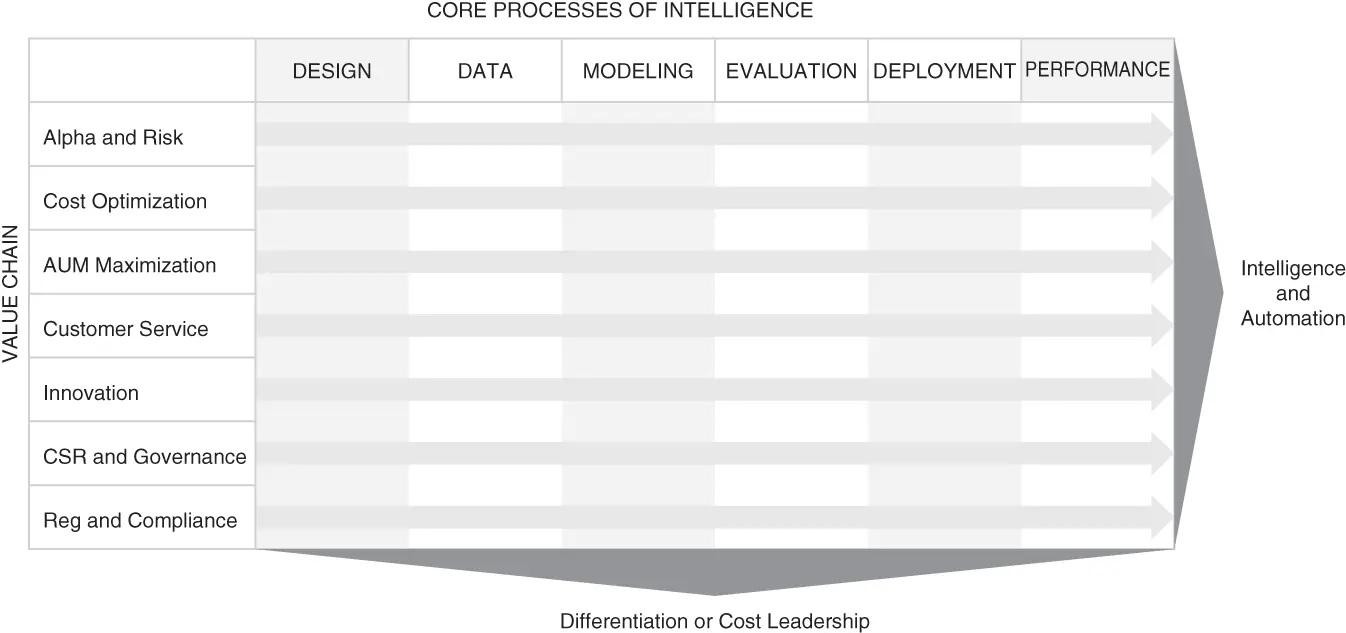

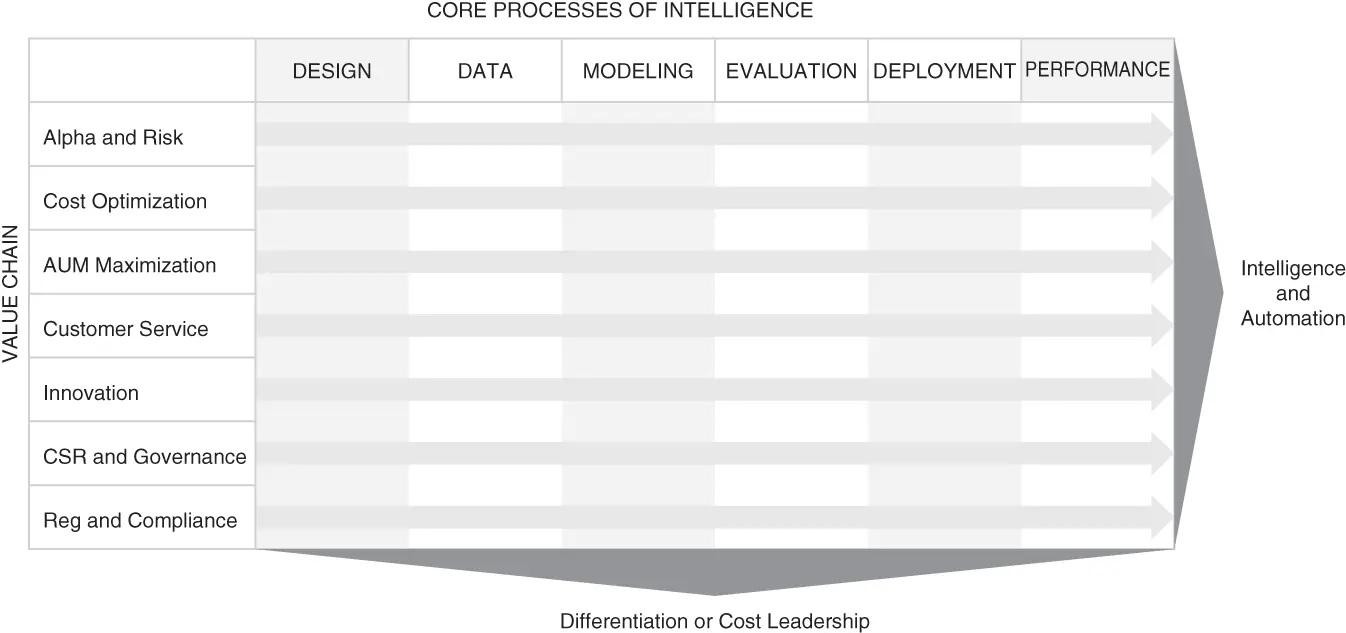

FIGURE 1.1 The AIAI Core Model

The horizontal dimension is composed of the scientific method, and it represents the operational excellence and execution potential of a firm. The scientific method is adopted to implement an industrial-scale enterprise machine learning approach for managing each function. The core processes of the scientific method include six competency areas of design, data, modeling, evaluation, deployment, and performance. Each one of those machine learning competency areas is independent of the vertical capability areas of the value chain. These competency areas are geared toward designing and developing machine learning solutions at an industrial scale.

When combined, the firm becomes a factory where AI artifacts are developed, deployed, nurtured, managed, and decommissioned at the end of the life cycle. Each of the artifacts plays a role in creating value for the business and is designed to be efficient and effective. The efficiency and effectiveness are determined in comparison to human performance or the performance of another machine and compared to the goals of the firm and the state of the competition and technical potential in the marketplace.

With both strategic excellence and operational excellence, firms are operated as research and science organizations—with every functional area transitioning to science-centric management. Thus, terms such as sales science, marketing science, human resources science, and supply chain science refer to the transformed organizations that are driven and led by data-centric planning and execution.

YOUR JOURNEY THROUGH THIS BOOK

