What Does It Cost to Incorporate? What Does It Cost to Incorporate? Setting up your professional corporation using a lawyer should cost you less than $2,000—and less than $1,000 if you take a do-it-yourself approach. Organizing the corporation—issuing shares and creating by-laws and shareholder agreements, for example—can drive up costs, but keep in mind that you can deduct up to $3,000 of costs related to incorporation. And while it's possible to incorporate using a DIY approach, consulting with a professional can help ensure that you're set up appropriately from the get-go. 1 To be frank, however, I view the cost of incorporation essentially as a “sunk cost” (a cost you have already incurred and cannot recover), as you will likely incur these organizational costs at some point in your career—the only question is when. Also, in my conversations I always stress that you shouldn't be fooled by the myth that higher legal costs will produce better outcomes for your corporation. Incorporating is simple. The only “trick” to watch out for is ensuring you create enough classes of shareholders at the outset so your spouse (or future spouse) and/or your kids (or future kids) can all have shares—they each need to have a letter in front of their shares (Class A, Class B, and so on) so the corporation can pay them different amounts, if you like. That's the (only) “secret sauce” for your Articles of Incorporation. (With that said, if this issue has to be fixed later on, it can be, but your legal costs may be much higher.) In general, your yearly corporate accounting fees might be in the range of $1,000–2,500/year, and ongoing maintenance fees could be as high as $500 (with a lawyer) or $150 (if you file yourself). These fees can be much higher if there is significant active and passive income. Additionally, each year, you'll need to renew the certificate of authorization, and you'll also need to keep the corporation's minute book up to date.

What's the Process to Incorporate? What's the Process to Incorporate? (If you're already incorporated, skip ahead to the section “How Does Purchasing a Home Fit into My Incorporation Timeline?”) We all know time is money, and addressing the added complexity of a corporation will take some of your valuable personal time. The good news, however, is that most of this extra time commitment is required only once, during the initial stages of incorporation. The following is the basic process to incorporate.

When Does It Not Make Sense to Incorporate? How Does Purchasing a Home Fit into My Incorporation Timeline? Can I Purchase My Principal Residence through My Corporation? What about Shareholder Loans? Does a Professional Corporation Give Me Creditor Protection? How Could I “Supercharge” My Charitable Donation? What Is the Lifetime Capital Gains Exemption (LCGE)? Now That I Have Incorporated, Can I Deduct My Golf Membership Fees? What Do I Do with My Corporation When I Retire? Real-Life Case Example of Restructuring Shares Notes

6 Chapter 2: The Compensation Decision: Salary or Dividends? Understanding the Roots of the Compensation Question Salary as Compensation Dividends as Compensation Do You Want to Put Your Savings in an RRSP or in Your Corporation? Do We Want to Participate in the Canadian Pension Plan (CPP)? Do We Have Investments Inside the Corporation? What Are Some Exceptions to these Rules? Notes

7 Chapter 3: Investing Inside Your Corporation Can I Invest through My Corporation? New Passive Income Tax Rules Reminder: Asset Allocation Still Matters What Are Corporate-Class Investments? The Power of Tax-Deferred Compounding Note

8 Chapter 4: Valuing Permanent Insurance on the Holistic Corporate Balance Sheet A Review of the Basics—Permanent Life Insurance as Tax Arbitrage The Benefits of Corporate-Owned Permanent Life Insurance A Real-World Example: My Plan in Action Understanding the Criticisms of Corporate-Held Permanent Life Insurance

9 Chapter 5: Risk ManagementA Careful Examination The Way We Think About Insurance Wealth Insurance Risk Insurance (Life and Disability Insurance) Critical Illness Insurance Long-Term Care Insurance

10 Chapter 6: Borrowing to InvestWhat Is Leverage? Who Are Good Candidates for Using Leverage? Enhancing Returns in the Corporation with Leverage Strategic Prudent Leverage: Timing Building a Non-Registered Portfolio Make Your Mortgage Interest Tax-Deductible Investments That Use Leverage When Does Leveraging Go Bad? Note

