Most firms have no better alternative. M&A is one of the most important means by which companies respond to changing conditions. It is an instrument of macroeconomic renewal. And even if you did opt out of M&A, the odds are that your competitors would use it to reach for strategic or financial advantage, with consequences that might be disastrous for your firm in the long run. Simply opting out of M&A is not feasible.

Some writers portray M&A as the kind of losing proposition that compulsive gamblers face in Las Vegas: You can’t win; you can’t break even; and you can’t get out of the game. This is unduly pessimistic. Though M&A is a very competitive business activity, it is possible to succeed. But competitive forces limit true success to a fortunate few.

So here’s the problem: How do you succeed at an activity in which you must participate and in which the odds of great success are slim? The problem manifests itself in four ways:

1 Getting a handle on the subject. Good practice begins with a good grasp of what is happening. “How can I make sense of what’s going on around me?” M&A is one of the most aggressive change agents in the business economy: volatile and disruptive. The volume of deals and their dollar value grew explosively over the past 30 years. Journalists, legislators, and consumers have watched this activity with fascination and concern. Those inside the firms have felt elation or anxiety as they watched deals hatch. The thoughtful practitioner needs an objective grasp of M&A to serve as an anchor amidst the emotional froth.

2 Setting goals and benchmarks. As one executive asked me, “What drives success in M&A? What will it take for my firm to do better than the averages?” The mystery about M&A deepens if one has no clear definition of success. The decision maker needs a guideline for action.

3 Getting prepared. Succeeding in M&A has a personal perspective. As an educator I am often asked, “What do I need to know? How can I best prepare myself to be effective, or at least survive, in the M&A arena?” Executives and analysts new to the field rarely know how to launch a program of personal development.

4 Adopting best practice. Most M&A professionals have some influence on the policies and practices of those who work with them. Executives, particularly, want to know, “What expectations should I set for the development of our M&A business processes? If I wanted to raise the bar in any dimensions, where should I do it?”

This book speaks to these problems. First, the book takes a pragmatic approach, highlighting useful insights wherever they are to be found. As a result, the discussion here synthesizes a range of perspectives rather than just focusing on one silo of ideas. Second, the book highlights seven important ideas that open fresh insights on subjects previously thought to be too narrow or confusing for meaningful commentary. Finally, the discussion here emphasizes that M&A is a world of contingencies and that therefore the M&A professional needs to become competent at forming a view for him- or herself. One finds few universal absolute truths about M&A success. While that frustrates the seeker of hard answers, it is good news to the professional adviser and business developer, for it dictates that there will always be a market for diligent research, sound judgment, and artful execution.

OVERVIEW OF A FRAMEWORK FOR M&A SUCCESS

“Success” in M&A is not so different from “success” achieved by value-style investing and created by the perfection of an analysis discipline that allows good judgment. The winners follow it over and over, and never deviate from the discipline. An aim of this book is to bring M&A analysis discipline to the forefront, in much the same way that Benjamin Graham and David Dodd did for securities analysis and Warren Buffett put into practice.

