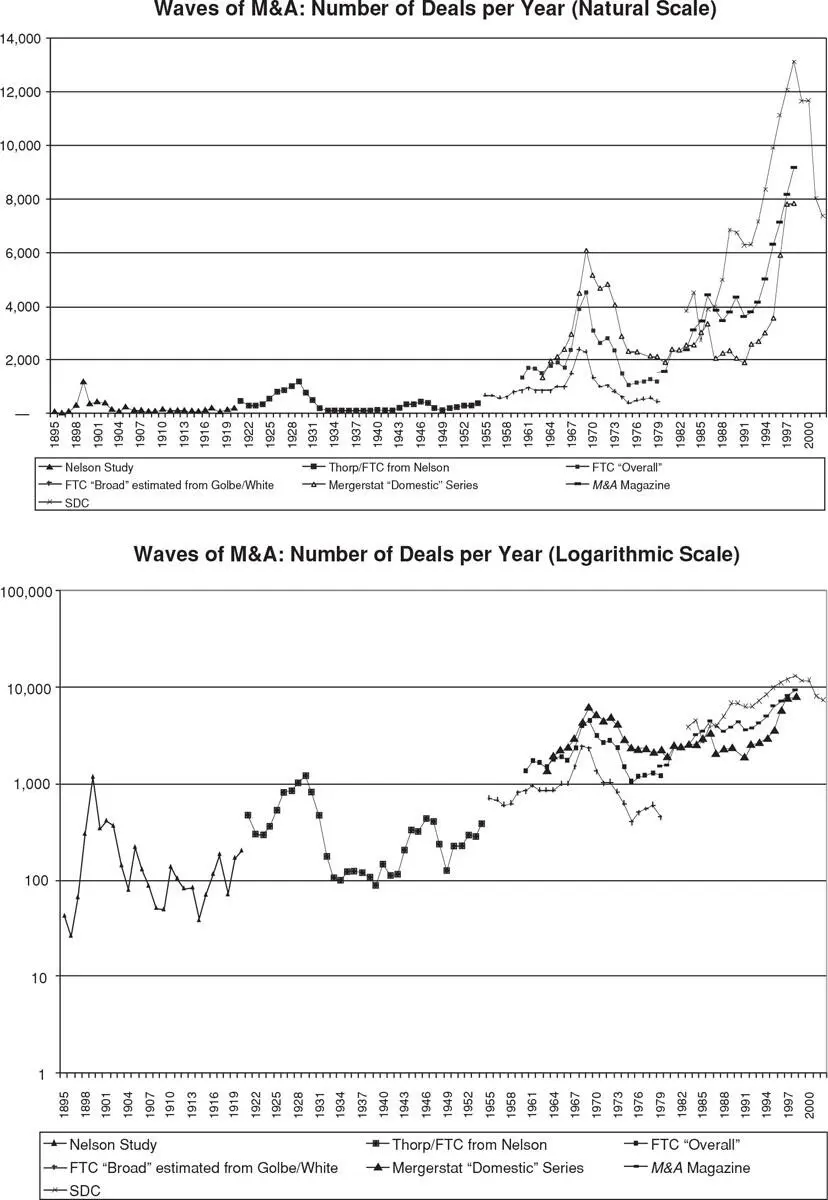

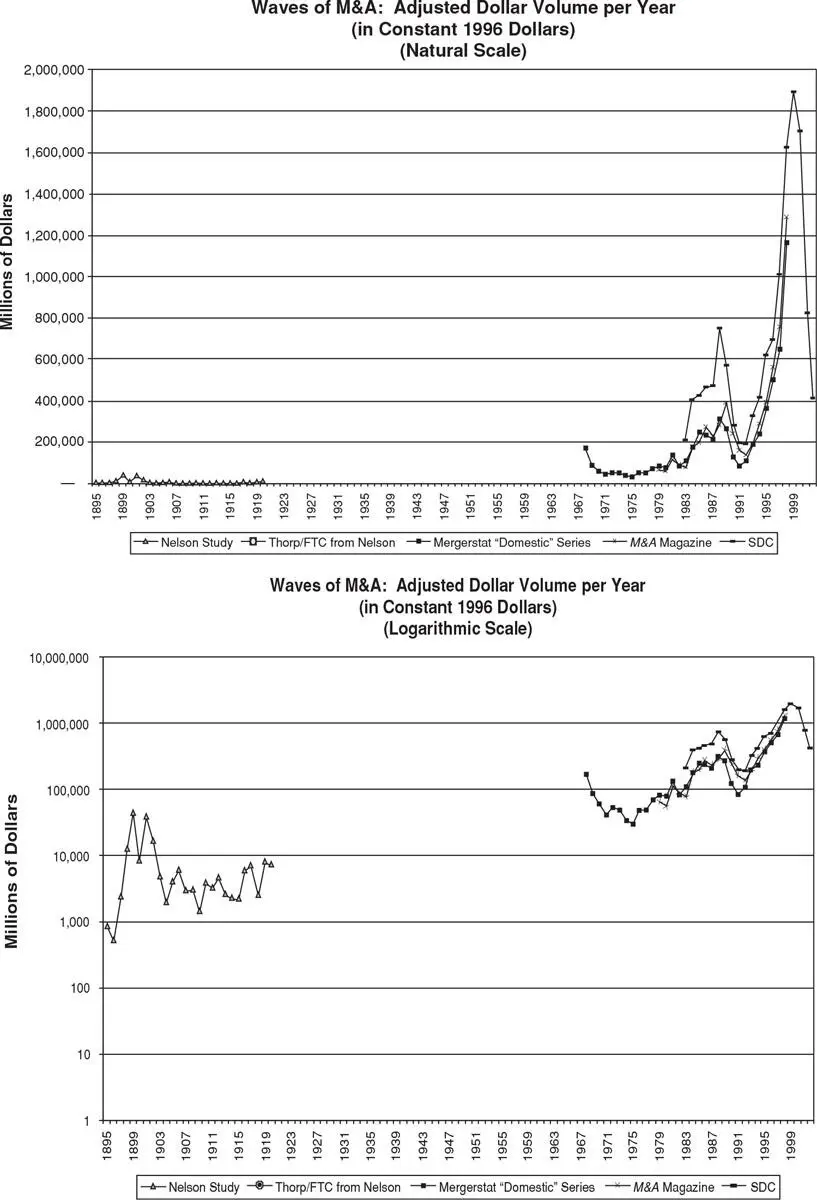

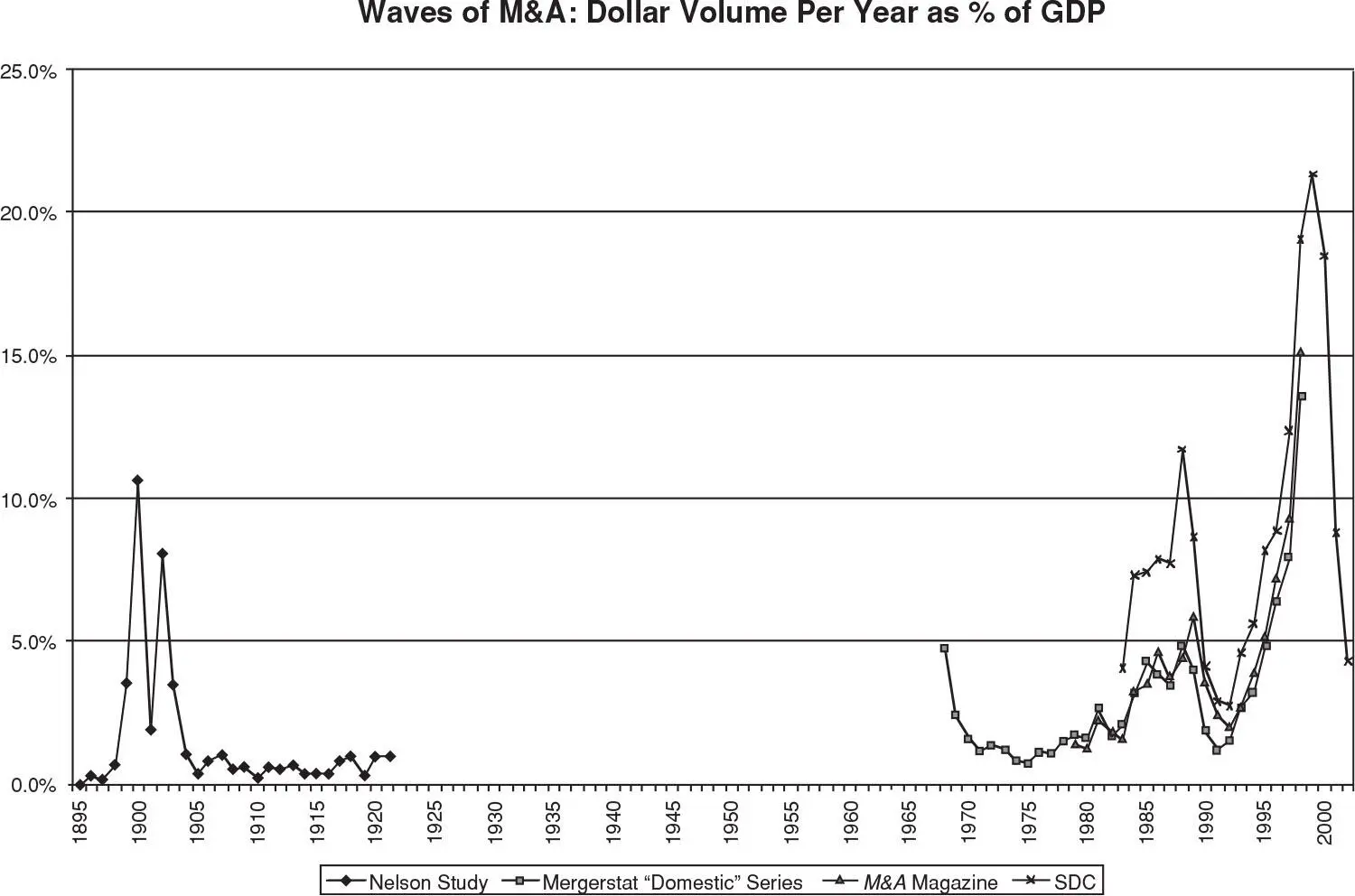

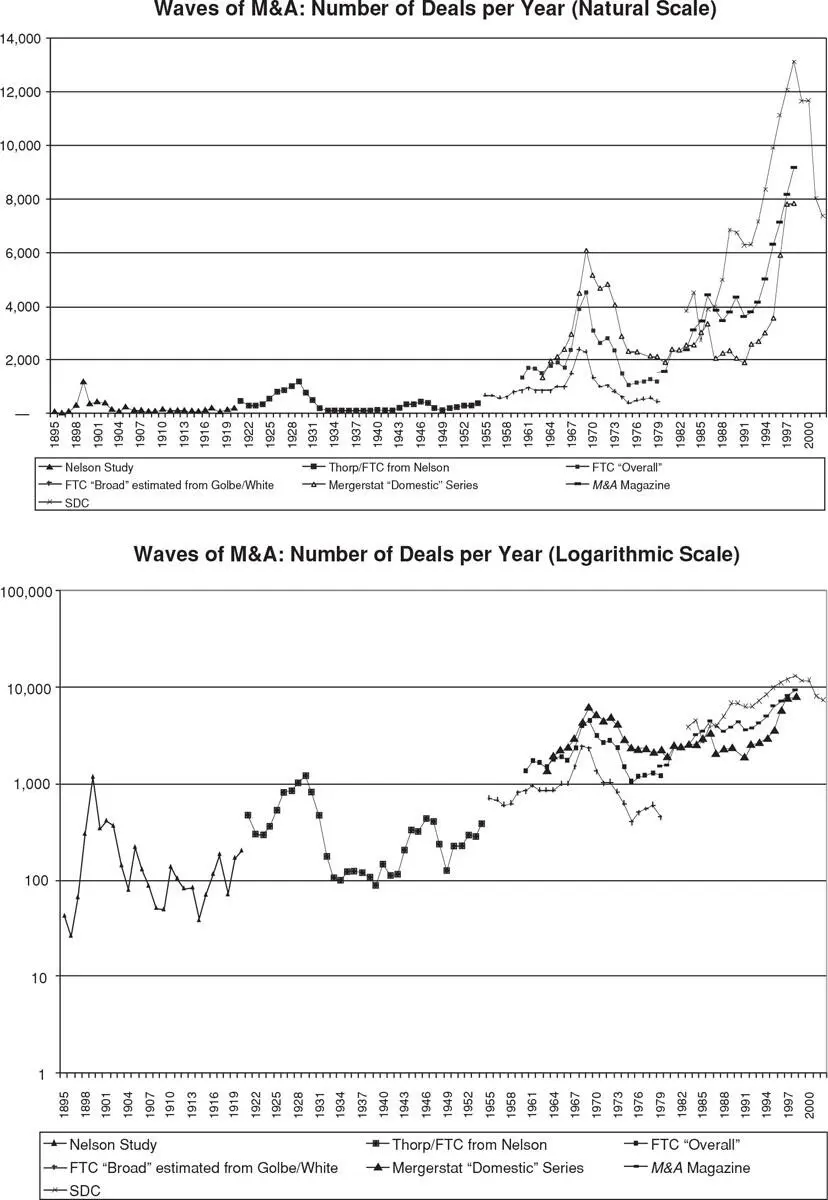

The first important insight from these graphs is that M&A activity reveals evidence of five periods of heightened merger activity; hereafter, I will call these “waves.” The appearance of waves is not isolated to the United States. A study of M&A activity in the United Kingdom also shows wavelike behavior (see Town (1992) and Resende (1999)). A study by Shugart and Tollison (1984) tested two of the time series—the Nelson and Federal Trade Commission (FTC) series—and concluded that merger activity does not deviate from a random walk—that these waves display no regularity in period or amplitude. Indeed, visually, Exhibits 4.1to 4.3lend credence to the irregularity of the waves. Brealey and Myers (1996) have cited the appearance of M&A waves as one of the 10 most important unresolved questions in financial economics. “What we need is a general hypothesis to explain merger waves. For example, everybody seemed to be merging in 1995 and nobody 5 years earlier. Why? … We need better theories to help explain these ‘bubbles’ of financial activity.” 2 The frustration of Brealey and Myers may be explained in part by the apparent uniqueness of each wave.

EXHIBIT 4.1 Number of U.S. M&A Transactions per Year on Natural Scale and Logarithmic Scale

See Exhibit 4.4for sources.

