Rodenstock and Broadbent were, of course, staunch defenders of the wine. “An ullaged bottle,” Broadbent recorded in his notebook. “Alas, but unsurprisingly ‘over the top,’ oxidised: colour dark brown; nose like pure balsamic vinegar; despite the rich components—undrinkable.” Few knew what a bottle so old should taste like, anyway. The number of people who had experienced pre-1800 wines was tiny, and of that handful, Broadbent and Rodenstock had tasted the most. This—a presumption of infallibility about old wines because they had tasted more than anyone else—was increasingly their fallback posture when questioned.

“I cannot believe that it is anything but genuine,” Broadbent said. “I thought the bottle alone was worth 10,000 pounds.”

IN THE THREE months following the Flatt tasting, Rodenstock privately sold four more Jefferson bottles. The buyer of all four was William Ingraham Koch, the scion of a Kansas oil-and-gas fortune. For the past eight years, Koch (pronounced like the soft drink) had been at the center of an epic feud with his family, including his twin brother, David. It had ignited in 1980, when Bill Koch attempted a coup by proxy fight to oust his older brother, Charles, from Wichita-based Koch Industries, then the second-largest privately held company in the country; Charles outmaneuvered him, and Bill, who worked from the Boston area, ended up jobless at age forty. Bill sued his brothers. Their mother told Bill he wasn’t welcome in her house. Eventually, in 1983, Bill took a buyout of his piece of the company. He walked away with $470 million.

Before the Koch brothers cut a deal, Bill’s wealth was illiquid, and he had been in a several-year funk. After receiving the windfall, Koch went on a hedonistic tear. He spent his newfound money on eating and drinking, and collecting houses, art, and wine. Koch had been interested in wine since the 1970s, when he noticed how much better Montrachet, the most famous white Burgundy, tasted than run-of-the-mill stuff. But it was the big payday that turned him into a collector. He started buying an average of 5,000 bottles a year, an acquisition rate he would maintain through the late 1980s.

Systematically, Koch set out to assemble deep verticals of four iconic wines; eventually he would own 95 years of Pétrus, 100 years of Latour, 120 years of Mouton, and 150 years of Lafite (as well as 33 vintages of Hennessey Cognac, back to 1851). It was while assembling these verticals that, in November of 1988, Koch bought a 1787 Branne-Mouton, a Jefferson bottle, from a Midwestern firm called the Chicago Wine Company. Koch was then approached directly by Farr Vintners, the London brokers who had obtained the bottle from Rodenstock and sold it to Chicago Wine.

Farr said they had three more, and partner Lindsay Hamilton flew to New York with the bottles—a 1784 Branne-Mouton, a 1784 Lafite, and a 1787 Lafite, all inscribed “Th.J.”—in a big leather lawyer’s briefcase and delivered them to Bill Koch at his Fifth Avenue apartment. For the group of three, Koch paid £116,000, or about $200,000. One month after buying the three Jefferson bottles from Farr, Koch bought another batch of (non-Jefferson) bottles from the brokers, including three eighteenth-century wines (1737 and 1771 “La Fitte,” and a 1791 “La Tour”) sourced from Rodenstock and priced, collectively, at £91,000 ($159,250).

Where were all these bottles coming from? 1771? 1737? They were Koch’s oldest wines. The 1737 was way beyond anything even Broadbent had encountered. When Broadbent auctioned the Forbes bottle, a mere 1787, it was the oldest authenticated vintage claret Christie’s had ever handled. Even the earliest Christie’s catalogs, published during the 1760s and 1770s and 1780s, made no specific mention of red wine as old as the bottles Koch had just bought. In Broadbent’s Great Vintage Wine Book, 1771 and 1791 were among the very few eighteenth-century vintages mentioned, and not because he had tasted them, but because they had been acclaimed in their time. Their turning up now seemed a remarkable coincidence. But selling the bottles to Koch put them in the hands of an enthusiastic collector, not a scholar, and using the private market for the transaction meant that it went unobserved by most people in the wine world.