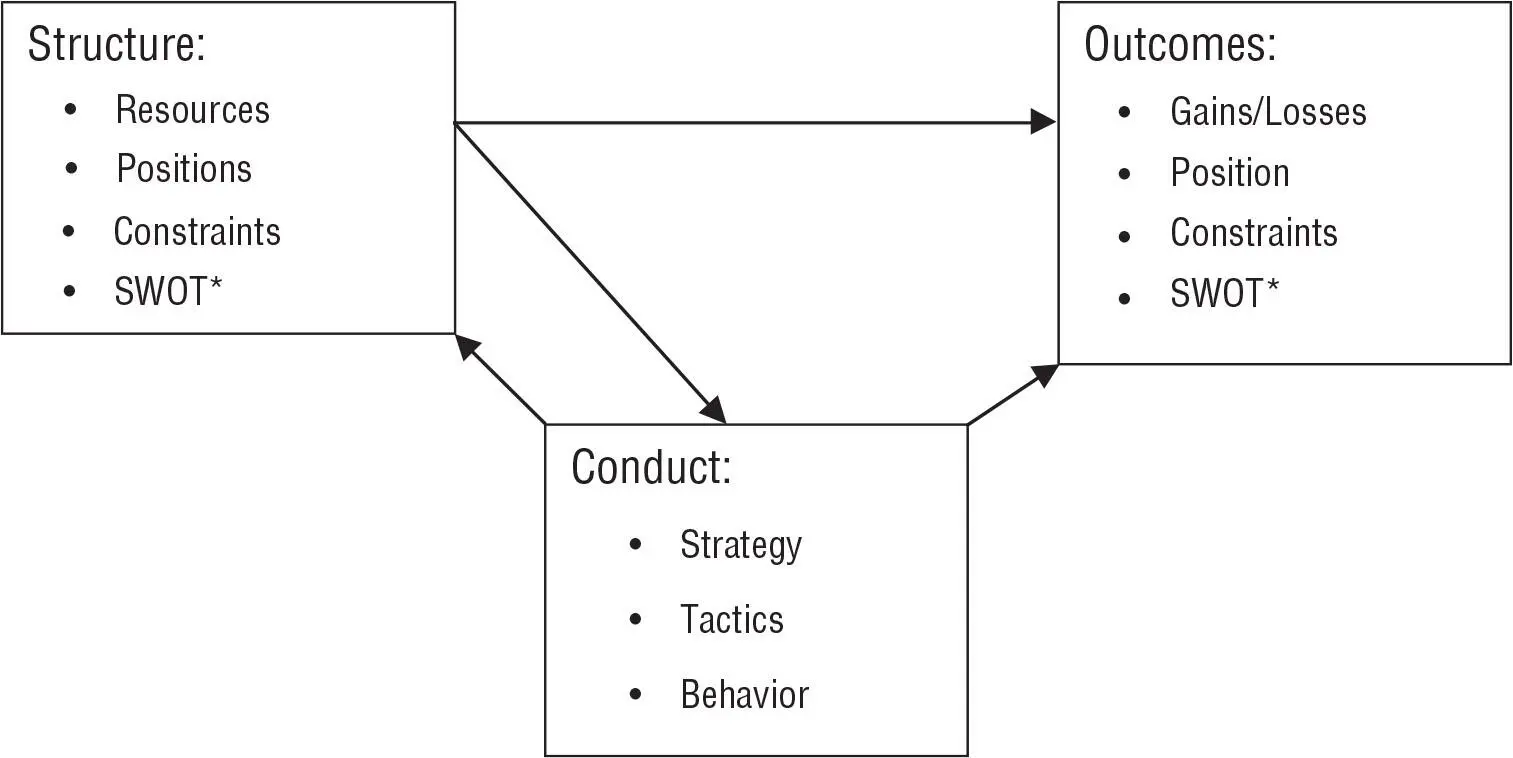

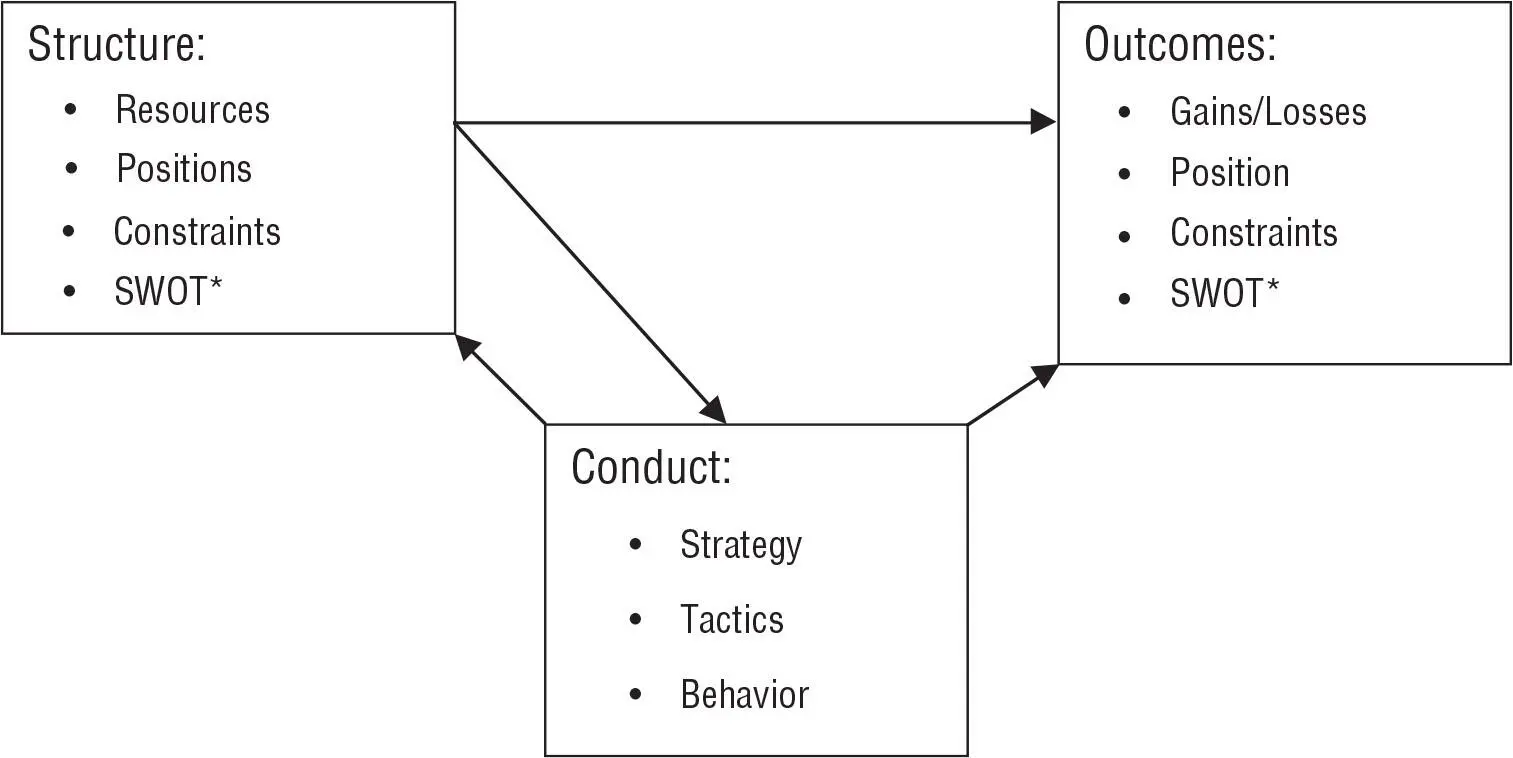

Even though success in M&A is uncertain, research and practice suggest the outlines of its key drivers. The perspective developed in this book is that success is driven by both the structure of the M&A opportunity one faces, as well as the conduct by which one pursues it. This venerable 2 model is useful for sorting out the determinants of success in M&A. Exhibit 1.1summarizes the direction of influence: Structure drives conduct and outcomes ; and conduct shapes structure 3 and drives outcomes. This has intuitive appeal when you consider the simple idea that where you wind up is a matter of the resources, opportunities, and constraints you began with, and of what you did along the way. The random strokes of good or bad luck also have an influence; therefore, your conduct of M&A needs to anticipate the possibility of both.

The structure of the M&A situation is like the setup of a game, the resources (the sports equipment you have), opportunities (the team you recruit), and constraints (the rules) under which you operate. In M&A, the elements of structure include:

EXHIBIT 1.1 A Model of the Drivers of Outcomes

*“SWOT” stands for strengths, weaknesses, opportunities, and threats. The use of SWOT analysis to develop strategy is discussed in Chapter 6.

Economics of the opportunity. This is simply the distribution of costs and revenues that determine cash flows, and ultimately net present values of investment. The “economics” also refers to the financial impact of the transaction on the buyer and target shareholders. From the buyer’s standpoint, the financial impact consists of the potential value to be created (as measured by net present value) as well as the effects of deal financing. Synergies are a key driver of the economic impact of the deal. Valuation analysis is the cluster of tools that enables one to assess the likelihood of the deal to create value. Best practitioners in M&A are rigorous analysts of the economics of an opportunity. In short, “economics” embraces the factors determining the financial risk and return of a deal. Chapters 9through 17outline the economic analysis of M&A opportunities; Chapters 18through 24present an economic lens through which to assess the design of transactions.

