IRELAND’S FINANCIAL DISASTER shared some things in common with Iceland’s. It was created by the sort of men who ignore their wives’ suggestions that maybe they should stop and ask for directions, for instance. But while the Icelandic male used foreign money to conquer foreign places—trophy companies in Britain, chunks of Scandinavia—the Irish male used foreign money to conquer Ireland. Left alone in a dark room with a pile of money, the Irish decided what they really wanted to do with it was buy Ireland. From each other. An Irish economist named Morgan Kelly, whose estimates of Irish bank losses have been the most prescient, has made a back-of-the-envelope calculation that puts the property-related losses of all Irish banks at roughly 106 billion euros. (Think $10.6 trillion.) At the rate money flows into the Irish treasury, Irish bank losses alone would absorb every penny of Irish taxes for the next four years.

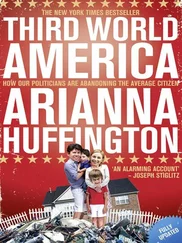

In recognition of the spectacular losses, the entire Irish economy has almost dutifully collapsed. When you fly into Dublin you are traveling, for the first time in fifteen years, against the traffic. The Irish are once again leaving Ireland, along with hordes of migrant workers. In late 2006 the unemployment rate stood at a bit more than 4 percent; now it’s 14 percent, and climbing toward rates not experienced since the mid-1980s. Just a few years ago Ireland was able to borrow money more cheaply than Germany; now, if it can borrow at all, it will be charged interest rates 6 percent higher than Germany, another echo of a distant past. The Irish budget deficit—in 2007 the country had a budget surplus—is now 32 percent of its GDP, the highest by far in the history of the euro zone. Professional credit analyst firms now judge Ireland the third most likely country in the world to default. Not quite as risky for the global investor as Venezuela, perhaps, but riskier than Iraq. Distinctly third world, in any case.

Yet when I arrived, Irish politics had a frozen-in-time quality. In Iceland, the business-friendly conservative party had been quickly tossed out of power, and the women had booted the alpha males out of the banks and government. In Greece the corrupt, business-friendly, every-Greek-for-himself conservative party was also given the heave-ho, and the new government is attempting to create a sense of collective purpose, or at any rate persuade the citizens to quit cheating on their taxes. (The new Greek prime minister is not merely upstanding but barely Greek.) Ireland was the first European country to watch its entire banking system fail, and yet its business-friendly conservative party, Fianna Fáil (pronounced “Feena Foil”), remained in office up until February 2011. There’s no Tea Party movement, no Glenn Beck, no serious protests of any kind. The only obvious change in the country’s politics has been the role played by foreigners. The new bank regulator, an Englishman, came from Bermuda. The Irish government and Irish banks are crawling with American investment bankers and Australian management consultants and faceless Euro-officials, referred to inside the Department of Finance simply as “the Germans.” Walk the streets at night and, through restaurant windows, you see important-looking men in suits, dining alone, studying important-looking papers. In some new and strange way Dublin was now an occupied city: Hanoi, circa 1950. “The problem with Ireland is that you’re not allowed to work with Irish people anymore,” an Irish property developer told me. He was finding it difficult to escape hundreds of millions of euros in debt he would never be able to repay.

Ireland’s regress is especially unsettling because of the questions it raises about Ireland’s former progress: even now no one is quite sure why the Irish did so well for themselves in the first place. Between 1845 and 1852 the country experienced the single greatest loss of population in world history: in a nation of 8 million, 1.5 million people left. Another million Irish people starved to death, or died from the effects of hunger. Inside of a decade the nation went from being among the most densely populated in Europe to one of the least. The founding of the Irish state in 1922 might have offered some economic hope—they now had their own central bank, their own economic policies—but right up until the end of the 1980s the Irish had failed to do what economists expected them to do: catch up with their neighbors’ standard of living. As recently as the 1980s 1 million Irish people, in a nation of a mere 3.2 million, lived below the poverty line.

WHAT HAS OCCURRED in Ireland since then is without precedent in economic history. By the start of the new millennium the Irish poverty rate was under 6 percent, and Ireland was the second richest country in the world, according to the Bank of Ireland. How did that happen? A bright young Irishman who got himself hired by Bear Stearns in the late 1990s and went off to New York or London for five years returned feeling poor . For the better part of the past decade there’s been quicker money to be made in Irish real estate than in American investment banking. How did that happen? For the first time in history people and money longed to get into Ireland rather than out of it. The most dramatic case in point are the Poles. The Polish government keeps no official statistics on the movement of its workforce, but its Foreign Ministry guesstimates that, since their admission to the European Union, a million Poles have left Poland to work elsewhere—and that, at the peak, in 2006, a quarter of a million of them were in Ireland. For the United States to achieve a proportionally distortive demographic effect it would need to hand green cards to 17.5 million Mexicans.

HOW DID ANY of this happen? There are many theories: the elimination of trade barriers, the decision to grant free public higher education, a low corporate tax rate introduced in the 1980s, which turned Ireland into a tax haven for foreign corporations. Maybe the most intriguing was offered by a pair of demographers at Harvard, David E. Bloom and David Canning, in a 2003 paper called “Contraception and the Celtic Tiger.” Bloom and Canning argued that a major cause of the Irish boom was a dramatic increase in the ratio of working-age to non–working-age Irishmen, brought about by a crash in the Irish birthrate. This in turn had been mainly driven by Ireland’s decision, in 1979, to legalize birth control. That is, there was an inverse correlation between a nation’s fidelity to the Vatican’s edicts and its ability to climb out of poverty: out of the slow death of the Irish Catholic Church arose an economic miracle.

The Harvard demographers admitted their theory explained only part of what had happened in Ireland. And at the bottom of the success of the Irish there remains, even now, some mystery. “It appeared like a miraculous beast materializing in a forest clearing,” writes the preeminent Irish historian R. F. Foster, “and economists are still not entirely sure why.” Not knowing why they were so suddenly so successful, the Irish can perhaps be forgiven for not knowing exactly how successful they were meant to be. They’d gone from being abnormally poor to being abnormally rich without pausing to experience normality. When, in the early 2000s, the financial markets began to offer virtually unlimited credit to all comers—when nations were let into the dark room with the pile of money, and asked what they would like to do with it—the Irish were already in a peculiarly vulnerable state of mind. They’d spent the better part of a decade under something very like a magic spell.

A few months after the spell was broken, the short-term parking lot attendants at Dublin Airport noticed that their daily take had fallen. The lot appeared full; they couldn’t understand it; then they noticed the cars never changed. They phoned the Dublin police, who in turn traced the cars to Polish construction workers, who had bought them with money borrowed from the big Irish banks. The migrant workers had ditched the cars and gone home. A few months later the Bank of Ireland sent three collectors to Poland to see what they could get back, but they had no luck. The Poles were untraceable. But for their cars in the short-term parking lot, they might never have existed.

Читать дальше