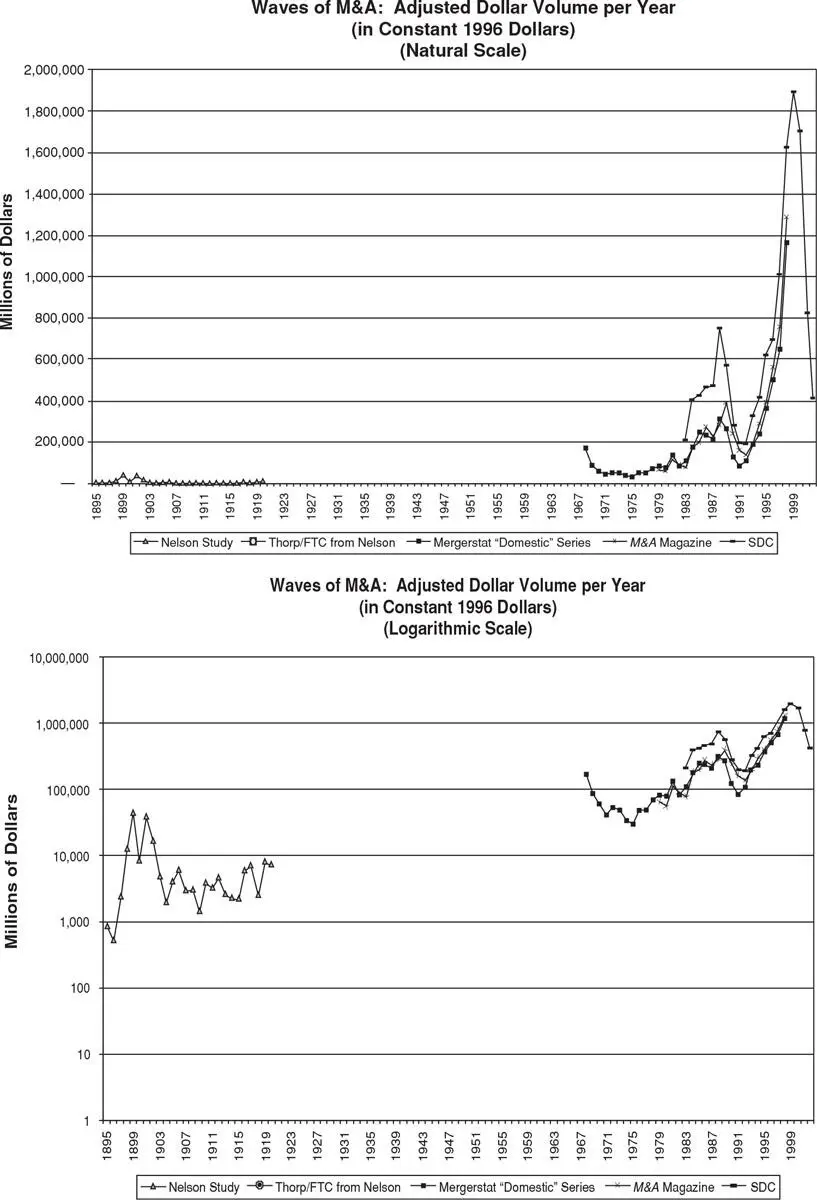

EXHIBIT 4.2 Dollar Volume of U.S. M&A Transactions per Year on Natural Scale and Logarithmic Scale

See Exhibit 4.4for sources.