Strategy. The recognition of a strategic threat or opportunity in the firm’s competitive arena motivates most deals. The industry positions of the buyer and target are important determinants of the attractiveness of a deal. The firm may want to engage in M&A activity to acquire special capabilities and to improve its strategic position. Strategy is not only a direct driver of deal success, but also a driver of the economics, organization, and reputational structure of the deal. Successful acquirers are critical analysts of the strategic positions of the buyer and the target. Chapters 4through 7explore the strategic perspective and present several tools with which to assess the position of a firm and the strategic attractiveness of a deal.

Organization. The buyer and the target come to the deal with organizations that are unique in terms of their structure, leadership, and culture. The ability of two organizations to mesh has a huge influence on the ability of the new firm to realize merger synergies and strategic benefits. Failure to integrate well can torpedo a deal that, on paper, looked like a winner. Thus, best practice acquirers devote serious attention to the organizational profiles of the two firms, and to the postmerger integration challenge. Chapters 24, 36, and 37assess the influence of social issues and the challenges of postmerger integration.

“Brand.” The reputation and influence of the buyer and target go largely unrecognized in conventional assessments of M&A, yet practitioners consider these to be a key influence on the conduct of the M&A effort. Economists think of the brand in terms of “signaling,” the ability of a firm to distinguish itself from other firms. Signals can have a large influence on prices and even the ability to close a deal. But for them to have much effect, they must be costly or difficult, and unambiguous. Brand names are signals of quality or other special attributes. Brands and signals have special influence where interaction with customers or counterparties is repeated over time. Best practitioners seek to create and preserve brand value, and to understand the sources of the counterparty’s brand. Worth noting is that in M&A personal brand is also important: The aura of a CEO, financial adviser, or operating manager has been known to advance or stall a deal. Chapters 30through 33explore some of the implications of reputation in M&A.

Читать дальше