Your journey through this book is divided into three parts. Part 1 starts you off in Chapter 2with a focused coverage of investment management firm level strategy in the AI era. Chapters 3through 8focus on the horizontal competency areas of design, data, modeling, evaluation, deployment, and performance. Each of those chapters introduces the necessary capability areas and organizational structure to transform your firm to an AI-centric firm. Chapter 9launches Part 2. Part 2 is function focused and from Chapters 10through 17covers customer experience science, marketing science, institutional investor science, investment science, supply chain science, and corporate social responsibility science. The addition of the word “science” to the traditional corporate organizations (for example, marketing or sales) is an acknowledgment that we are transforming our firms and business models in such a way that data science becomes the operational structure of the firm. Part 3 has three chapters: Chapter 18is about AI project management, Chapter 19covers governance and ethics issues, and Chapter 20is the conclusion.

HOW TO READ AND APPLY THIS BOOK?

Chapters 2to 8show you how to restructure your firm for the AI era. They give you the new twenty-first-century structure to run your business in a scientific manner, understand that model, and then figure out how to set up your firm from a horizontal capability perspective.

Chapters 9to 17are about functional competencies. This is what we call departments in our twentieth-century terminology. We view them as functional capabilities embedded in the value chain of the firm. I strongly suggest that you read and understand the function-specific opportunities. Then build your functional capacities based on the applications introduced in the chapters—but their development and application should be done as a scientific process, introduced in Chapters 2to 8.

