1 ...7 8 9 11 12 13 ...17 The act of investing is fundamentally a matter of trust.So, let's now look at the role that trust should play in your approach to investing.

Trusting yourself sounds easy, but it's hard for many people to believe they can trust their own judgment about investing. So I'm going to emphasize this point: Investing takes common sense and self-knowledge, and you possess both of those already. Trust yourself to know your current financial situation, your objectives, and your tolerance for risk better than anyone else. You know your own strengths and weaknesses. Is it going to be easy for you to develop disciplined savings habits, or will you need to find ways to motivate yourself to save? Will you be able to maintain a long-term focus, or will you be losing sleep every time the Dow Jones Industrial Average swoons? You'll want to tailor your investment program accordingly. You are the expert about you.

If you trust yourself, you'll be able to develop a baseline level of knowledge about investing and then make sound decisions based on factors that you thoroughly understand. As a result, you'll be less apt to second-guess yourself every time you see or hear something about a particular investment or market movement. You'll be better equipped to tune out misinformation and bad advice. You won't be swayed by ego and emotion. Having faith in yourself doesn't mean you'll never need professional advice. But if you should decide at some point that you do want help, you'll seek out a credible, qualified source instead of being vulnerable to a smooth-talking salesperson who cares little for your interests. Think of it as being the hunter instead of the hunted.

Suppose your brother-in-law brags about the killing he made on some obscure stock. It's human nature to grind your teeth and think, “ Yeesh —if I were playing the market, I'd be a winner, too.” (Sadly, there are online brokerage companies that encourage that mindset in their advertising. I find it incredibly irresponsible.) But if you have faith in your own ability to make investment decisions, the envy will quickly pass. You'll know that your brother-in-law's investment activities are not relevant to your life because you have your own set of objectives and a roadmap for getting to them. Your risk tolerance and time horizon are unlikely to be the same as someone else's. And you may also realize that your brother-in-law is unlikely to tell you about the severe losses he took on his three other “can't miss” stocks.

Having faith in your own ability to manage your financial affairs should make it easier to avoid the pitfalls that you'll encounter as an investor. As mentioned in the previous chapter, I'll be discussing quite a few pitfalls in this book, but here are some obvious ones for starters:

Don't pay attention to hot tips. Whether the tip is from a friend or from a knowledgeable-sounding “insider” in an online forum or community, be very leery. Your friend may know plenty, but who's to say he knows the whole story about that stock or mutual fund? If it's the online insider who has the tip, you have even more reason to be suspicious. There have been many cases in which unscrupulous people used these forums to deceive gullible investors and drive up the price of a worthless stock.

Ignore invitations for free financial seminars. Some financial advisors will seek to drum up new business by inviting you and other members in your community to free seminars, perhaps with dinner and cocktails as extra enticements. Sure, you might learn something, but you might also have to fend off a hard sales pitch on why you need to sign on as a client to the advisor.

Disregard sage-sounding aphorisms about the markets. I mean sayings like “buy on the dips” or “the trend is your friend.” Buying during a market dip would be a splendid strategy if you could ever be sure it was really a brief dip and not a deep plunge. As for the friendly trend, the idea is that if you find out about a rising stock or a hot industry, you should jump on the bandwagon. In fact, the trend is not your friend. By the time a market trend is noticeable, chances are that the bandwagon is already overloaded, the early money has jumped out, and you're arriving just in time for the end of the parade.

You're sure to be faced with situations like these as an investor. You won't be susceptible once you know that you can trust your own abilities.

Trust the Financial Markets

The second dimension of trust is having confidence that your investments in the financial markets will grow time over time. An expanding economy generally means more jobs, higher incomes, and increased opportunities for businesses to earn profits. And increased profits will ultimately raise stock prices, producing gains for investors. Personally, I believe that the U.S. economy will continue to grow over the long run, as it has in the past. While any economy will have ups and downs, the U.S. economy is the envy of the world because of its resilience and its ability to adapt and grow over the years. Over the long term, economic growth has averaged 3.1% a year over and above the rate of inflation.

