1 ...6 7 8 10 11 12 ...35 Yet, despite his power and privilege within the organization, Kevin shrank in his father’s presence. Conditioned by the beatings – psychological rather than physical – which he had received as a child, his eyes would dart agitatedly around, nervously sensing his father’s approach, and sometimes at meetings he would slightly raise his hand to stop someone interfering: ‘Let the old man finish.’ Kevin may well have thought that he could manage the family business honestly, but within recent months either he had veered towards dishonesty or his remaining scruples had been distorted by Robert Maxwell. Many would blame his father’s lifelong dominance for that change, while others would point to his mother’s failure to imbue her youngest son with the moral strength to resist her husband’s demands.

Robert Maxwell had become a collector rather than a manager of businesses. Size, measured in billions of pounds, was his criterion. The excitement of the deal – the seduction, the temptation, the haggling, the consummation and the publicity – had fed his appetite for more. By November 1990, he owned interests in newspapers, publishing, television, printing and electronic databases across the world estimated to be worth £4.2 billion. But the cost of his greed was debts of more than £2.2 billion, and the coffers to repay the loans were empty. This was the background to Ghislaine’s flight to New York to bring back the Berlitz share certificates.

The principal cause of indebtedness was the $3.35 billion spent by Maxwell in 1988 on the ‘Big One’, as his excitable American banker Robert Pirie called it. The money had bought Official Airline Guides (OAG) for $750 million and, more importantly, after an intense and successful public battle with Henry Kravis, the famous pixie-like arbitrageur, the Macmillan publishing group for $2.6 billion. Pirie had throughout stoked Maxwell’s burning sense of triumph.

Pirie, the chief executive of Rothschild Inc., had played on Maxwell’s weaknesses. ‘If you want to be in the media business,’ advised the Rothschild banker, ‘you’ve got to be prepared to pay the price.’ He did not add that he would earn higher fees if Maxwell won. Telling his client, ‘You’re paying top dollar,’ Pirie did not discourage him from going for broke. Maxwell’s self-imposed deadline for joining the Big Ten League, alongside his old rival Rupert Murdoch, would expire in just thirteen months. Intoxicated by the publicity of spending $3 billion, he crossed the threshold without considering the consequences. ‘Plays him like a puppet,’ sniped one who was able to observe Pirie’s artful sycophancy. To Pirie, Maxwell had not overpaid. There were, in the jargon of that frenetic era, ‘enormous synergies’ and the Publisher himself did not even consider his plight as a debtor owing $3 billion. After all, Pirie boasted, ‘Maxwell had no credibility problem with the lending banks.’ But the Rothschild banker disclaimed any responsibility for the other deal. ‘He paid too much for OAG,’ he later volunteered, adding unconvincingly, ‘The deal was done by Maxwell, not me.’

Forty-four banks had lent Maxwell $3 billion, hailed by all as proof of his return to respectability. Astonishingly, the giant sum was not initially secured against any assets. He could lose all that cash without more than a blink. The interest rates, moreover, were a derisory 0.5 per cent over base rate. The deal was a phenomenal bargain negotiated through Crédit Lyonnais and Samuel Montagu by Richard Baker, MCC’s gruff deputy managing director, who had been born in Shepherds Bush, west London. Maxwell had inherited Baker when he bought the British Printing Corporation (BPC), Britain’s biggest printers, in an exquisite dawn raid in 1980.

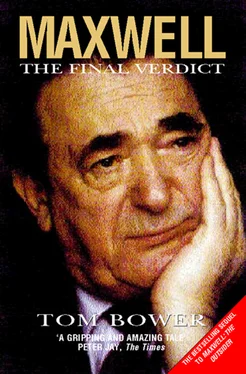

Maxwell’s victory was more than commercial. Despite his infamous branding as a pariah by British government inspectors in 1971, which had cast him into the wilderness, Maxwell had re-established his respectability and acceptability among most in the City. Here was the reincarnation of what had long ago been unaffectionately dubbed ‘The Bouncing Czech’. Leading the supporters was the Nat West Bank, his bankers since 1945, who were impressed by the way their client had crushed the trade unions at BPC, restoring the company to robust profitability. Now the ‘Jumbo Loan’ was the world financial community’s statement of faith in Maxwell. ‘All the banks were clamouring to join the party,’ recalled Ron Woods, Maxwell’s soft-spoken Welsh tax adviser and a director of MCC. Bankers judged MCC to be not only an exciting but a safe company. Former enemies had become allies – and over the years he had collected many enemies. Their numbers had multiplied after 1969 when he had sold Pergamon Press, his scientific publishing company, to Saul Steinberg, a brash young New York tycoon. Since Maxwell was a publicity-seeking, high-profile Labour member of parliament, the deal had attracted unusual attention. Pergamon, Maxwell’s brainchild, was a considerable international success, elevating its owner into the rarefied world of socialist millionaires.

But within weeks the take-over was plunged in crisis. Steinberg’s executives had discovered that Maxwell’s accounts were fraudulent, shamelessly contrived to project high profits and conceal losses. In the ensuing storm of opprobrium, Maxwell was castigated by the Take-Over Panel, lost control of Pergamon and was investigated by two inspectors appointed by the Department of Trade and Industry. In their first report published in 1971, the inspectors, after reminding readers that Maxwell had been censured in 1954 by an official receiver for trading as a book wholesaler while insolvent, revealed that his confidently paraded finances were exercises in systematic dishonesty. Their final conclusion was to haunt Maxwell for the rest of his life:

He is a man of great energy, drive and imagination, but unfortunately an apparent fixation as to his own abilities causes him to ignore the views of others if these are not compatible.… The concept of a Board being responsible for policy was alien to him.

We are also convinced that Mr Maxwell regarded his stewardship duties fulfilled by showing the maximum profits which any transaction could be devised to show. Furthermore, in reporting to shareholders and investors, he had a reckless and unjustified optimism which enabled him on some occasions to disregard unpalatable facts and on others to state what he must have known to be untrue.…

We regret having to conclude that, notwithstanding Mr Maxwell’s acknowledged abilities and energy, he is not in our opinion a person who can be relied upon to exercise proper stewardship of a publicly quoted company.

Even before that excruciating judgment was published, most City players had deserted Maxwell or refused his business. Ostracized, he did not begin to shrug off his pariah status until July 1980, when he succeeded in his take-over bid for the near-bankrupt British Printing Corporation (partly financed by the National Westminster bank). Within two years, his brutal but skilful management had transformed Britain’s biggest printers into a profitable concern, laying the foundations for his purchase of the Mirror Group in 1984.

Building on that apparent respectability, the financial community had cast aside their doubts and contributed to the Jumbo Loan. Among his closest advisers were Rothschilds, his bankers, who had shunned him after 1969; his accountants were Coopers and Lybrand, one of the world’s biggest partnerships; and among his lawyers was Bob Hodes of Wilkie Farr Gallagher, who had led the litigation against him in 1969. For Hodes, a scion of New York’s legal establishment, Maxwell had become ‘a likeable rogue who appeared to enjoy the game’. Like all the other professionals excited by the sound of gunfire, Hodes was confident that he could resist any pressure from Maxwell to bend the rules.

Читать дальше