GLOBAL SOLUTIONS, INTERNATIONAL PARTNERSHIPS

THE EUROPEAN INVESTMENT BANK DEVELOPMENT REPORT 2021

About the European Investment Bank

The European Investment Bank is the world’s biggest multilateral lender. The only bank owned by and representing the interests of the EU countries, the EIB finances Europe’s economic growth. Over six decades the Bank has backed start-ups like Skype and massive schemes like the Øresund Bridge linking Sweden and Denmark. Headquartered in Luxembourg, the EIB Group includes the European Investment Fund, a specialist financer of small and medium-sized enterprises.

FOREWORD BY THE PRESIDENT

PROJECT DATA FROM AROUND THE WORLD

SOLUTIONS AND PARTNERSHIPS

THE PANDEMIC AND DEVELOPMENT FINANCE: WHAT COVID-19 MEANS FOR DEVELOPMENT

COVAX: VACCINE SOLIDARITY

COVID-19 AND MOROCCO’S HOSPITALS: FAST RELIEF

EDUCATION AND DEVELOPMENT: AGAINST THE IMPACT OF COVID-19 IN MOROCCO AND TUNISIA

CLIMATE CHANGE AND DEVELOPMENT FINANCE: HOW TO CALCULATE CLIMATE RISK FOR A DEVELOPING COUNTRY

CLIMATE CHANGE AND GENDER: HOW TO FIGHT CLIMATE CHANGE WITH EQUALITY

THE LUXEMBOURG CLIMATE FINANCE PLATFORM: DE-RISKING CLIMATE INVESTMENT

COCOA AND SUSTAINABLE FORESTS IN CÔTE D’IVOIRE: FOREST REHAB FOR YOUR CHOCOLATE

WATER ENGINEERING IN EAST AFRICA: CREATIVE FLOW

WATER AND KNOWLEDGE TRANSFER: SHARE IT

PLASTIC POLLUTION AND THE OCEANS: PROTECTING THE WATERWAYS

WATER SOLUTIONS IN NIGER: FRESH WATER DOUSES VIOLENCE

SUSTAINABLE TRANSPORT AND GENDER: ALL ABOARD

GENDER INVESTMENT: CREDIT WHERE IT’S OVERDUE

FRAGILE AND CONFLICT-AFFECTED COUNTRIES: HOW TO BE SENSITIVE

INDIGENOUS STAKEHOLDER ENGAGEMENT IN HONDURAS: HOW TO LISTEN

AFRICA URBAN PLANNING: PROSPERITY TO THE CITY

DIGITALISATION: THE GREATER THE RISK, THE GREATER THE REWARD

VENTURE CAPITAL: EQUITY FOR INNOVATIVE BUSINESS MODELS

MICROFINANCE IN AFRICA: A BIG DIFFERENCE FOR SMALL FARMERS

GEORGIA SMALL BUSINESSES: A GUARANTEE FOR STRAWBERRIES

MOLDOVA AGRICULTURE: CULTIVATING SUCCESS

IMPACT IN DETAIL

OUR APPROACH TO EXAMINING RESULTS AND IMPACT

EXPECTED RESULTS OF NEW PROJECTS

THE EIB’S CONTRIBUTION TO NEW PROJECTS

CARBON FOOTPRINT EXERCISE

MACROECONOMIC IMPACT MODELLING

RESULTS OF COMPLETED PROJECTS

IN-DEPTH IMPACT STUDIES

LENDING VOLUMES

AFTERWORD BY THE VICE-PRESIDENTS FOR DEVELOPMENT

The climate crisis, the mass displacement of people and the international dimension of the COVID-19 pandemic remind us that we cannot face our challenges alone—our solutions must be global. The European Investment Bank is at the heart of the EU effort to turn Europe’s policy initiatives into real development solutions on the ground. This report provides insights into our vital projects and initiatives in all regions around the world that are of priority to the European Union, data and insights on their impact and ideas for our contribution to an enhanced European architecture for development through a series of expert essays.

