Copyright: © 2014 Géza Várkuti

Published by: epubli GmbH, Berlin, www.epubli.de

ISBN 978-3-7375-2629-6

Imprint Imprint Copyright: © 2014 Géza Várkuti Published by: epubli GmbH, Berlin, www.epubli.de ISBN 978-3-7375-2629-6

Results* Results* First of all, I think everyone is interested in how profitable this strategy is, the results are available here:

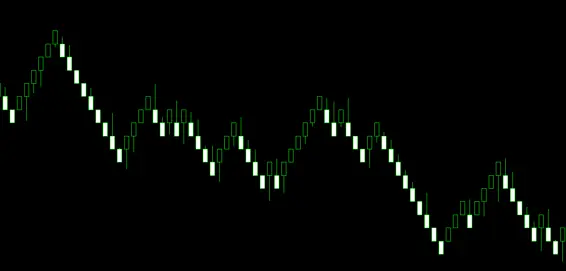

Prologue Prologue The first step on the road to perfection is to focus on the essentials. There is an ancient Japanese proverb, which sounds like this. It hasn´t been put here by accident. On the following pages a centuries-old Japanese technique, the actual application of the Renko chart will be discussed. According to the descriptions, rice traders used this technique to visualize the movement of the rice prices. Were they the first futures traders? The Japanese culture is known for simple elegant forms and clear lines, both in the world of design and thought, but this simplicity originates from reducing things to their most essential content. If we see a chart of a currency pair, index or a bond today, we can read a lot of information out of it. Opening and closing prices can be seen up to 1 minute resolution, peaks, volumes, etc. Now if we pack up a few more indicator to the chart, draw more trend lines, look at Fibonacci-levels etc. we believe we know almost everything about the current status of the market, but what does all this really tell us about the future? Does it really help us to make trading decisions, or is all that wealth of information just giving us the illusion of predictability? Already the temporal resolution of the chart itself is questionable. If we imagine that the exchange rate movements are really endless undulating streams, then why we do we aggregate that information in a way that makes a candle appear in every hour? Or why do we assume that the opening and closing value is a more important piece of information than the top or bottom of the spikes? Why do we say that the 10:00 tick - optionally the middle of a rising wave – is more relevant than the 9:46 tick? Why? Obviously we need handrails, we pull a time grid on the market to make it easier to map it, but it is fairly arbitrary. Don´t you think so too? The Renko charts do not care about the time, but are solely focused on the movements. It only shows that the price has taken a certain distance or not. No matter how long that takes. This creates a clean chart with no unnecessary information, which is much easier to read. Let's look at how it is structured, how it should be interpreted and applied.

The Renko chart

Renko chart in MetaTrader 4

The use of the Renko chart

Renko zig-zag strategy

Entry – Stop - Closing

Pull into breakeven

Reopen

Lossy situations

Breakeven situations

Profitable situations

Summarizing

Difficulties - errors

Results – alternative exit strategies

XAUUSD

DAX

GBPJPY

Summarizing

Automated version – Expert Advisor

The author

Terms

High risk warning

First of all, I think everyone is interested in how profitable this strategy is, the results are available here:

XAUUSD 1952 pip

XAUUSD 4118 pip

XAUUSD 1916 pip

GER30 (DAX) 2690 pip

GBPJPY 1756 pip

* Past and back test data do not constitute guarantees of future performance .

The first step on the road to perfection is to focus on the essentials. There is an ancient Japanese proverb, which sounds like this. It hasn´t been put here by accident.

On the following pages a centuries-old Japanese technique, the actual application of the Renko chart will be discussed. According to the descriptions, rice traders used this technique to visualize the movement of the rice prices. Were they the first futures traders?

The Japanese culture is known for simple elegant forms and clear lines, both in the world of design and thought, but this simplicity originates from reducing things to their most essential content.

If we see a chart of a currency pair, index or a bond today, we can read a lot of information out of it. Opening and closing prices can be seen up to 1 minute resolution, peaks, volumes, etc. Now if we pack up a few more indicator to the chart, draw more trend lines, look at Fibonacci-levels etc. we believe we know almost everything about the current status of the market, but what does all this really tell us about the future? Does it really help us to make trading decisions, or is all that wealth of information just giving us the illusion of predictability?

Already the temporal resolution of the chart itself is questionable. If we imagine that the exchange rate movements are really endless undulating streams, then why we do we aggregate that information in a way that makes a candle appear in every hour? Or why do we assume that the opening and closing value is a more important piece of information than the top or bottom of the spikes? Why do we say that the 10:00 tick - optionally the middle of a rising wave – is more relevant than the 9:46 tick? Why? Obviously we need handrails, we pull a time grid on the market to make it easier to map it, but it is fairly arbitrary. Don´t you think so too?

The Renko charts do not care about the time, but are solely focused on the movements. It only shows that the price has taken a certain distance or not. No matter how long that takes. This creates a clean chart with no unnecessary information, which is much easier to read.

Let's look at how it is structured, how it should be interpreted and applied.

Конец ознакомительного фрагмента.

Текст предоставлен ООО «ЛитРес».

Прочитайте эту книгу целиком, купив полную легальную версию на ЛитРес.

Безопасно оплатить книгу можно банковской картой Visa, MasterCard, Maestro, со счета мобильного телефона, с платежного терминала, в салоне МТС или Связной, через PayPal, WebMoney, Яндекс.Деньги, QIWI Кошелек, бонусными картами или другим удобным Вам способом.