Consider your time horizon

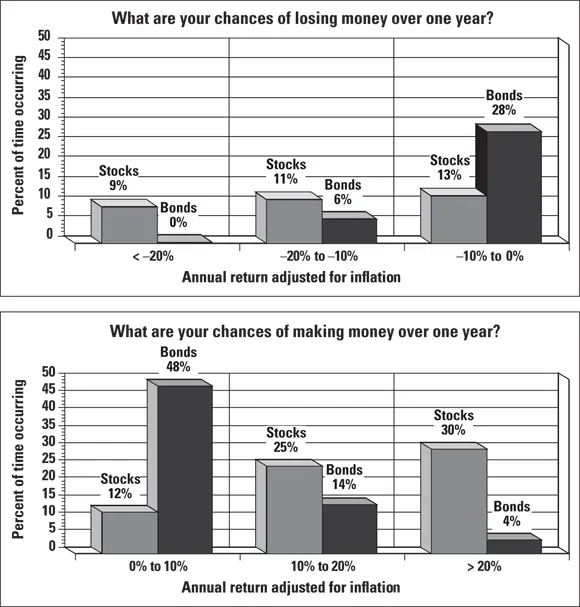

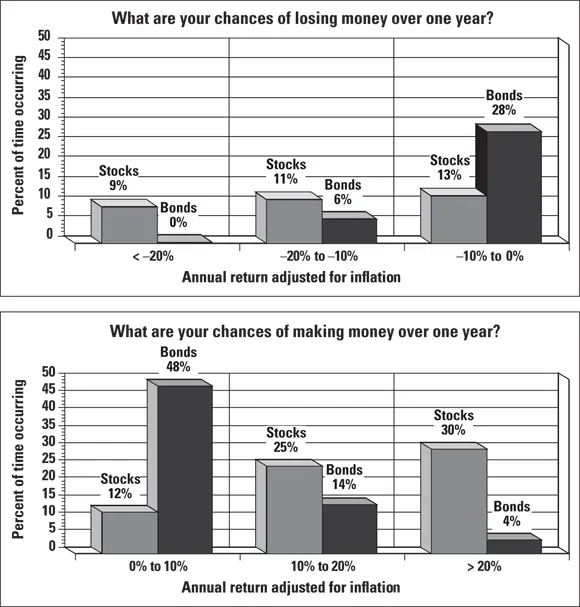

Investors who worry that the stock market may take a dive and take their money down with it need to consider the length of time that they plan to invest. In a one-year period in the stock and bond markets, a wide range of outcomes can occur (as shown in Figure 2-1). History shows that you lose money about once in every three years that you invest in the stock and bond markets. However, stock market investors have made money (sometimes substantial amounts) approximately two-thirds of the time over a one-year period. (Bond investors made money about two-thirds of the time, too, although they made a good deal less on average.)

Although the stock market is more volatile than the bond market in the short term, stock market investors have earned far better long-term returns than bond investors have. (See the “ Stock returns” section later in this chapter for details.) Why? Because stock investors bear risks that bond investors don’t bear, and they can reasonably expect to be compensated for those risks. Remember, however, that bonds generally outperform a boring old bank account.

© John Wiley & Sons, Inc.

FIGURE 2-1:What are the odds of making or losing money in the U.S. markets? In a single year, you win far more often (and bigger) with stocks than with bonds.

