Acquiring new customers and new product revenues, or the upper right‐hand quadrant of the matrix, is a “share grab”. . . using a new product to take away customers from competitors. This is an expected and classic strategy in the game of product improvement. You can see that across industries – the launch of a new phone, the introduction of a new COVID antibody test, the development of a new shoe fashion – each of these can attract new customers because they want a new product.

Quadrant 4: Grow Customer Base

New customers buying existing products and services has a variety of causes typically associated with its selection, including the failure of a competitor’s product (supply chain or product dissatisfaction) or strategies of bundling with newer more disruptive products to allow access. Often times it follows an increase in sales focus on a new customer community or geography.

Oliver Richards has been a part of Beacon’s story for the past decade. Senior Vice President and leader of our Healthcare and Lifesciences practice, Oliver is also my chief growth officer and is fundamental in driving the success of our firm. A University of Chicago undergrad in chemistry followed up by a PhD in cellular and molecular biology and an MBA from Wisconsin, Oliver is not only brilliant, he’s also a great husband and father, and takes care of all teammates and clients in his orbit. We talked a bit about the four quadrants of the Revenue Matrix.

I think by nature what we do is look at the new and the unknown quite a bit. And so I think we spend probably a disproportionate amount of time on new products and new customers. Probably in the existing customer, new product, new customer, existing product. We focus there versus where our clients spend the bulk of their time, in the existing customer, existing product bucket.

He’s right; we do tend to work on the emerging end of things at Beacon, and Oliver helps his clients drive significant growth in these vectors. As consultants, we love two‐by‐two matrices. They are easy to write, easy to understand, and if they work, they are generally powerful; if they don’t, you toss them out! Like all frameworks, they give structure to challenges and problems, which is one of the goals of this book. However, we have additional goals beyond structuring the problem. We want our output to be pragmatic, actionable, and exhaustive in the planning process. A two‐by‐two illustration alone doesn’t achieve that.

The Four Key Questions: Customers

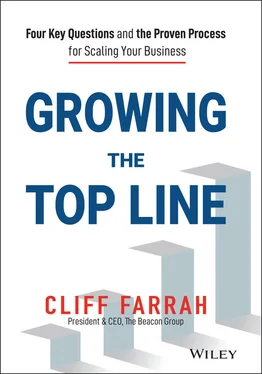

Growth strategy is complex. Growth strategy is risky. Growth strategy is an art that can’t be taught . These are three of the biggest myths in enterprise business today. If you can answer four questions for your business, you can develop a growth strategy. The questions are simple, powerful, and linked to both risk and reward.

When I started Beacon, the challenge I had was to teach my way of thinking to the people I worked with. There is quite a bit of subjectivity to the approach, but over time I was able to determine that there were objective key risk/reward questions that drove success and failure as my clients executed growth plans in their worlds.

Beyond customer and goods/services elements, there is a near‐limitless group of questions that strategists consider depending on their industry and company. It’s what I call the Strategist’s Challenge: If there are no boundaries to your creativity, how do you know what to focus on?

I always have looked at decision‐making from a pareto position. What are the most critical things to worry about as you plan a successful growth strategy? The initial, most clarifying questions to help a strategist plan and focus? The greatest risk/reward variables? Based on my analysis and experience, there are Four Key Questions to consider.

Which CUSTOMERS will I serve?

Which GEOGRAPHIES AND LOCATIONS will I serve?

What GOODS AND SERVICES will I sell?

What BUSINESS MODEL will I use?

Our work shows that if you can answer these questions, you can build a successful growth strategy. If you miss on these, it’s pretty tough to do well.

Our next chapter focuses on Question 1: Which customers will I serve?

CHAPTER 2 Which CUSTOMERS Will I Serve?

We talked about the value of a customer as the source of all revenue in Chapter 1. What we didn’t talk about is how important choosing wisely is. Whom you choose to sell to is the single most critical question a company must answer.The amount of time and energy that goes into customer acquisition is staggering, and for good reason. It is a much more efficient, less risky proposition to sell to an existing customer than it is to sell to a new customer. But new customers are generally aligned with growth for a new business. What percentage of your time and energy should be focused on existing versus new customers?

As you ponder this, let’s make it real. There are only 24 hours in a day. There are only so many employees you can lean on. There are only so many dollars you can spend. As an entrepreneur, this is an intuitive set of data. Your gut tells you what you can and cannot support. At a larger enterprise, it’s a more formal budgeting process. But in either model, you need to think about where to focus your limited resources.

Older companies tend to have more customers to serve, and care and feeding of those customers becomes the primary objective of the revenue engine. David Maister, former Harvard Business School professor, consultant, and best selling author, coined the phrase, “hunters and farmers.” Older companies, with more mature processes and client relationships tend to “farm,” meaning they rely on existing customers, while younger companies or product lines tend to “hunt,” or look for new customers. From a skills standpoint, it’s generally accepted that it’s easier to find and develop farmers than hunters, and that is simply because you can rely on the legacy of the relationship and brand that has been developed over time as a farmer.

We will talk more about this in later chapters, but without a doubt, the customers you choose to serve are the critical first growth question to consider.

How your revenue breaks down has a lot to do with what kind of company you work for. As a start‐up, you will find much of your effort focused on the addition of new customers, where a more mature business focuses more on generating more from existing customers. The revenue mix changes over time as customers become repeat businesses.

Doug Fletcher is the modern‐day version of a Renaissance man. An author, professor, board member, speaker, consultant, and former member of GE’s management development program – I’ve known and respected Doug’s contributions to business thought since we sat next to each other over 25 years ago at the Darden Graduate School of Business at UVA. He’s a proud dad, a killer fly fisherman, and one of the most pragmatic people I know. I was lucky enough to corral Doug into offering up some of his wisdom in this book. Doug is a specialist in the world of services in general and professional services in particular. He teaches consultants, accountants, lawyers, engineers, system integrators, and financial service practitioners how to attract new customers. If you are lucky enough to have a chance to sit in on one of his sessions, I highly recommend it. Doug has two great books under his belt, his first as a coauthor and the latest solo. It’s called How to Win Client Business and talks about the challenges of getting new clients. This is generally accepted as the single hardest act in services business development, and we talked a bit about why:

Читать дальше