As the financing arm of the European Union, and as the only development bank entirely and exclusively owned by the EU’s Member States, we give the European Union the strategic autonomy to act quickly and at scale.

You can see this in our massive and immediate commitment to the European Union’s COVID-19 response, spearheaded by the European Commission through Team Europe. Now that safe and effective COVID-19 vaccines are available—our investment backed the very first to be approved—it is essential that lower-income economies are not left behind. Our €600 million support for the COVAX project in partnership with the European Commission is our largest ever for public health.

With our focus on a green recovery from COVID-19, we never lose sight of the long-term challenge of climate change whether in our investments or our development of new instruments. When we invented green bonds more than a decade ago, we knew that remarkable innovation was only the start of the job. We are still working to ensure transparency and accountability for green investments globally, even as we develop an entirely new market for sustainability awareness bonds.

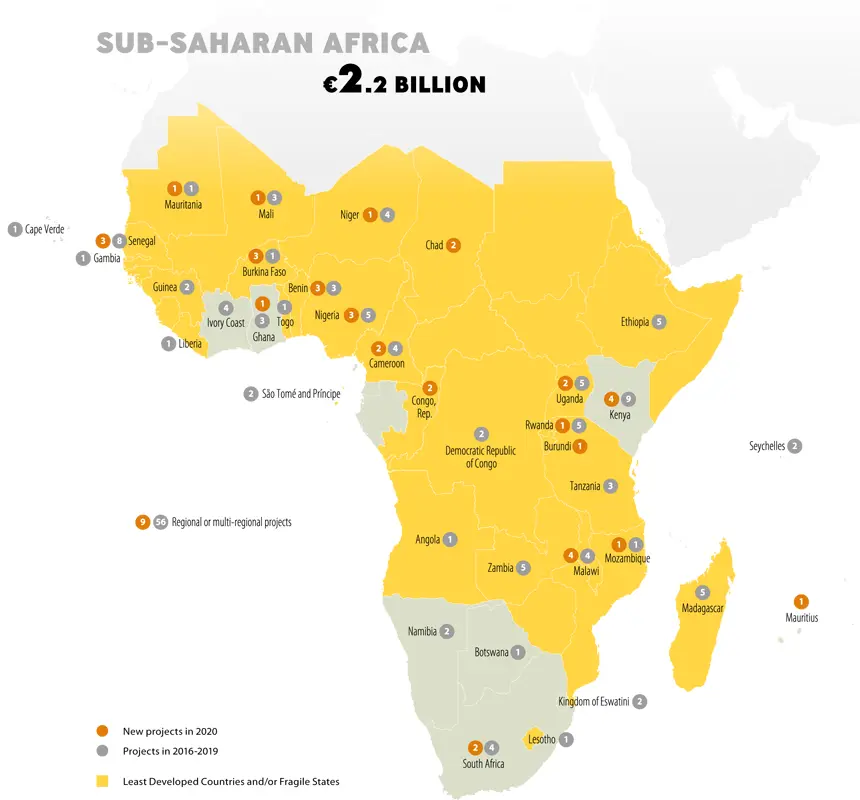

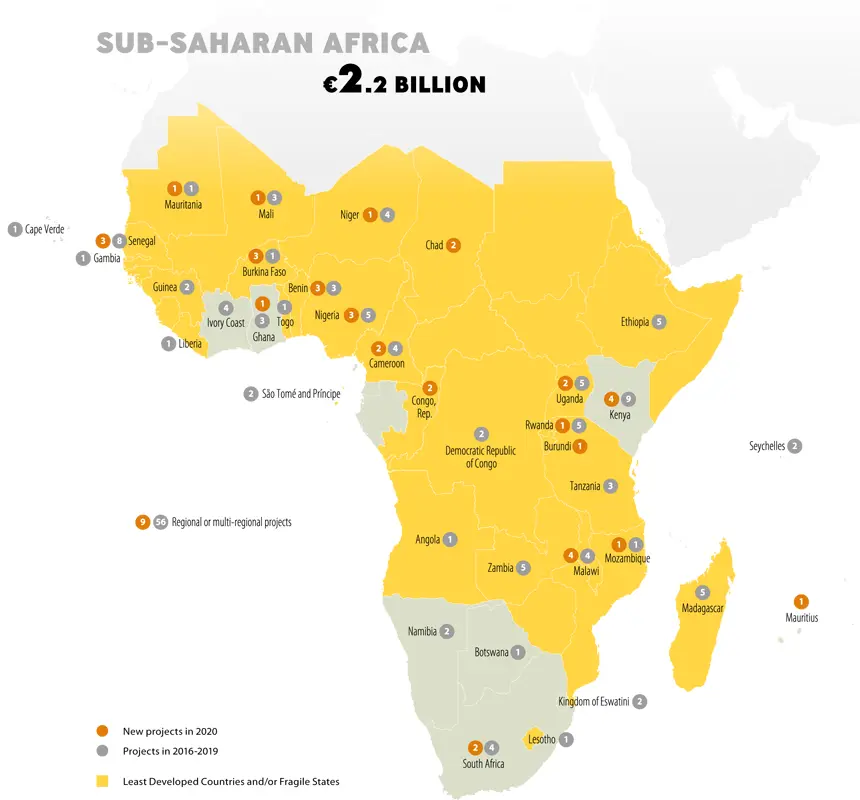

We have a long history as a cornerstone of Europe’s development finance architecture, with operations in more than 140 countries. In Africa, we achieved record lending levels in 2020, signing €5 billion in financing, half of it with the private sector. Over 70% of our investment in sub-Saharan Africa was in least developed countries and fragile states.

The expert pieces in this report are a reminder that we constantly fine-tune our approach to adapt and respond to evolving EU policy priorities and to deliver greater impact, efficiency and effectiveness. With this in mind, we are further specialising our business delivery outside the European Union. We aim to put more of our bankers and engineers at the disposal of EU Delegations to further strengthen the European Union’s value added on the ground, increase EU visibility and, ultimately, have a stronger developmental impact. This reorganisation is aimed at maximising EU impact and visibility through a dedicated EU development finance partner with technical expertise, upholding and delivering on EU and partner country priorities, including climate, health, migration, gender and digitalisation.

“ As the financing arm of the European Union, and as the only development bank entirely and exclusively owned by the EU’s Member States, we give the European Union the strategic autonomy to act quickly and at scale.”

