать онлайн «Barbara Weltman - J.K. Lasser's 1001 Deductions and Tax Breaks 2022» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:J.K. Lasser's 1001 Deductions and Tax Breaks 2022

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:3 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 60

- 1

- 2

- 3

- 4

- 5

J.K. Lasser's 1001 Deductions and Tax Breaks 2022: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «J.K. Lasser's 1001 Deductions and Tax Breaks 2022»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

J.K. Lasser's 1001 Deductions and Tax Breaks 2022: Your Complete Guide to Everything Deductible

1001 Deductions and Tax Breaks, 2022

J.K. Lasser's 1001 Deductions and Tax Breaks 2022 — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «J.K. Lasser's 1001 Deductions and Tax Breaks 2022», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

Tax‐Favored Items

There are 5 types of tax‐advantaged items receiving preferential or favorable treatment under the tax law:

1 Tax‐free income—income you can receive without any current or future tax concerns. Tax‐free income may be in the form of exclusions or exemptions from tax. In many cases, tax‐free items do not even have to be reported in any way on your return.

2 Capital gains—profits on the sale or exchange of property held for more than one year (long‐term). Long‐term capital gains are subject to lower tax rates than the rates on other income, such as salary and interest income, and may even be tax free in some cases. Ordinary dividends on stocks and capital gain distributions from stock mutual funds are taxed at the same low rates as long‐term capital gains.

3 Tax‐deferred income—income that isn't currently taxed. Since the income builds up without any reduction for current tax, you may accumulate more over time. However, at some point the income becomes taxable.

4 Deductions—items you can subtract from your income to reduce the amount of income subject to tax. There are 2 classes of deductions: those “above the line,” which are subtracted directly from gross income, and those “below the line,” which can be claimed only if you itemize deductions instead of claiming the standard deduction (explained later).

5 Credits—items you can use to offset your tax on a dollar‐for‐dollar basis. There are 2 types of tax credits: one that can be used only to offset tax liability (called a “nonrefundable” credit) and one that can be claimed even if it exceeds tax liability and you receive a refund (called a “refundable” credit). Usually you must complete a special tax form for each credit you claim.

This book focuses on different types of tax‐favored items: exclusions (tax‐free income), above‐the‐line deductions that don't require itemizing, itemized deductions, tax credits, and other benefits, such as subtractions that reduce income. At the end of this Introduction you'll see symbols used to easily identify the type of benefit being explained.

Limits on Qualifying for Tax‐Favored Items

In many cases, eligibility for tax benefits (including Economic Impact Payments), or the extent to which they may be claimed, depends on adjusted gross income (AGI) or modified adjusted gross income (MAGI).

Adjusted gross incomeis gross income (all the income you are required to report) minus certain deductions (called “adjustments to gross income”). Adjustments or subtractions you can make to your gross income to arrive at your adjusted gross income are limited to the following items:

Alimony payments for pre‐2019 divorces and separation agreements

Archer Medical Savings Accounts (MSAs) (for accounts set up prior to 2008)

Business expenses of self‐employed individuals

Capital loss deductions of up to $3,000

Charitable contributions up to $300 ($600 for joint filers) if you don't itemize personal deductions

Educator expenses up to $250

Employer‐equivalent portion of self‐employment tax

Forfeiture‐of‐interest penalties because of early withdrawals from certificates of deposit (CDs)

Health Savings Account (HSA) contributions

Individual Retirement Account (IRA) deductions

Jury duty pay turned over to your employer

Legal fees for unlawful discrimination claims

Net disaster loss if you don't itemize personal deductions

Net operating losses (NOLs)

Performing artist's qualifying expenses

Qualified retirement plan contributions for self‐employed individuals

Rent and royalty expenses

Repayment of supplemental unemployment benefits required because of the receipt of trade readjustment allowances

Self‐employed health insurance deduction

Simplified employee pension (SEP) or savings incentive match plan for employees (SIMPLE) contributions for self‐employed individuals

Student loan interest deduction up to $2,500

Travel expenses to attend National Guard or military reserve meetings more than 100 miles from home

Figuring AGI may sound complicated, but in reality it's merely a number taken from a line on your tax return. For example, AGI is the figure you enter on line 11 of the 2021 Form 1040 or 1040‐SR.

Modified adjusted gross incomeis merely AGI increased by certain items that are excludable from income and/or certain adjustments to gross income. Which items are added back varies for different tax breaks. For example, the MAGI limit on eligibility to claim the student loan interest deduction is AGI (disregarding the student loan interest deduction) increased by the exclusion for foreign earned income and certain other foreign income or expenses. All of these items are explained in this book.

Household incomeis a term in tax law used to determine eligibility for the premium tax credit to help pay for coverage purchased through a government marketplace. Household income is explained further in this book in connection with these tax rules.

Qualified business income.If you are an owner in a pass‐through entity—a sole proprietorship, limited liability company, partners, or S corporation—you may be eligible for a qualified business income (QBI) deduction. QBI for purposes of this personal deduction is explained further in Chapter.

TABLE I.1 Standard Deduction Amounts for 2021

| Filing Status | Standard Deduction |

|---|---|

| Married filing jointly | $ 25,100 |

| Head of household | 18,800 |

| Single (unmarried) | 12,550 |

| Qualifying widow(er) (surviving spouse) | 25,100 |

| Married filing separately | 12,550 |

Taxable income.This is the amount of income remaining after subtracting deductions. Taxable income is the amount on which taxes are figured. Taxable income is also the threshold used for determining the QBI deduction explained in

Chapter.Standard Deduction versus Itemized Deductions

Every taxpayer, other than a dependent of another taxpayer, is entitled to a standard deduction. This is a subtraction from your income, and the amount you claim is based on your filing status. Table I.1 shows the standard deduction amounts for 2021. In 2018 (the most recent year for statistics), about 88% of all filers used the standard deduction.

In addition to the basic standard deduction, certain taxpayers can increase these amounts. An additional standard deduction amount applies to those age 65 and older and for blindness. For 2021, the additional amount is $1,700 for individuals who are not married and are not a surviving spouse and $1,350 for those who are married or a surviving spouse.

Example

In 2021, you are single, age 68, and not blind. Your standard deduction is $14,250 ($12,550 + $1,700).

You cannot claim any additional standard deduction that applies to those 65 or older and/or blind if you choose to itemize deductions in lieu of claiming the basic standard deduction amount.

Individuals who do not itemize but suffer a net qualified disaster loss in a federally declared disaster area can effectively increase their standard deduction amount. Net qualified disaster losses are explained in

Chapter 12.Instead of claiming the standard deduction, you can opt to list certain deductions separately (i.e., itemize them). Itemized deductions include:

Medical expenses

Taxes

Interest payments

Gifts to charity (without regard to the dollar limit allowed for those claiming the standard deduction)

Читать дальшеИнтервал:

Закладка:

Похожие книги на «J.K. Lasser's 1001 Deductions and Tax Breaks 2022»

Представляем Вашему вниманию похожие книги на «J.K. Lasser's 1001 Deductions and Tax Breaks 2022» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «J.K. Lasser's 1001 Deductions and Tax Breaks 2022» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.