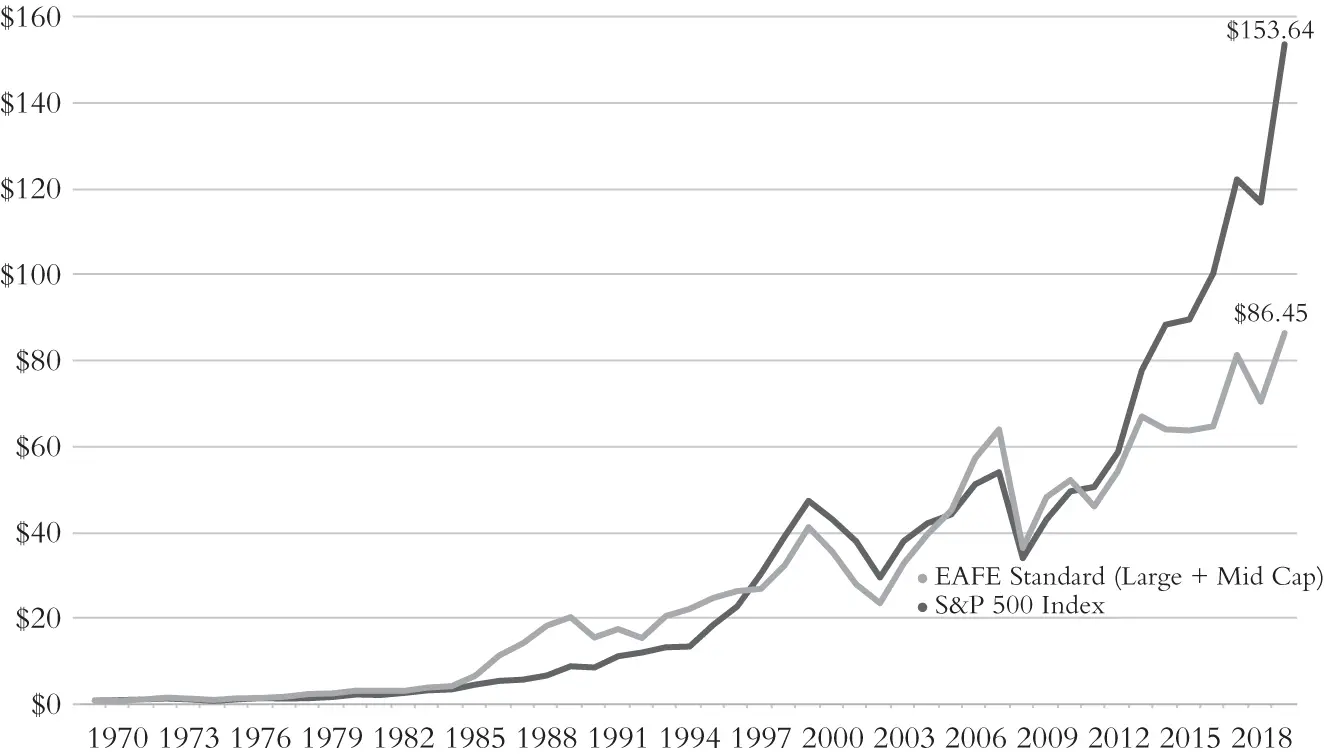

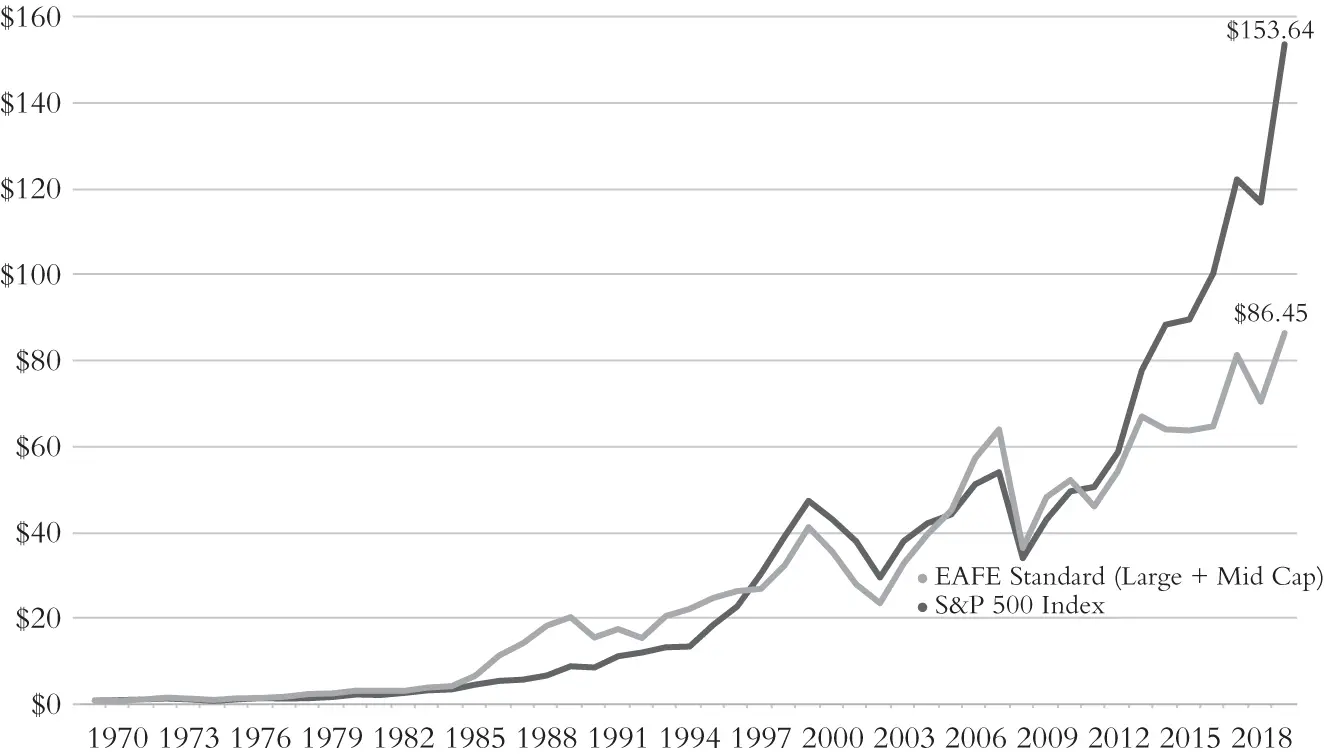

As shown in Figure 2.1, there have been many peaks and valleys in the growth of the global stock markets, but the general direction has been upward, as measured by two common stock market benchmarks: the Standard & Poor's 500 Index (a proxy for U.S. stocks) and the MSCI EAFE Index (a proxy for international stocks). A $1 investment in the S&P 500 Index on December 31, 1969, would have been worth $153.64 as of December 31, 2019, assuming dividends were reinvested. The same $1 investment over the same time period in the MSCI EAFE Index would have a value of $86.45, assuming dividends were reinvested.

People tend to forget that long-term upward trajectory when the market has one of its periodic downturns. Conversely, when the market spends a year or two doing notably better than its historical average, people tend to become euphoric and forget that a downturn is sure to come at some point. That's just human nature.

Figure 2.1 Growth of $1 in U.S. and International Stocks (1970–2019)

Sources: Morgan Stanley Capital International (MSCI), Standard & Poor's

This behavior came to the fore shortly after I was named CEO at Vanguard in 1996. The market went on an extraordinary surge (up 166% from December 1995 to September 2000) in a continuation of a bull market that started in the early 1990s. With such a prolonged period of gains, investors become infatuated with the stock market and investing. The ardor dissipated quickly when the market came back to earth with the bursting of the so-called tech bubble . Stocks fell 49% and didn't turn around for another two years. It was a painful, but instructive, period.

Despite periodic setbacks, the historical trend suggests that you'll be rewarded if you invest in the stock market. But there is no guarantee, of course. You shouldn't put your money in stocks if you don't share the belief that the economies around the world will continue to grow over the coming decades. Without growth in productivity and innovation in the products and services in our collective economies, there will not be good returns on stocks, and corporate bonds will prove risky. Instead, put your money in the bank and collect a guaranteed return, or buy U.S. Treasury bills, the safest debt instrument in the world. Recognize that you'll have to be content with very modest returns that may not keep ahead of inflation. Remember the trade-off: Lower-risk investments (i.e., ones that possess price stability) cannot be expected to reward you as well as riskier ones (i.e., ones that possess price volatility).

Читать дальше