The first manufacturers began production in accordance with Resolution No. 166 in 2007. Shortly afterwards, suppliers of automotive components began their manufacture in accordance with Resolution No. 566. However, in their current form these resolutions do not meet WTO requirements, meaning that based on the agreement on Russia’s accession to the WTO the “industrial assembly” arrangements must be brought into line with WTO rules by 1 July 2018. This does not affect the validity of the agreements concluded with companies by the Ministry of Economic Development of Russia. The Russian ministries are since then in the process of amending the resolutions to comply with WTO provisions. This is done by a subsidy scheme based on retrospective compensation via the Russian Ministry of Industry and Trade and the Ministry of Economic Development.

Cooperation with the Ministry of Economic Development, the Ministry of Industry and Trade, and the customs authorities plays a crucial role in practical implementation of the resolutions. Over time, this cooperation has become more professional, more like collaboration, both successful and effective.

The system was put to a serious test in 2015 when the ruble lost 50 % of its value over a very short period of time in late 2014 and imports became so expensive that the indicated levels of localisation were unattainable for many companies.

Given the unpredictability of the crisis and the limited amount of time available to react, the crisis management measures of the Russian authorities can be deemed effective. A solution for 2015 was found thanks to intensive dialogue between the authorities, industry and associations. The planned increase in the level of localisation in 2015 was abandoned.

The automotive industry has experienced several crises since Resolutions No. 166 and 566 came into effect: the financial crisis of 2009, when the Russian market contracted to half of its former size, and the fall in oil prices and depreciation of the Russian currency in combination with the sanctions since 2015. These situations required quick reactions from the affected enterprises, as well as a high level of flexibility and the ability to adapt to mitigate the negative impact as much as possible.

Throughout all the crises it was clear that the Russian government was adhering to its goals – sustained industrial development, with a reliance on and support for foreign investors, and an attempt to maintain as far as possible a stable and predictable strategic and operating situation.

Experience shows that if a company operates within the framework of Russian law and follows the rules on compliance, and if it contacts the right decision-makers in a timely manner, solutions can usually even be found for complex problems.

4. Localisation in everyday practice

The main problem for the automotive industry is that production is performed almost exclusively for the limited and very fickle Russian market.

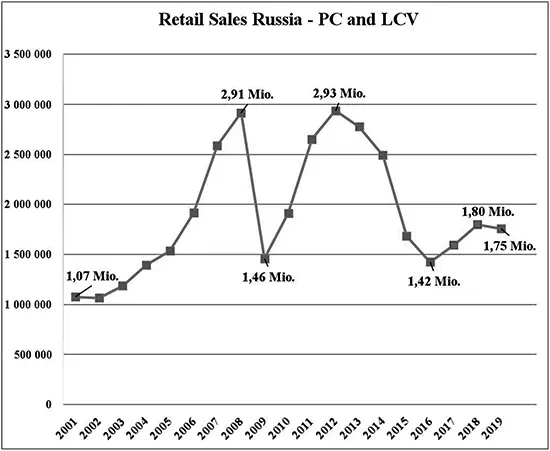

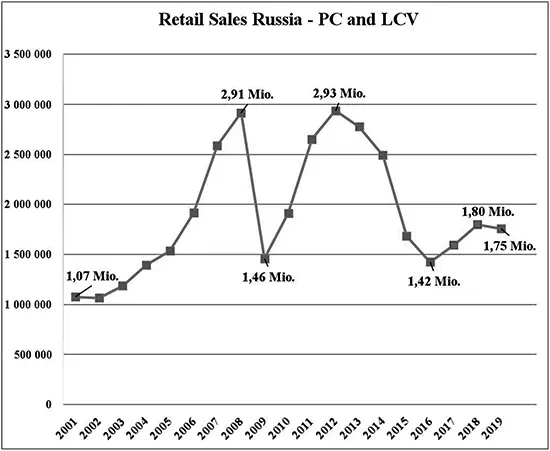

For example, this market has shown to have an annual potential of more than three million vehicles, a target that was reached in 2008 and 2012. However, in 2013 the market contracted significantly, and only began to grow again in the second quarter of 2017. Ultimately, growth in 2017 equaled 12 % and 2018 13 %. However, pursuant to the latest statistics, in 2019 the Russian market has declined by 2 % with showing total sales of 1,75 Mio. cars and LCV.

The very limited total sales and production volume is highly segmented. The resulting low volume for each individual platform and car model is setting the boundaries for the successful establishment of vertical localisation. This represents the main obstacle to the further development of production and attainment of the localisation goals set forth in Resolutions No. 166 and No. 566.

Source: Association of European Businesses (AEB), statistics of the Automobile Manufacturers’ Association, annual retail turnover in the Russian Federation, passenger cars and light commercial vehicles, 2001–2019.

For the time being the search for local sub-suppliers remains problematic in all regions, and the localisation of international suppliers is often impossible due to the low overall production volumes. Even reliable supplies from local manufacturers have often encountered difficulties in terms of both volume and quality.

In the manufacturing and processing industry, which is very important for the automotive industry, there are still only a few small and medium-sized specialized enterprises. And those that exist take the form of a trading enterprise with a relatively low level of attached production. However, trading is still the key aspect.

Small businesses consider production to be a fairly risky process owing to its longevity, capital intensity, transparency and the need to be tied down to one place. For this reason, local companies do not exploit market niches in the volume that you might expect. If you do manage to find a local supplier, the financial and legal structures of its company may rapidly become a risk from a compliance angle. Dubious ownership structures, labyrinthine management structures and frequent changes to the corporate name may, for example, deliver tax benefits, but run counter to long-term investments and significant supply volumes, which is a key criterion for serial suppliers in the automotive business.

The crises and sanctions since 2014 have affected small private businesses the most. In addition to the more than 50 % drop in demand, and against the backdrop of sanctions, they find it virtually impossible to obtain bank loans at acceptable rates. This fact has definitely brought a certain number of investments to a halt. By contrast, it is highly likely that big enterprises can count on state finance and support.

To achieve reliable in-depth localisation with the assistance of local companies, close ties and guidance by an international partner can be a definite advantage.

Staffing issues look far better. In this respect, you have more opportunities than risks in Russia. In theory, significant know-how has been transferred to the country. A number of specialists boast a good education and many years of experience in different specialist areas. It is possible to receive training in professional, technical and communications skills from local and international companies in both Russian and English.

Today Russia has lots of managers, who received good training at the start of the 2000s and today no longer fit the stereotype of “command-and-control socialist workers”. Regardless of whether this picture actually complied with reality at some point in time, such negative connotations frequently still exist even to this day.

The contemporary generation of Russian managers is more often than not aged between 30–40. Furthermore, individuals who gained experience at international companies and abroad are the majority here. In many instances they also studied abroad. This generation knows the culture, opportunities and limitations, and also Russian and foreign companies and their management.

In connection with the need for savings due to the crisis, international companies entrust the management of their Russian companies primarily to local employees. In practice, this trend is to large extent having a positive impact. These managers are very pragmatic and goal-oriented, and are well acquainted with Russian conditions. Consequently, less time is needed on planning and reaction.

Nevertheless, it is worth noting here that a frequent change of employer in Russia is often considered the rule, and therefore continuity and uniformity may suffer.

Читать дальше