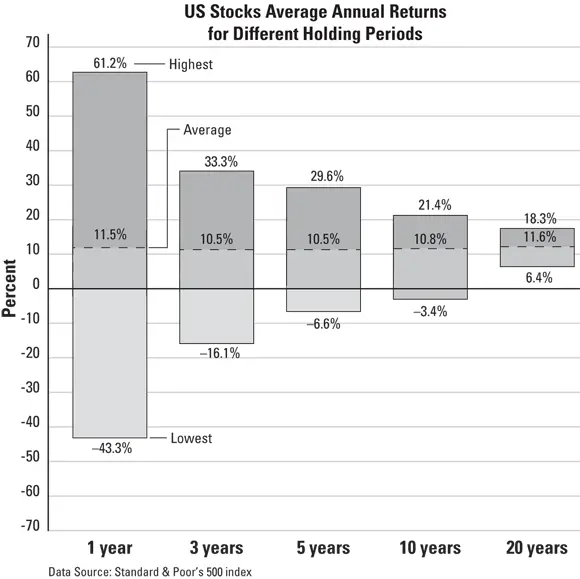

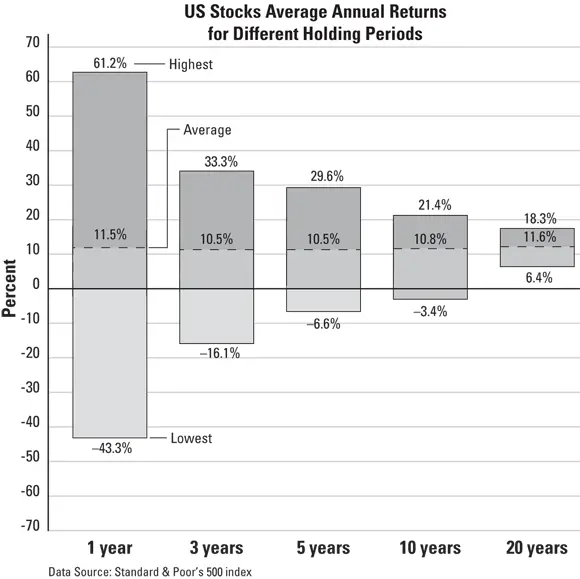

History has shown that the risk of a stock or bond market fall becomes less of a concern the longer that you plan to invest. Figure 2-2 shows that as the holding period for owning stocks increases from 1 year to 3 years to 5 years to 10 years and then to 20 years, there’s a greater likelihood of seeing stocks increase in value. In fact, over any 20-year time span, the U.S. stock market, as measured by the S&P 500 index of larger company stocks, has never lost money, even after you subtract the effects of inflation.

History has shown that the risk of a stock or bond market fall becomes less of a concern the longer that you plan to invest. Figure 2-2 shows that as the holding period for owning stocks increases from 1 year to 3 years to 5 years to 10 years and then to 20 years, there’s a greater likelihood of seeing stocks increase in value. In fact, over any 20-year time span, the U.S. stock market, as measured by the S&P 500 index of larger company stocks, has never lost money, even after you subtract the effects of inflation.

Most stock market investors I know are concerned about the risk of losing money. Figure 2-2 clearly shows that the key to minimizing the probability that you’ll lose money in stocks is to hold them for the longer term. Don’t invest in stocks unless you plan to hold them for at least five years — and preferably a decade or longer. Check out Part 2for more on using stocks as a long-term investment.

© John Wiley & Sons, Inc.

FIGURE 2-2:The longer you hold stocks, the more likely you are to make money.

Pare down holdings in bloated markets

Perhaps you’ve heard the expression “buy low, sell high.” Although I don’t believe that you can time the markets (that is, predict the most profitable time to buy and sell), spotting a greatly overpriced or underpriced market isn’t too difficult. For example, in the second edition of this book, published in 1999, I warned readers about the grossly inflated prices of many internet and technology stocks (see Chapter 5). Throughout this book, I explain some simple yet powerful methods you can use to measure whether a particular investment market is of fair value, of good value, or overpriced. You should avoid overpriced investments for two important reasons:

If and when these overpriced investments fall, they usually fall farther and faster than more fairly priced investments.

You should be able to find other investments that offer higher potential returns.

Ideally, you want to avoid having a lot of your money in markets that appear overpriced (see Chapter 5for how to spot pricey markets). Practically speaking, avoiding overpriced markets doesn’t mean that you should try to sell all your holdings in such markets with the vain hope of buying them back at a much lower price. However, you may benefit from the following strategies:

Ideally, you want to avoid having a lot of your money in markets that appear overpriced (see Chapter 5for how to spot pricey markets). Practically speaking, avoiding overpriced markets doesn’t mean that you should try to sell all your holdings in such markets with the vain hope of buying them back at a much lower price. However, you may benefit from the following strategies:

Invest new money elsewhere. Focus your investment of new money somewhere other than the overpriced market; put it into investments that offer you better values. As a result, without selling any of your seemingly expensive investments, you make them a smaller portion of your total holdings. If you hold investments outside of tax-sheltered retirement accounts, focusing your money elsewhere also allows you to avoid incurring taxes from selling appreciated investments.

