Time and again in this book, I talk about the Gaussian (normal) distribution. Chapter 2has a definition and explanation and a picture of the famous bell curve.

Please don’t get alarmed by the maths. I tried to follow the advice of the physicist Albert Einstein that ‘Everything should be made as simple as possible, but not simpler.’

Pricing, managing and trading

Quantitative finance is used by many professionals working in the financial industry. Investment banks use it to price and trade options and swaps. Their customers, such as the officers of retail banks and insurance companies, use it to manage their portfolios of these instruments. Brokers using electronic-trading algorithms use quantitative finance to develop their algorithms. Investment managers use ideas from modern portfolio theory to try to boost the returns of their portfolios and reduce the risks. Hedge fund managers use quantitative finance to develop new trading strategies but also to structure new products for their clients.

Meeting the market participants

Who needs quantitative finance? The answer includes banks, hedge funds, insurance companies, property investors and investment managers. Any organisation that uses financial derivatives, such as options, or manages portfolios of equities or bonds uses quantitative finance. Analysts employed specifically to use quantitative finance are often called quants, which is a friendly term for quantitative analysts, the maths geeks employed by banks.

Perhaps the most reviled participants in the world of finance are speculators . (Bankers should thank me for writing that.) A speculator makes transactions in financial assets purely to buy or sell them at a future time for profit. In that way, speculators are intermediaries between other participants in the market. Their activity is often organised as a hedge fund, which is an investment fund based on speculative trading.

Speculators can make a profit due to

Speculators can make a profit due to

❯❯ Superior information

❯❯ Good management of the risk in a portfolio

❯❯ Understanding the products they trade

❯❯ Fast or efficient trading mechanisms

Speculators are sometimes criticised for destabilising markets, but more likely they do the opposite. To be consistently profitable, a speculator has to buy when prices are low and sell when prices are high. This practice tends to increase prices when they’re low and reduce them when they’re high. So speculation should stabilise prices (not everyone agrees with this reasoning, though).

Speculators also provide liquidity to markets. Liquidity is the extent to which a financial asset can be bought or sold without the price being affected significantly. ( Chapter 18has more on liquidity.) Because speculators are prepared to buy (or sell) when others are selling (or buying), they increase market liquidity. That’s beneficial to other market participants such as hedgers (see the next paragraph) and is another reason not to be too hard on speculators.

In contrast to speculators, hedgers like to play safe. They use financial instruments such as options and futures (which I cover in Chapter 4) to protect a financial or physical investment against an adverse movement in price. A hedger protects against price rises if she intends to buy a commodity in the future and protects against price falls if she intends to sell in the future. A natural hedger is, for example, a utility company that knows it will want to purchase natural gas throughout the winter so as to generate electricity. Utility companies typically have a high level of debt (power stations are expensive!) and fixed output prices because of regulation, so they often manage their risk using option and futures contracts which I discuss in Chapters 5and 6, respectively.

Walking like a drunkard

The random walk, a path made up from a sequence of random steps, is an idea that comes up time and again in quantitative finance. In fact, the random walk is probably the most important idea in quantitative finance. Chapter 3is devoted to it and elaborates how random walks are used.