The bottles were of a piece with a curious phenomenon in the old-wine scene in the latter half of the 1980s: the appearance of ever-rarer rarities. The 1970s and early 1980s had seen the progressive depletion of the buried stocks of Europe, thanks largely to Broadbent. “They don’t exist now,” Broadbent told an interviewer once. “They’ve been explored like the Pyramids or the tombs of the Nile. They’ve all been desecrated by me.” Yet in the years since his streak of discoveries, several more bottles from the eighteenth century had surfaced. A possible explanation was that Broadbent had done the strip-mining, and a new breed of bottle hunters was digging deeper. Then again, it seemed strange that the bottle hunter raising his shovel in triumph was invariably Hardy Rodenstock.

Koch, in the mold of Forbes and Shiblaq/Al-Fayed, was a deep-pocketed outsider whose extravagant purchase of the bottles did nothing to validate them to wine-world insiders. For Chicago Wine Company and Farr Vintners to sell the bottles, however, was to provide yet two more seals of approval for Rodenstock and his bottles. The list of respected wine-world players willing to vouch for the bottles—Michael Broadbent, Christie’s, Marvin Shanken, Château Margaux, Château d’Yquem—had just gotten a little bit longer.

Farr, in particular, was a major player, an upstart which, in a very short time, had emerged as the foremost London broker of Bordeaux futures as well as a leader in the rarities market. “We used to call them ‘the weasels,’” Broadbent recalled. Now Farr was the top seller of Jefferson bottles. Four—the number Farr had sold to Koch, three directly and one through Chicago Wine—was one more than even Broadbent had sold. And Farr had sold a fifth.

CHAPTER 10

A PLEASANT STAIN, BUT NOT A GREAT ONE

BILL SOKOLIN WAS MAKING HIS WAY ACROSS THE ROOM to see Rusty Staub when he had the first inkling that something had gone terribly wrong. It was Sunday, April 24, 1989, and Sokolin was at a black-tie, $250-a-head, seven-course, seventeen-wine dinner at the Four Seasons. During the week the restaurant played host to Manhattan’s power elite; on Sundays it was often closed to accommodate the great and grand of the wine world at private events such as this. Sokolin, a wine-shop owner, was a controversial figure among his colleagues, known for his roster of well-heeled clients, his loopy newsletter soliloquies, and a Barnumesque promotional style (when a newspaper once termed him “an incorrigible hypemeister,” Sokolin wrote to thank the editor). At this moment, the proprietor of D. Sokolin & Co. was navigating the Pool Room, a high-ceilinged, midcentury-modern space bordered with stubby palm trees and surrounding an elevated, square, white marble pool rippling with azure water.

Nearly two hundred people were here, among them every wine retailer of note in the New York area, including Michael Aaron from Sherry-Lehmann and Don Zacharia from Zachys. Former major-league baseball player Staub, now a restaurateur, had brought Mets first baseman Keith Hernandez. But what Sokolin was most excited about, what had goaded him to bring the bottle, were the guests of honor: Châteaux Margaux owners Laura and Corinne Mentzelopoulos and Paul Pontallier, the estate’s urbane director.

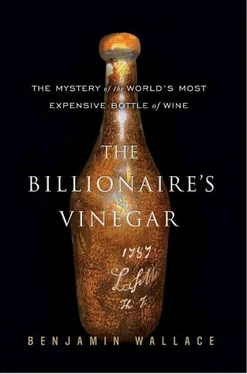

Sokolin happened to be in possession of a Margaux the likes of which most of these people had never seen. A 1787 Margaux. A Jefferson bottle. The most expensive bottle of wine in the world, as far as Sokolin was concerned. Guinness might bestow that honor on Malcolm Forbes, but Sokolin’s bottle was insured for $212,000, $56,000 above the price of the Forbes Lafite. Tonight, Sokolin couldn’t resist showing the bottle around, and as a former minor-league baseball player, he was especially eager to show it to Staub.

Читать дальше