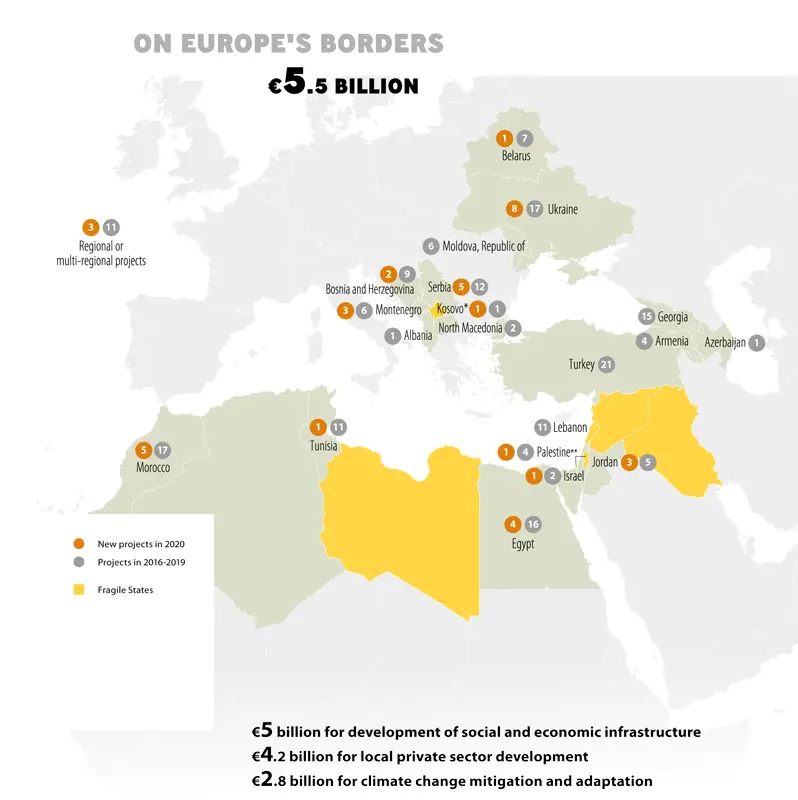

The European Investment Bank is an investment bridge between EU policies and projects on the ground. Working in almost every African country, in the Western Balkans countries on their path to EU accession, in the EU’s Southern and Eastern Neighbourhoods and around the world, we use our unrivalled sector expertise to help build investments that reduce poverty, disease and environmental degradation.

Our plans respond to the growing demand for a stronger partnership between Europe and the world. We are committed to improving lives, together.

Werner Hoyer

PROJECT DATA FROM AROUND THE WORLD

TOTAL LENDING OUTSIDE THE EU €9.3 BILLION

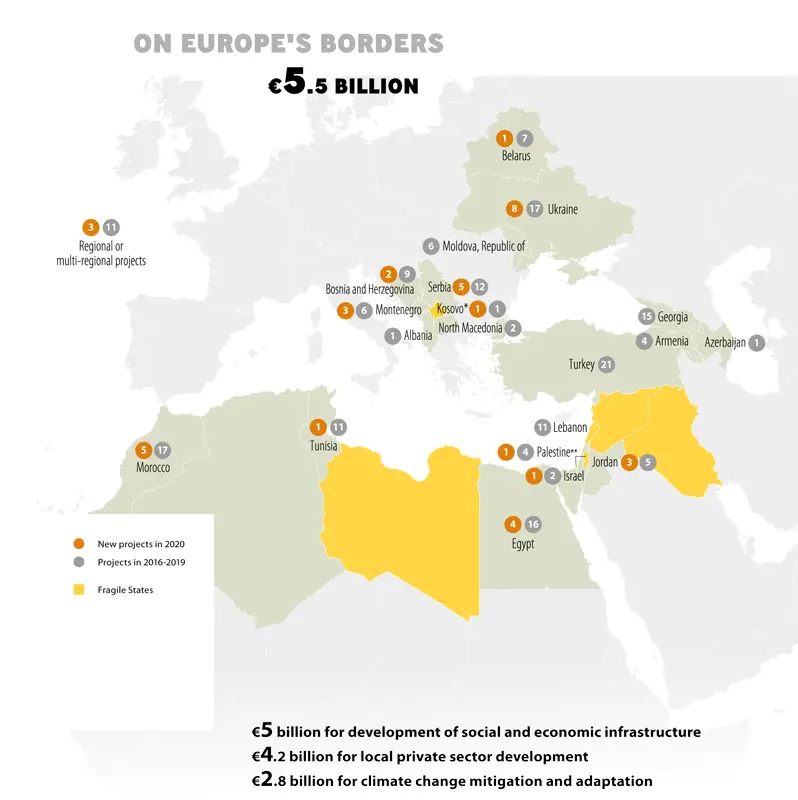

The European Investment Bank does not endorse, accept or judge the legal status of any territory, boundaries, colours, denominations or information depicted on any map in this section. One operation involves three intermediaries in Cameroon, Chad and the Republic of Congo and is counted once in each country.

Kosovo* : This designation is without prejudice to the positions expressed by the EU Member States on Kosovo’s status and is in line with United Nations Security Council Resolution No. 1244/1999 and the International Court of Justice Opinion of 22 July 2010 on Kosovo’s declaration of independence.

Читать дальше