If bank interest rates had dropped instead, Uncle James would have done something different. Realizing what a great deal he was offering compared to the dropping interest rates of the banks, he would have told Amy, “You can invest in this scheme. You will receive a 5 percent coupon on $10,000 but it will cost you $10,500, not $10,000. Therefore, your yield would be 4.8 percent, not 5 percent, because I'll return less than what you invested. It would still be profitable, of course, because you would receive $500 per year. But it would be less so.”

If you followed this strange little story, then you'll understand how most bonds work. Newly issued bonds have an expiration term and a fixed rate of interest. Investors purchasing such bonds when they're launched earn the same coupon and yield. If the interest paid amounts to 3 percent per year, this is what investors will make each year if they hold the bonds to maturity. If they sell early, they would receive more or less than what they deposited, depending on current bond prices. If they hold the bonds to maturity, they would receive exactly what they had invested, plus the cash interest they had earned twice a year.

Other investors can jump into a bond after the initial launch date. But if demand for bonds is high, they'll pay a premium for the bond. So their yield will be lower than the coupon rate that was advertised when the bond was launched. If demand for bonds is lower (this occurs when bank interest rates rise), bond prices drop. This increases the yield for new investors jumping into the same bond.

Can You Lose Money with Bonds?

Those buying low‐grade corporate bonds from companies with shaky financial foundations can certainly lose money. To entice investors, such companies offer higher than average interest rates. For example, assume a new technology company needs money for research and development. It might issue a bond with a 10 percent coupon, which is well above typical rates. But if the company goes bankrupt, investors might lose some or all of their original capital. It could get flushed down the toilet, along with the company's future.

Likewise, investors loading up on long‐term bonds can lose money in real terms. Remember that a real return is the profit made after inflation. If investors bought bonds maturing in 20 years with coupons of 3 percent per year, inflation could devour the profits. Sure, they would still earn 3 percent per year on their investment. But if inflation averaged 4 percent, the investor's real return would be negative. Such interest payments would lose to the rising price of a box of corn flakes.

That's why I recommend shorter term or broad market government bond index funds. Every year you'll see a “Bonds Are Going to Crash” headline. They might quote some crazy banker whose mother dropped him on his head.