If you have to sell, sell the expensive stuff. If you need to raise money to live on, such as for retirement or for a major purchase, sell the pricier holdings. As long as the taxes aren’t too troublesome, it’s better to sell high and lock in your profits. Chapter 21discusses issues to weigh when you contemplate selling an investment.

Individual-investment risk

A downdraft can put an entire investment market on a roller-coaster ride, but healthy markets also have their share of individual losers. For example, from the early 1980s through the late 1990s, the U.S. stock market had one of the greatest appreciating markets in history. You’d never know it, though, if you held one of the great losers of that period.

Consider a company now called Navistar, which has undergone enormous transformations in recent decades. This company used to be called International Harvester and manufactured farm equipment, trucks, and construction and other industrial equipment. Today, Navistar makes mostly trucks.

In 1979, this company’s stock traded at more than $400 per share. It then plunged more than 90 percent over the ensuing decade (as shown in Figure 2-3). Even with a rally in recent years, Navistar stock still trades at less than $35 per share (after dipping below $10 per share). If a worker retired from this company in the late 1970s with $200,000 invested in the company’s stock, the retiree’s investment would be worth about $14,000 today! On the other hand, if the retiree had simply swapped his stock at retirement for a diversified portfolio of stocks, which I explain how to build in Part 2, his $200,000 nest egg would’ve instead grown to more than $5 million!

© John Wiley & Sons, Inc.

FIGURE 2-3:Even the bull market of the 1990s wasn’t kind to every company.

Just as individual stock prices can plummet, so can individual real estate property prices. In California during the 1990s, for example, earthquakes rocked the prices of properties built on landfills. These quakes highlighted the dangers of building on poor soil. In the decade prior, real estate values in the communities of Times Beach, Missouri, and Love Canal, New York, plunged because of carcinogenic toxic waste contamination. (Ultimately, many property owners in these areas received compensation for their losses from the federal government as well as from some real estate agencies that didn’t disclose these known contaminants.)

Here are some simple steps you can take to lower the risk of individual investments that can upset your goals:

Here are some simple steps you can take to lower the risk of individual investments that can upset your goals:

Do your homework. When you purchase real estate, a whole host of inspections can save you from buying a money pit. With stocks, you can examine some measures of value and the company’s financial condition and business strategy to reduce your chances of buying into an overpriced company or one on the verge of major problems. Parts 2, 3, and 4of this book give you information on researching your investment.

Читать дальше

History has shown that the risk of a stock or bond market fall becomes less of a concern the longer that you plan to invest. Figure 2-2 shows that as the holding period for owning stocks increases from 1 year to 3 years to 5 years to 10 years and then to 20 years, there’s a greater likelihood of seeing stocks increase in value. In fact, over any 20-year time span, the U.S. stock market, as measured by the S&P 500 index of larger company stocks, has never lost money, even after you subtract the effects of inflation.

History has shown that the risk of a stock or bond market fall becomes less of a concern the longer that you plan to invest. Figure 2-2 shows that as the holding period for owning stocks increases from 1 year to 3 years to 5 years to 10 years and then to 20 years, there’s a greater likelihood of seeing stocks increase in value. In fact, over any 20-year time span, the U.S. stock market, as measured by the S&P 500 index of larger company stocks, has never lost money, even after you subtract the effects of inflation.

Ideally, you want to avoid having a lot of your money in markets that appear overpriced (see Chapter 5for how to spot pricey markets). Practically speaking, avoiding overpriced markets doesn’t mean that you should try to sell all your holdings in such markets with the vain hope of buying them back at a much lower price. However, you may benefit from the following strategies:

Ideally, you want to avoid having a lot of your money in markets that appear overpriced (see Chapter 5for how to spot pricey markets). Practically speaking, avoiding overpriced markets doesn’t mean that you should try to sell all your holdings in such markets with the vain hope of buying them back at a much lower price. However, you may benefit from the following strategies: