Takeovers, mergers and splits: Another way of becoming a shareholder in a listed company is through a takeover, merger or split. For example, the Bank of NSW was taken over by Westpac and the Sydney Futures Exchange merged with the ASX. In the opposite type of scenario, Coles Ltd became a listed company when Wesfarmers decided to get out of the grocery retailing business and make Coles a separate company (and no longer part of Wesfarmers).

Selling shares acquired in any one of the ways included in this section is likely to have tax implications, so you need to keep accurate records of the date and cost of the shares when you acquired them. I discuss this in greater detail in chapter 11.

You might be surprised to learn that, despite the large number of different company shares traded on the Australian market, there are many, many more companies you can't buy shares in or subscribe to. This means you simply can't become a part‐owner of the business, no matter how much you might want to. A large number of private companies (Pty Ltd) are held by private owners who want to retain the business and not transfer it to public ownership. A prime example is Aldi, which is a very successful and expanding supermarket chain in Australia. You can't become an Aldi shareholder because Aldi is a privately owned company and all profits flow back to the owners.

Another type of company you can't become a shareholder in directly is a fully‐owned subsidiary company. A good example is Bunnings, which is a very successful hardware chain operating in Australia. You can't become a Bunnings shareholder because Bunnings is a fully‐owned subsidiary of Wesfarmers. The only way you can get a slice of the action at Bunnings is to buy Wesfarmers shares. The problem is that Wesfarmers owns a lot of other enterprises so when you buy Wesfarmers shares you get all the others in the package and Bunnings profits will be diluted.

Another problem is that many of the larger and most profitable companies that operate in Australia are based overseas and so their shares aren't listed with an Australian exchange. Examples of these include Google, Facebook, Microsoft and General Motors. In fact, the value of Australian listed shares is less than 2% of the world market. We are indeed small players!

Trading shares listed on overseas exchanges is possible if you deal with a broker who can arrange these types of trades. However, this introduces a raft of issues including currency exchange rates so I suggest that at this stage you stick to trading Australian listed shares.

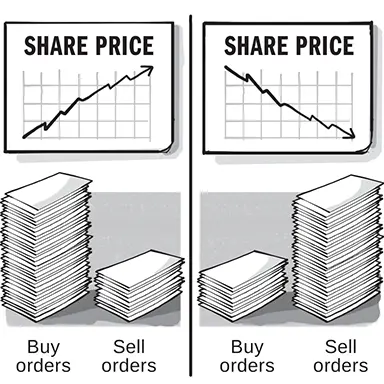

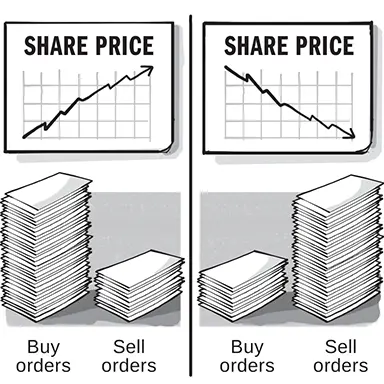

As you no doubt know, share prices change from day to day, or indeed during the course of one day's trading. The price fluctuates because of market forces. If more shares are wanted by buyers than are available from sellers, the price rises. If more shares are for sale than buyers for them, the price falls. It's really as simple as that. Shares are like any other traded commodity such as real estate or collectables. Short supply (where supply is less than demand) drives prices higher as buyers scramble to get in. Oversupply (supply greater than demand) drives prices lower as sellers scramble to get out. In the sharemarket, there's a constant interaction between buyers and sellers and this causes share prices to fluctuate.