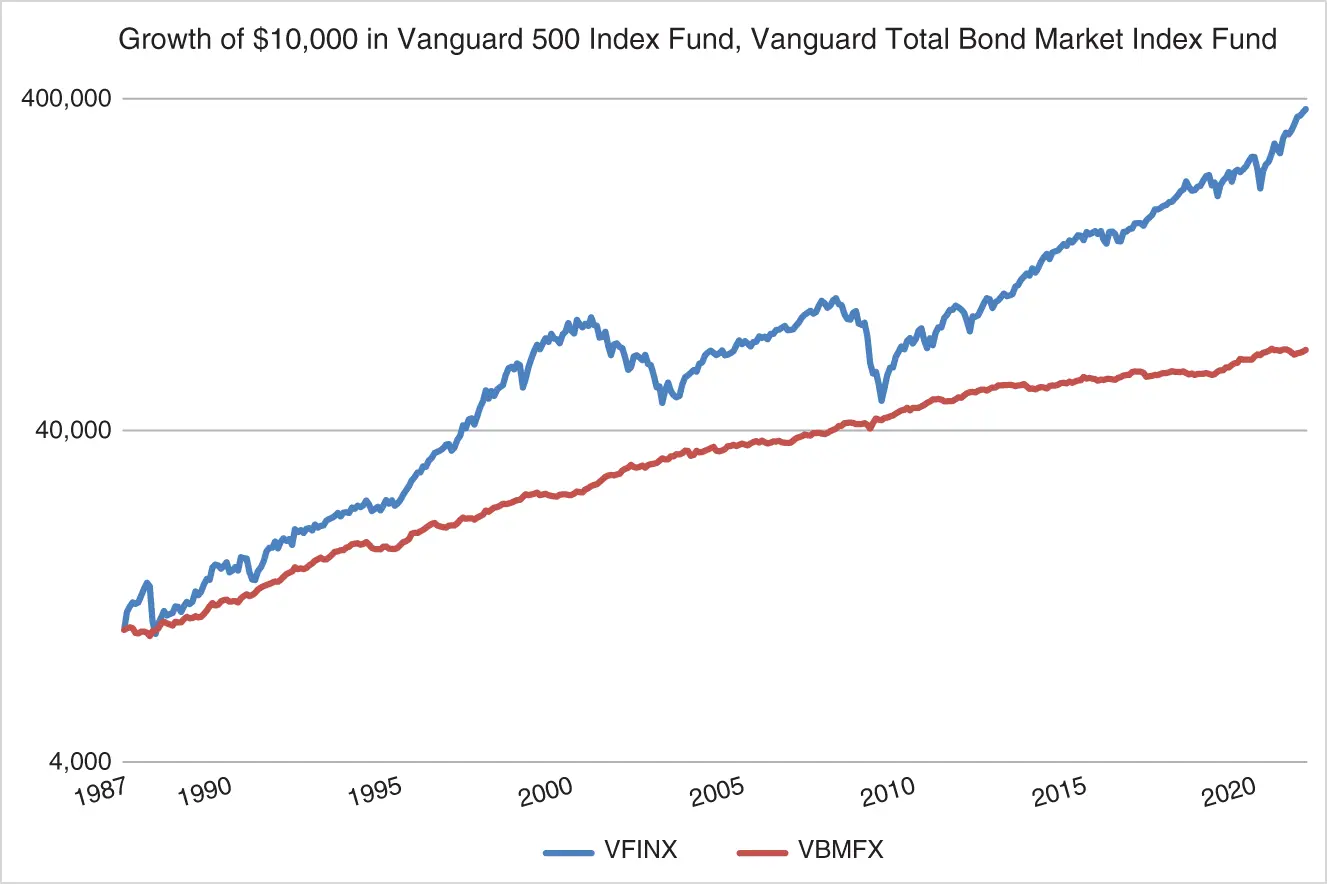

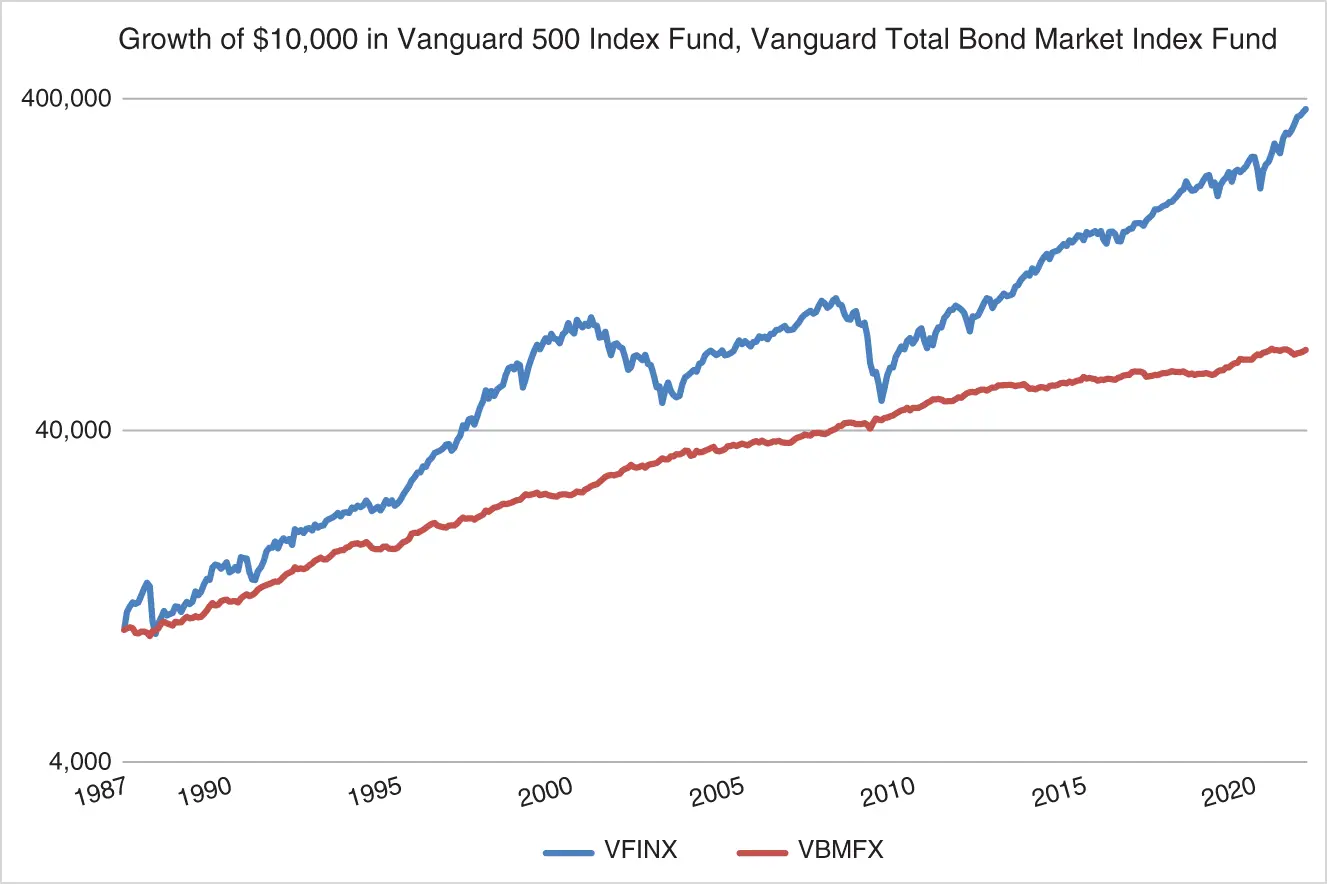

In Figure 1.2, you can see the sleepiness of a broad US government bond index. The roller‐coaster line on top is the S&P 500 (VFINX). You should be able to see the stock market crash of 1987, the crash of 2002–2003, the crash of 2008–2009 and the mid‐2020 dip. The line below it represents Vanguard's US Bond Market Index (VBMFX) with all interest reinvested. Compared to the stock market's movement, government bond index funds don't crash.