11 Chapter 7: Investing: Active or Passive? What Is Active Investing and What Is Passive Investing? Understanding Investment Trends A Deep Dive into Passive Management Diving into Active Management Wrapping Up the Debate Notes

12 Chapter 8: The Role of Trusts in Your Financial Plan Speaking the Language of Trusts Trust Concepts Inter Vivos Trusts Discretionary Investment Trust for Grandchildren Bearer Trusts Inter Vivos Cottage Trust Testamentary Trusts Spousal Trust

13 Chapter 9: Alternative Investment Strategies Capital Gains Strip Individual Pension Plans (IPP and PPP) Retirement Compensation Arrangements Investing in Watches: Can I Buy My Rolex through the Corporation? Art: Can I Buy My Pablo Picasso Painting through the Corporation? Private Health Services Plans Health Spending Accounts Notes

14 Chapter 10: Pulling It All Together: Your Financial Plan The Value of a Financial Plan Plan Analysis Synopsis Private Corporation Synopsis Net Worth Statement Net Worth Timeline Net Worth Outlook Cash Flow Outlook Retirement Cash Flow Timeline Retirement Need and Investable Assets Detailed Estate Analysis

15 Utilizing Tax-Efficient Strategies Recommendations Cash Flow Outlook Net Worth Timeline Net Worth Outlook Retirement Cash Flow Timeline Retirement Need and Investable Assets Detailed Estate Analysis

16 Closing Thoughts: Your Next Steps

17 Index

18 End User License Agreement

1 Chapter 2 Table 2.1 Ontario Scenario 1: Corporation's Income $500,000, $150,000 Salary,... Table 2.2 Ontario Scenario 2: Corporation's Income $500,000, $67,037 Dividend... Table 2.3 Ontario Scenario 1: Corporation's Income $500,000, $150,000 ... Table 2.4 Ontario Scenario 2: Corporation's Income $500,000, $105,800 Dividen... Table 2.5 Combined 2020 Federal and Provincial Tax Rates in Ontario

2 Chapter 4Table 4.1 My Real-World Example: Projected Death BenefitTable 4.2 My Real-World Example: Projected Death Benefit with Dividend Paymen...Table 4.3 My Real-World Example: Rate of Return on Cash Surrender ValueTable 4.4 My Real-World Example: Rate of Return on Estate Value

3 Chapter 5Table 5.1 Cash Value and Death Benefit

4 Chapter 6Table 6.1 How Leverage Impacts Effective ReturnsTable 6.2 Enhancing Returns in the Corporation with Leverage: Two ScenariosTable 6.3 How Do Leveraged ETFs Work?

5 Chapter 7Table 7.1 The Impact of FeesTable 7.2 SPIVA: Percentage of Funds Underperforming the IndexTable 7.3 SPIVA: Equal-Weighted Fund ReturnsTable 7.4 SPIVA: Asset-Weighted Fund Returns

6 Chapter 8Table 8.1 Estate Trust Tax Savings: The first three yearsTable 8.2 Estate Trust Tax Savings: After three years

7 Chapter 9Table 9.1 Tax-Advantaged Contributions: IPP versus RRSPTable 9.2 Countries with Tax Treaties with CanadaTable 9.3 Is Your Watch a Good Investment?

8 Chapter 10Table 10.1 How Many Years Will the Money Last?Table 10.2 How Much Do I Need for a 30-Year Retirement?

1 Chapter 2 Figure 2.1 After-Tax Investment Income: RRSP versus Corporate Investing

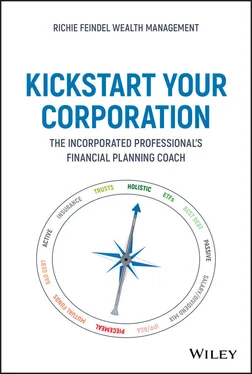

1 Cover

2 Table of Contents

3 Begin Reading

1 iii

2 iv

3 v

4 xvii

5 xviii

6 xix

7 xx

8 xxi

9 xxii

10 1

11 2

Читать дальше