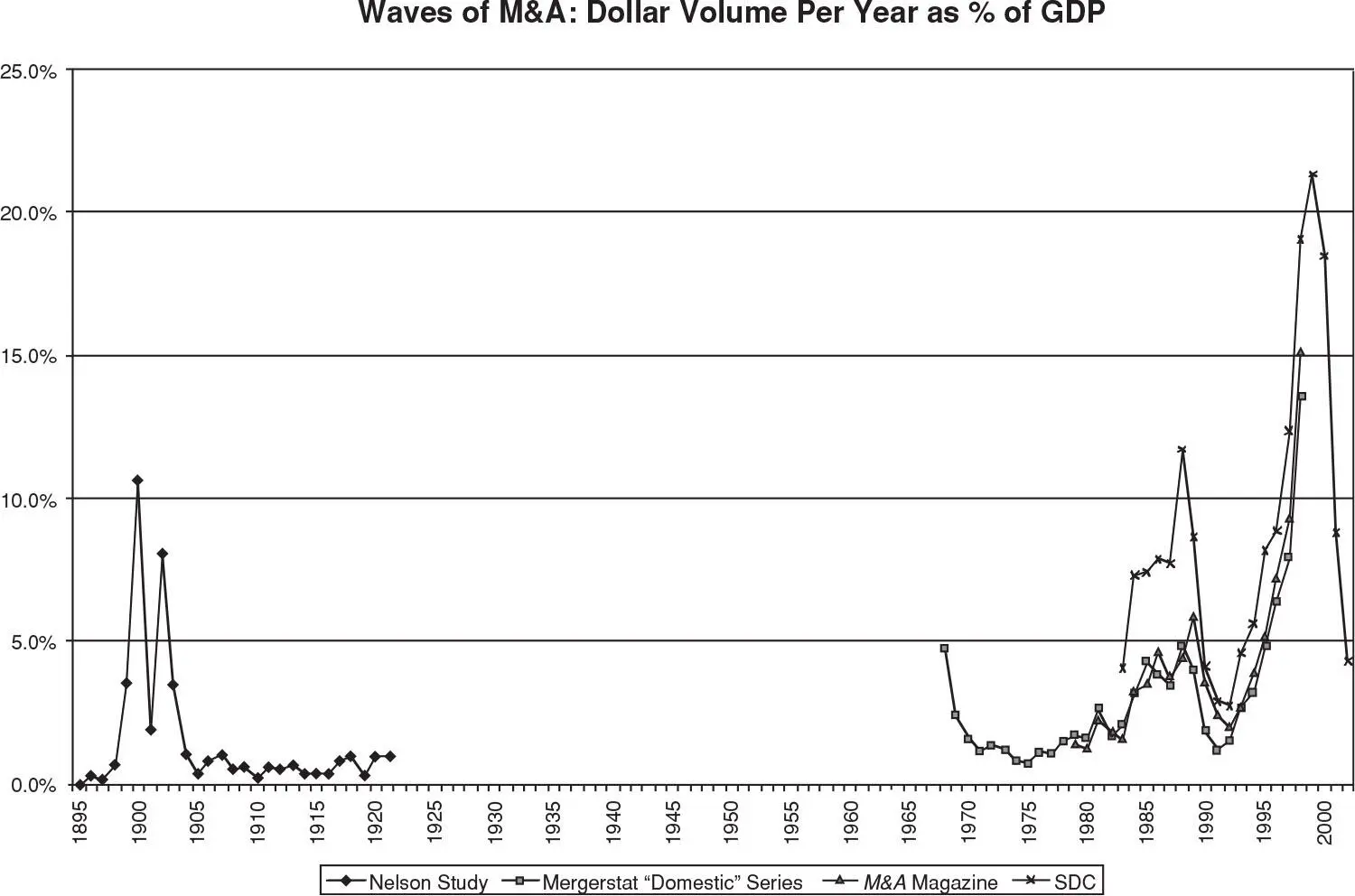

EXHIBIT 4.3 Dollar Volume of U.S. M&A Activity per Year as a Percentage of U.S. Gross

National Product

Based on constant U.S. dollars, 1996.

See Exhibit 4.4for sources.

Horizontal mergers characterized this wave. Beginning on the heels of the depression that ended in 1896, the wave coincided with a period of economic and capital market buoyancy. Firms sought to build market power in response to overcapacity induced by rapid technological innovation. The wave touched a wide variety of manufacturing industries. Examples of firms that originated in wave include DuPont, Standard Oil, General Electric, Eastman Kodak, and U.S. Steel. Stigler (1950) characterized this wave as a period of “merger for monopoly.” President Theodore Roosevelt’s decision in 1902 to enforce the Sherman Act in the famous Northern Securities case was an important turning point of the first wave. The Supreme Court’s decision in 1904 limited horizontal mergers among large competitors and took the momentum out of the trust-building trend.

EXHIBIT 4.4 Notes on the Sources of M&A Activity Series

| Study |

Time Period Available |

Time Period Included |

Notes |

| Nelson (1959) |

1895 to 1920 |

1895 to 1920 |

Only manufacturing and mining included; bottom cutoff limit not clear; based on firm disappearances. |

| Thorp (1941) from Nelson |

1921 to 1939 |

1921 to 1939 |

Only manufacturing and mining included; based on firm disappearances. |

| FTC Overall (1981) |

1940 to 1979 |

1960 to 1979 |

All deals recorded by FTC; no value totals available. |

| FTC Broad— Estimated from Golbe/White (1988) |

1940 to 1979 |

1940 to 1979 |

Only manufacturing and mining included; no acquisitions by individuals or groups included; no value totals available. |

| Mergerstat |

1963 to present |

1963 to 1998 |

Refer to announcements rather than completed deals; bottom cutoff limit is $500,000 in transaction value. |

| M&A Magazine |

1967 to present |

1979 to 1998 |

Lower cutoff limit through 1980 was $700,000 in transaction value; after 1980 lower limit value is $1 million; includes cross-border deals involving a U.S. buyer or target. |

| Thomson Securities Data Corp. |

1983 to present |

1983 to 1999 |

All completed deals of those announced; no lower cutoff limit; includes cross-border deals involving a U.S. buyer or target. |