Figure 1.2 Bonds Are More Stable Than Stocks

SOURCE: Vanguard.com.

Patience, diversification, and low investment costs are keys to large profits in the stock and bond markets. To earn such returns, however, investors must avoid the industry's traps. Let me show you how.

1 Stocks earn strong, long‐term returns. Historically they have averaged about 10 percent per year. But calendar year returns are wildly inconsistent. Stocks almost never record a calendar year gain between 9 percent and 11 percent.

2 Investors shouldn't focus on short time periods. Even for someone who's 60 years old, returns over a 30‐year duration are far more relevant.

3 Nobody can consistently predict how stocks will perform, so it's best not to try.

4 Fast‐growing economies don't always produce the best returns, which is why smart investors include exposure to the entire world's markets.

5 Bonds add safety to a portfolio, increasing stability.

1 1. “S&P 500 Index,” Bogleheads. Accessed August 19, 2021. www.bogleheads.org/wiki/S%26P_500_index; Morningstar.com.

2 2. “Why detached home Prices in Greater Vancouver have been rising, while condo prices have remained stagnant,” CBC News, February 3, 2021: https://www.cbc.ca/news/canada/british-columbia/pandemic-real-estate-vancouver-1.5898782, accessed August 10, 2021.

3 3. Moneysense.ca (1976–2010 data), Portfoliovisualizer (2010–2021 data, using iShares ETFs, XSP, XBB, XIC).

4 4. Stingy Investor, Asset Mixer Portfolios: http://www.ndir.com/SI/articles/Asset-Mixer-Portfolios.shtml

5 5. Vanguard.com (using prospectus from Vanguard's Global Stock Market Index). Accessed February 10, 2021. https://personal.vanguard.com/us/funds/snapshot?FundId=0628&FundIntExt=INT

6 6. Joshua Kennon, “Reinvesting Dividends vs. Not Reinvesting Dividends: A 50‐Year Case Study of Coca‐Cola Stock.” Accessed May 1, 2017. www.joshuakennon.com/reinvesting-dividends-versus-not-reinvesting-dividends-coca-cola/.

7 7. Kenneth L. Fisher, Jennifer Chou, and Lara Hoffmans, The Only Three Ques‐ tions That Count: Investing by Knowing What Others Don't (Hoboken, NJ: John Wiley & Sons, 2007).

8 8. Rachel Siegel, Andrew Van Dam and Eric Werner, “2020 was the worst year for economic growth since World War II,” The Washington Post, January 28, 2021, accessed August 10, 2021, https://www.washingtonpost.com/business/2021/01/28/gdp-2020-economy-recession/

9 9. “The Voting and Weighing Machines,” Morningstar News. Accessed May 1, 2017. http://news.morningstar.com/classroom2/course.asp?docId=142901&page=7

10 10. “China Wealth Proves Elusive as Stocks Earn 1% in 20 Years,” Bloomberg.com. Accessed May 1, 2017. www.bloomberg.com/news/2013-07-14/china-wealth-eluding-foreigners-as-equities-earn-1-for-20-years.html

11 11. David F. Swensen, Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment (New York: Free Press, 2000).

12 12. Portfoliovisualizer.com

Chapter 2 Don't Start a Fight with an Escalator

Admit it. When you were a kid, you were tempted at least once to run up an escalator that was heading down. Sure, it was tougher than taking the stairs, but mastering the mechanical monster was part of the fun.

Unfortunately, most global expatriates trudge against an escalator full‐time with their investments.

I could use any of the world's stock markets to explain this. But in honor of roast beef, Yorkshire pudding, and mushy peas, let's give a nod to the British.

During the decade ending September 30, 2021, the typical UK stock earned 95.52 percent. 1

This means £10,000 invested in the average British stock grew to £19,552. Did most British investors make such profits? Not even close. Instead, most financed the lavish lifestyles of those working in the financial services industry.

If every stock on the British market were sold, most of the direct recipients would be pension funds, unit trusts (mutual funds), college endowment funds, and hedge funds. The money would then be paid to investors with stakes in such products. Because the vast majority of the money in the markets is professionally managed, when the UK market earns 95.52 percent over a given decade, it means the average professional fund earned roughly 95 percent—before fees.

Читать дальше