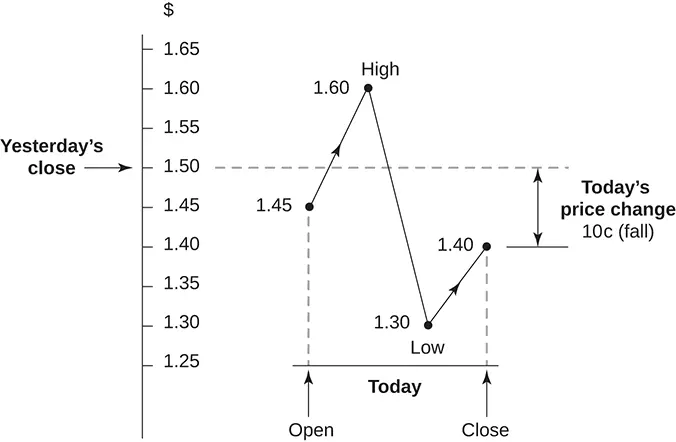

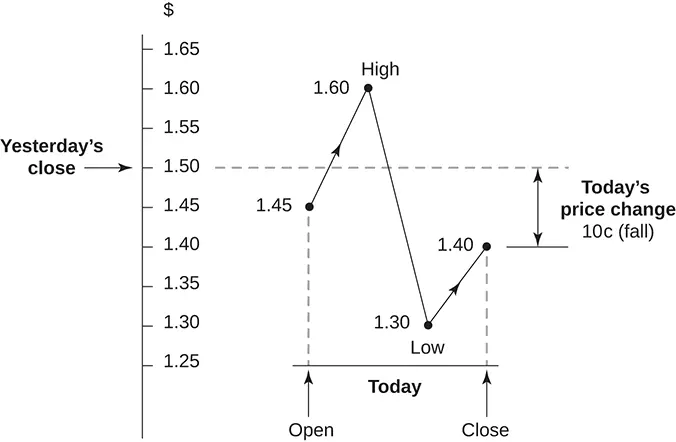

There are several important share prices. These are fairly self‐explanatory but I will outline them briefly here:

Opening price: This is the price of the first trade for the day when the exchange opened.

High price: This is the highest trade price for the day.

Low price: This is the lowest trade price for the day.

Last price: This is the price of the most recent trade.

Closing price: This is the last price of the day (before the exchange closes).

Price change: This is the amount by which the share price has changed. For example, after trading ceases for the day, the price change for the day is today's closing price minus yesterday's closing price. This could be zero if no price change occurred, or could be up (price rise) or down (price fall).

Within these prices, a heap of different scenarios are possible. Figure 2.1 shows just one scenario for a day's trading.

In this case, the shares closed yesterday at $1.50 and opened today at $1.45, before rising to a high of $1.60, falling to a low of $1.30 and then recovering to close the day at $1.40. This means the price change for the day was a fall of 10¢.

The scenario illustrated in figure 2.1 is a relatively complex one; often a share price moves in just one direction during the day's trading. For example, the price might rise or fall all day between opening and closing. After successive days, a price trend can become established. Analysis of trends is a very important aspect of share trading, and I discuss this in greater detail in chapter 9.

Figure 2.1: Possible price changes in one day's trading

You might expect that today's opening price would be the same as yesterday's closing price but this isn't necessarily the case. When today's opening price isn't the same as yesterday's closing price (as in my example) this is known as a gap . In the hours between the closing trade one day and the following trading day's opening trade, a number of factors can affect a share price so gaps occur frequently.

Shares are units of ownership in a company and the number of shares you own determines the extent of your ownership. Shares are also known as equities and stocks.

Shares are a financial security because they have a tradeable value.

Shareholders are entitled to share in the assets and profits of the business they own shares in and to have a say in the running of the company. Shareholders can vote at AGMs (annual general meetings) and post questions.

The main reason a business wants to go public and issue shares is so it can raise a substantial amount of money — known as equity capital.

The other way a business can raise money is by loan capital — that is, by means of a business loan.

The great advantage for a company of equity capital is that no interest or loan repayments are required.

A shareholder can benefit if the business has some loan capital and can use it to make a higher profit than the interest cost of the loan. However, too much loan capital is undesirable.

You can obtain shares by subscribing to the issue (float or IPO) when the shares are first made available to the public. You do this by completing the application form in the prospectus and submitting the required funds (based on the number of shares you want).

The most common way of becoming a shareholder is to purchase shares in a company that's listed with an exchange.

You can't deal directly with an exchange and need to become a client of a licensed broker who arranges trades on your behalf. The broker charges a fee — known as brokerage — which can vary widely between different types of broker.

Some less common ways of becoming a shareholder include inheritance, privatisation of a government enterprise, demutualisation, takeover, merger or split, and private treaty (rare).

Some profitable companies operating in Australia are privately owned so you can't become a shareholder in them.

Читать дальше