A few notes about the book. While I was authoring this book, I was also writing a book on AI in auditing. Some chapters—especially the ones that introduce machine learning—will seem similar. As much as possible, I have kept the book simple and understandable for businesspeople. Finally, instead of limiting the book to a narrow definition of asset management, sometimes I use the broader category of investment management. If a certain section or topic coverage is not applicable to you, feel free to skip it—for example, if you are more interested in institutional, skip the retail section. Lastly, you will notice that I use both “I” and “we” throughout the book. When I use “we,” I imply the American Institute of Artificial Intelligence.

1 Gately, E. (1996) Neural Networks for Financial Forecasting. John Wiley & Sons.

2 Murphy, S. P. (2018) The Road to AUM: Driving Assets Under Management Through Effective Marketing and Sales. Noble Ark Ventures.

3 De Prado, M. L. (2018) Advances in financial machine learning. John Wiley & Sons.

4 Refenes, A.-P. (1995) Neural Network in the Capital Markets. John Wiley & Sons.

Chapter 2 AI and Business Strategy

THE AI REVOLUTION IS NOT AN EXTENSION of the digital revolution. There are some clear and distinct differences (Makridakis, 2017). Business strategy is not static. It is dependent on the changes in the underlying variables. But certain times and technological revolutions are far more extraordinary than others (Perez, 2002). In fact, I have no hesitation in stating that the AI revolution will launch the most transformational times in human history. The AI revolution is unleashing a powerful economic change that will require monumental amendments in the way business strategy is approached. Understanding those competitive dynamics is critical for developing an intuition about how to develop your firm's strategy.

WHY STRATEGY? THE RED BUTTON

In 2016, when the AI fever was just starting to pick up the pace, I had the opportunity to talk strategy with the co-founder of what he described as the world's first automated hedge fund. In a typical Silicon Valley's passionate and visionary entrepreneurial style, he gave me the analogy of OODA loop, which was a model used to explain the success of the most successful fighter pilots in dog fights in the Korean War. OODA stands for Observe, Orient, Decide, Act. It is a loop where, after you act, you observe your environment again, reorient, decide, and act. Basically, you go through these loops, and you make your trades. Human traders, he argued, are constantly looking, second-guessing, checking their current state, analyzing their profitability, deciding whether they need to make a decision, what decision to make, reading the signals, understating the context, and taking action. As you go through the loop, you adapt and readjust. The AI apparatus he described was composed of random forest and an evolutionary rule-based genetic algorithm (an approach known as Pittsburgh-Style Learning Classifier System, which is used to evolve a solution composed of multiple rules). He claimed that news is a lagging measure in terms of useful signal since news is already reflected in the time series. At best, news can increase confidence in the signal, but it is not signal itself, he contended. Hence, if you genetically evolve the solution, a machine can pick patterns throughout the trading day, and while it can explore millions of options, it may take only a handful of buy-sell actions. He said that his hedge fund was fully automated and required absolutely no human intervention. In his fund, staff set things up, and they do have a big red button to press only if all hell breaks loose—other than that, the system decides everything: what to trade, when to trade it, how to trade it, how long to hold, when to exit. This all sounded like a dream come true for AI. It was perfection at its peak. As long as no one had to push the red button, things seemed in control. Except, in 2018, the hedge fund was suddenly liquidated. Bloomberg reported that the fund had not made any money in 2018, after making a meager 4% in 2017 (Kishan and Barr, 2018). The failure of the fund can be attributed to the approach, or to the technology, or to the lack of human guidance, or to the fact that no single strategy can be viewed as the winning strategy, or that perhaps strategy was not consistent with the market conditions. We may never find out. But what we can learn from this failure are two lessons: (1) the human role in investment management needs to be more than the red button pusher or cheerleader for a strategy; and (2) the role of broader business strategy is critical for investment management. The former because we know that human intervention in the strategy could have observed that the strategy was not working (actually, a machine could have helped point that out) if humans were not emotionally invested in the fully autonomous model and did not view the human intervention as counter to the business model. The latter because we operate in a dynamic system where the environment evolves and a change in strategy becomes necessary. It is likely that if the investment team were surrounded by a diverse set of thinkers, the chances of groupthink could have been minimized. Strategy is not just about investment. It should not be limited to investment strategy. The broader strategy for the organization is just as important, if not more. This chapter is dedicated to strategy building, and its value will become clear as we go through the book.

Читать дальше