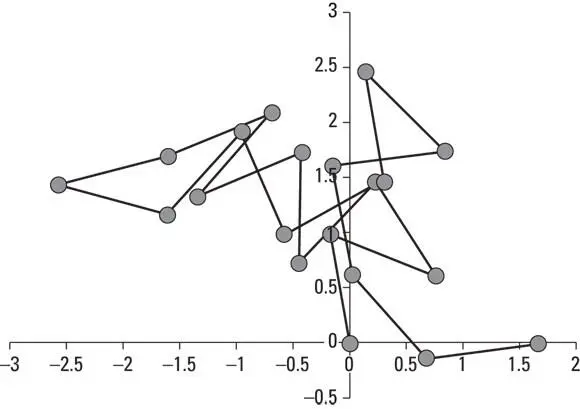

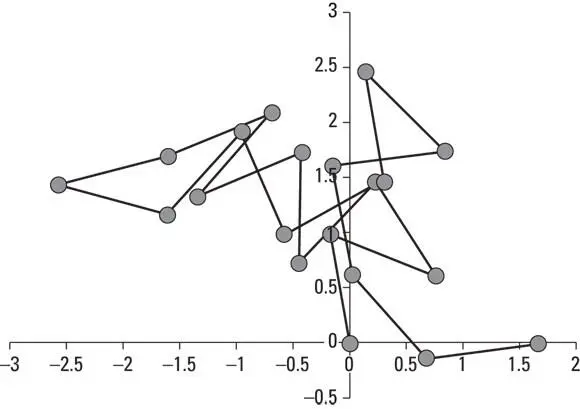

Figure 1-1shows the imagined path of a bug walking over a piece of paper and choosing a direction completely at random at each step. (It may look like your path home from the pub after you’ve had a few too many.) The bug doesn’t get far even after taking 20 steps.

© John Wiley & Sons, Ltd.

FIGURE 1-1: A random walk.

In finance, you’re interested in the steps taken by the stock market or any other financial market. You can simulate the track taken by the stock market just like the simulated track taken by a bug. Doing so is a fun metaphor but a serious one, too. Even if this activity doesn’t tell you where the price ends up, it tells you a range within which you can expect to find the price, which can prove to be useful.

Random walks come in different forms. In Figure 1-1, the steps are all the same length. In finance, though random walks are often used with very small step sizes, in which case you get a Brownian motion. In a slightly more complex form of Brownian motion, you get the geometric Brownian motion, or GBM, which is the most common model for the motion of stock markets. You can find out in detail about GBM in Chapter 3.

Random walks come in different forms. In Figure 1-1, the steps are all the same length. In finance, though random walks are often used with very small step sizes, in which case you get a Brownian motion. In a slightly more complex form of Brownian motion, you get the geometric Brownian motion, or GBM, which is the most common model for the motion of stock markets. You can find out in detail about GBM in Chapter 3.

Knowing that almost nothing isn’t completely nothing

The orthodox view is that financial markets are efficient, meaning that prices reflect known information and follow a random walk pattern. It’s therefore impossible to beat the market and not worth paying anyone to manage an investment portfolio. This is the efficient market hypothesis, or EMH for short. This view is quite widely accepted and is the reason for the success of tracker funds, investments that seek to follow or track a stock index such as the Dow Jones Industrial Average. Because tracking an index takes little skill, investment managers can offer a diversified portfolio at low cost. Chapter 14has much more about diversification and portfolios.

Academics often distinguish different versions of the efficient market hypothesis (EMH):

Academics often distinguish different versions of the efficient market hypothesis (EMH):

❯❯ Weak efficiencyis when prices can’t be predicted from past prices.

❯❯ Semi-strong efficiencyis when prices can’t be predicted with all available public information.

❯❯ Strong efficiencygoes a step further than semi-strong efficiency and says that prices can’t be predicted using both public and private information.

Anomalies are systematically found in historical stock prices that violate even weak efficiency. For example, you find momentum in most stock prices: If the price has risen in the past few months, it will tend to rise further in the next few months. Likewise, if the price has fallen in the past few months, it will tend to continue falling in the next few months. This anomaly is quite persistent and is the basis for the trend following strategy of many hedge funds.

Somehow, though, the EMH smells wrong. Even though you can find many vendors of market information, EMH has a cost. It’s no coincidence that some of these vendors are very wealthy indeed. Also, if you examine publicly available information, you soon find that such information is not perfect. Often the information is delayed, with the numbers published days or even weeks following the time period they apply to. Some exceptions exist and you can read about one of them in the sidebar, ‘ The impact of US employment numbers’.

Читать дальше

Speculators can make a profit due to

Speculators can make a profit due to

Academics often distinguish different versions of the efficient market hypothesis (EMH):

Academics often distinguish different versions of the efficient market hypothesis (EMH):