Series Citations:

Nelson, R. Merger Movements in American Industry 1895–1956 . Princeton: Princeton University Press, 1959.

Thorp, W. “The Merger Movement.” In Temporary National Economic Committee Monograph No. 27. Washington, D.C.: U.S. Government Printing Office, 1941.

Federal Trade Commission, Bureau of Economics. Statistical Report on Mergers and Acquisitions . Washington, D.C.: U.S. Government Printing Office, 1981.

Golbe, D., and L. White. “Mergers and Acquisitions in the U.S. Economy: An Aggregate and Historical Overview.” In A. Auerbach, ed. Mergers and Acquisitions , 25–47, Chicago: University of Chicago Press, 1988.

W. T. Grimm & Co. and Houlihan Lokey Howard & Zukin, Mergerstat Review , Chicago and Los Angeles (various issues 1988–1999).

Mergers & Acquisitions (various issues 1989–1999).

Thomson Securities Data Corp., Mergers & Acquisitions Database.

Vertical combinations characterized this wave as firms sought to integrate backward into supply and forward into distribution of their core businesses. Stigler (1950) called it a period of “merger for oligopoly.” Large public utility holding companies emerged on the business landscape. The U.S. government increased its antitrust enforcement following the passage of the Clayton Act. The wave coincided with a boom in stock market prices and volume that began following the recession of 1923 and ended with stock market crash in 1929.

In the context of heightened antitrust enforcement to limit horizontal combinations, firms turned to conglomerate or diversifying combinations in this wave. Activity was especially concentrated among a group of conglomerates and oil companies. The wave coincided with a strong economy and bull market in the 1960s. Antitrust enforcement against the rise of conglomerates marked the peak of this wave.

The popular hallmarks of this wave were larger deals involving more hostile takeovers, more leverage, and more going-private transactions than previous waves. However, the activity was very broad-based, touching virtually all sectors of the U.S. economy, and dominated by combinations among small and medium-sized firms. The Tax Reform Act of 1986 may have contributed to the boom in M&A activity as tax changes took effect. This wave featured the appearance of financial and international buyers as more significant players than ever before. The complexity of transactions increased in concert with growing capital market innovation and sophistication. This was a period of generally falling interest rates and rising stock prices.

Following the 1990–1991 recession, M&A activity increased briskly in all segments of the economy and all size categories. The announcement of a few large deals signaled to some observers a “paradigm shift” 3 in M&A where old rules about strategy, size, and deal design were being replaced by new rules. Of general note was the significance of “strategic buyers” who sought to combine with targets who were related along business lines, and with whom synergy value might be created. The superior economics of strategic combinations dampened somewhat the influence of financial buyers (i.e., LBO specialists). Of special note was the high M&A activity in banking, health care, defense, and technology. This sector-focused activity was a response to overcapacity as the industry was deregulated (banking), as national defense spending declined, and as the payment patterns by insurers changed (health care). In technology, the high rate of activity was stimulated by rapid invention and technological change. Finally, the high rate of M&A activity coincided with historically low rates of interest, and rising stock prices. As Exhibits 4.1, 4.2, and 4.3reveal, the M&A activity in the most recent wave far exceeded any levels seen previously, with transaction values rising to about 15 percent of the U.S. gross national product (GNP) in 1999. Following the bursting of the Internet bubble in March 2000, M&A activity declined sharply, in tandem with the stock market and the U.S. economy, and in conjunction with the rise of global economic and security concerns.

Читать дальше