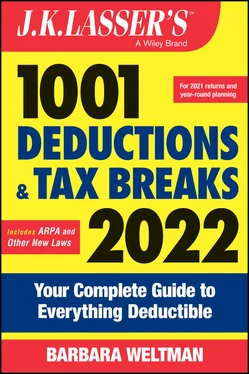

Barbara Weltman - J.K. Lasser's 1001 Deductions and Tax Breaks 2022

Здесь есть возможность читать онлайн «Barbara Weltman - J.K. Lasser's 1001 Deductions and Tax Breaks 2022» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:J.K. Lasser's 1001 Deductions and Tax Breaks 2022

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:3 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 60

- 1

- 2

- 3

- 4

- 5

J.K. Lasser's 1001 Deductions and Tax Breaks 2022: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «J.K. Lasser's 1001 Deductions and Tax Breaks 2022»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

J.K. Lasser's 1001 Deductions and Tax Breaks 2022: Your Complete Guide to Everything Deductible

1001 Deductions and Tax Breaks, 2022

J.K. Lasser's 1001 Deductions and Tax Breaks 2022 — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «J.K. Lasser's 1001 Deductions and Tax Breaks 2022», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

TABLE 1.4 Earned Income Needed for Top Credit in 2021

| Earned Income Needed | |

|---|---|

| Number of Qualifying Children | for Top Credit |

| No qualifying child | $ 9,820 |

| 1 qualifying child | 10,640 |

| 2 or more qualifying children | 14,950 |

Nontaxable employee compensation, such as tax‐free fringe benefits or salary deferrals—for example, contributions to company 401(k) plans—is not treated as earned income.

Earned income does not include pensions and retirement plan distributions, long‐term disability and military disability pensions, welfare, and Social Security benefits (for retirement or disability).

To qualify for the maximum credit, you must have earned income at or above a set amount. Table 1.4 shows the earned income you need to obtain the top credit (depending on the number of your qualifying children, if any).

For 2021, you may use your 2019 earned income to figure the credit if it was higher than your earned income in 2021.

ADJUSTED GROSS INCOME

If your adjusted gross income is too high, the credit is reduced or eliminated. Table 1.5 shows the AGI phaseout range for the earned income credit. This depends not only on the number of qualifying children, if any, but also on your filing status, as shown in the table.

JOINT RETURN

If you are married, you usually must file a joint return with your spouse in order to claim an earned income credit. However, this requirement is waived if your spouse did not live in your household for the last 6 months of the year or have a decree, instrument, or written agreement of separation and did not live with a spouse by the end of the year. In this case, assuming you paid the household expenses in which a qualifying child lived for the full year, you qualify as single for purposes of the earned income credit (using “other taxpayers” limits on AGI).

TABLE 1.5 AGI Phaseout Range for the Earned Income Credit in 2021

| Number of Qualifying Children | Married Filing Jointly | Other Taxpayers |

|---|---|---|

| No qualifying child | $17,560–27,380 | $11,610–21,430 |

| 1 qualifying child | $25,470–48,108 | $19,520–42,158 |

| 2 qualifying children | $25,470–53,865 | $19,520–47,915 |

| 3 or more qualifying children | $25,470–57,414 | $19,520–51,464 |

Example

You are married and file a joint return. You and your spouse have 1 qualifying child. In 2021, if your AGI is less than $25,470, your earned income credit is not subject to any phaseout. If your AGI is $48,108 or higher, you cannot claim any earned income credit; it is completely phased out. If your AGI is between these amounts (within the phaseout range), you may claim a reduced credit.

CHILDLESS INDIVIDUALS

For 2021, the minimum age for claiming the earned income credit, which had been 25, is reduced to 19. The minimum age for a full‐time student is 24; it's 18 for a former foster child or homeless youth. The maximum age, usually 65, does not apply in 2021.

If you have a qualifying child who lacks a Social Security number, you may claim the earned income tax credit as if you were childless.

Planning Tips

The credit is based on a set percentage of earned income. However, you don't have to compute the credit. You merely look at an IRS Earned Income Credit Table, which accompanies the instructions for your return.

You can have the IRS figure your credit for you (you don't even have to look it up in the table). To do this, just complete your return up to the earned income credit line and put “EIC” on the dotted line next to it. If you have a qualifying child, complete and attach Schedule EIC to the return. Also attach Form 8862, Information to Claim Earned Income Credit after Disallowance , if you are required to do so as explained next.

If your child does not qualify as your dependent because of the tie‐breaker rule (discussed earlier in this chapter), you may claim the earned income credit with no qualifying child. For example, a grandmother has a home in which her daughter and the baby (granddaughter) live. Under the tie‐breaker rule, while the baby could be a qualifying child of the grandmother and mother, she is the daughter's qualifying child. The grandmother can claim the earned income tax credit with no qualifying child, assuming all other requirements for the credit are met. Alternatively, if the daughter foregoes the dependency exemption, the grandmother can claim it and the earned income tax credit, assuming that her AGI exceeds the daughter's AGI. In this instance, the daughter could claim the earned income tax credit with no qualifying child, assuming all other requirements for the credit are met.

Pitfalls

You lose eligibility for the credit if you have unearned income over $10,000 in 2021 from dividends, interest (both taxable and tax free), net rent or royalty income, net capital gains, or net passive income that is not self‐employment income.

You lose out on the opportunity to claim the credit in future years if you negligently or fraudulently claim it on your return. (If you use a paid preparer, he or she is required to perform to diligence before allowing you to claim the earned income credit.) You are banned for 2 years from claiming the earned income credit if your claim was reckless or in disregard of the tax rules. You lose out for 10 years if your claim was fraudulent. If you become ineligible because of negligence or fraud, the IRS issues a deficiency notice. You may counter the IRS's charge by filing Form 8862, Information to Claim Earned Income Credit after Disallowance , to show you are eligible.

If the IRS accepts your position and recertifies eligibility, you don't have to file this form again (unless you again become ineligible). For 2021 returns filed in 2022, the IRS is not permitted to issue tax refunds for the refundable earned income tax credit before February 15, 2022. As a result, refunds usually aren't received until the third or fourth week in February, even for returns filed in January 2022.

Where to Claim the Earned Income Credit

You can claim the earned income credit on line 27 of Form 1040 or 1040‐SR.

Dependent Care Expenses

Many taxpayers must pay for the care of a child in order to work. According to the World Population Review, the cost of child care in 2021 for an infant is $15,000 at a center. The tax law provides a limited tax credit for such costs, called the dependent care credit. The amount of the credit you may claim depends on your income. It may be as much as 50% of eligible expenses. Or, if your employer helps with child care costs, you may exclude the payments from your income.

Benefit

If you hire someone to care for your children or other dependents to enable you to work or incur other dependent care expenses, you may be eligible for a fully refundable tax credit of up to $8,000. More specifically, this credit is a percentage of eligible dependent care expenses (explained later). The credit percentage ranges up to 50%. However, no credit may be claimed if income is $440,000 or more (explained later).

If your employer pays for your dependent care expenses, you may be able to exclude this benefit from income up to $10,500 in 2021.

The maximum amount of expenses taken into account for the credit in 2021 is $8,000 for one qualifying dependent and $16,000 for 2 or more qualifying dependents. This limit doesn't need to be divided equally among them.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «J.K. Lasser's 1001 Deductions and Tax Breaks 2022»

Представляем Вашему вниманию похожие книги на «J.K. Lasser's 1001 Deductions and Tax Breaks 2022» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «J.K. Lasser's 1001 Deductions and Tax Breaks 2022» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.