Millionaire Expat (3 rd edition) outlines how to plan for your future. How much money should you invest, based on your future needs? How much of your investment portfolio can you afford to sell during each retirement year?

Several expats, however, might say, “I would love to retire, but I can't afford it.” In some cases, they didn't save enough. Others saved well, but they were rooked into long‐term investment schemes that didn't make them decent profits. But such people shouldn't fret. I'll describe some desirable locations where you could retire on a shoestring. You could live (full‐time or part‐time) in a low‐cost country, spending a fraction of what it would cost to live in the United States, Canada, Australia, New Zealand or much of Europe. I also provide tips for younger, global nomads who are keen to travel the world while working online.

As an expatriate, you can build lifetime memories by experiencing more of what the world has to offer. You can live better, earn more, and provide for a generous retirement. You'll just need a plan. Fortunately, you're reading it.

Chapter 1 Grow Big Profits Without Any Effort

Once upon a time, in a land far away, there lived a young farmer. His name was Luke Skywalker. Don't get confused by his Star Wars namesake. That was just a movie.

Luke had a farming mentor, an awkward little guy with a massive green thumb. His name was Yoda. “Use the Force you must, young Skywalker,” he said. “Add new seeds to your crop fields every year. The Force will grow those seeds. They will flower and spread more seeds and those seeds will grow.”

“Which seeds should I plant?” asked Luke. “Buy the bags that contain every type of seed for every type of vegetable,” replied Yoda. “You'll never know which vegetables will grow the best in any given year,” he said. “Plant them all, you should. Let the Force look after the rest. But watch out for the dark side.”

Luke wasn't sure what Yoda meant by the dark side . He just knew that Yoda was a mysterious little dude. So Luke bought a bag that contained every seed. He planted every one, and his crops began to flourish. Some years, his carrots grew best. Other years, his lettuce, parsnips, or beets took center stage. Sometimes, droughts and a searing sun hurt his crops. But his crops always came back, stronger than ever.

This is how the stock market works. You can buy a single fund called a global stock market index fund. Like a bag of seeds representing multiple plants, it contains thousands of different stocks, representing dozens of different markets. It contains American stocks, British stocks, Canadian stocks, Australian stocks, and Chinese stocks. In fact, a global stock market index contains about 7,400 stocks from at least 49 different countries. Nobody trades those stocks. With a global stock market index, you own all of those stocks. You would also have access to that money, any time you want.

Some years (much like the garden during a drought), the proceeds recede. But just like that garden, the stock market always comes back stronger than before.

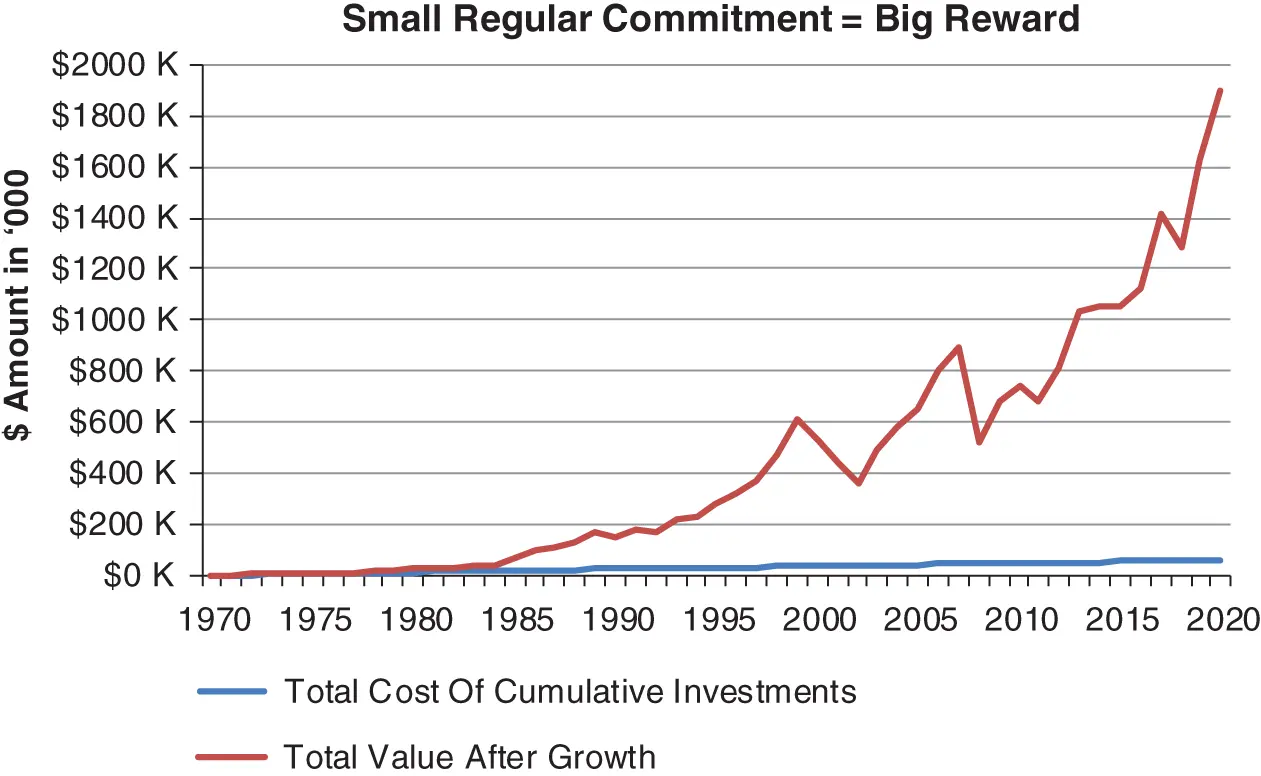

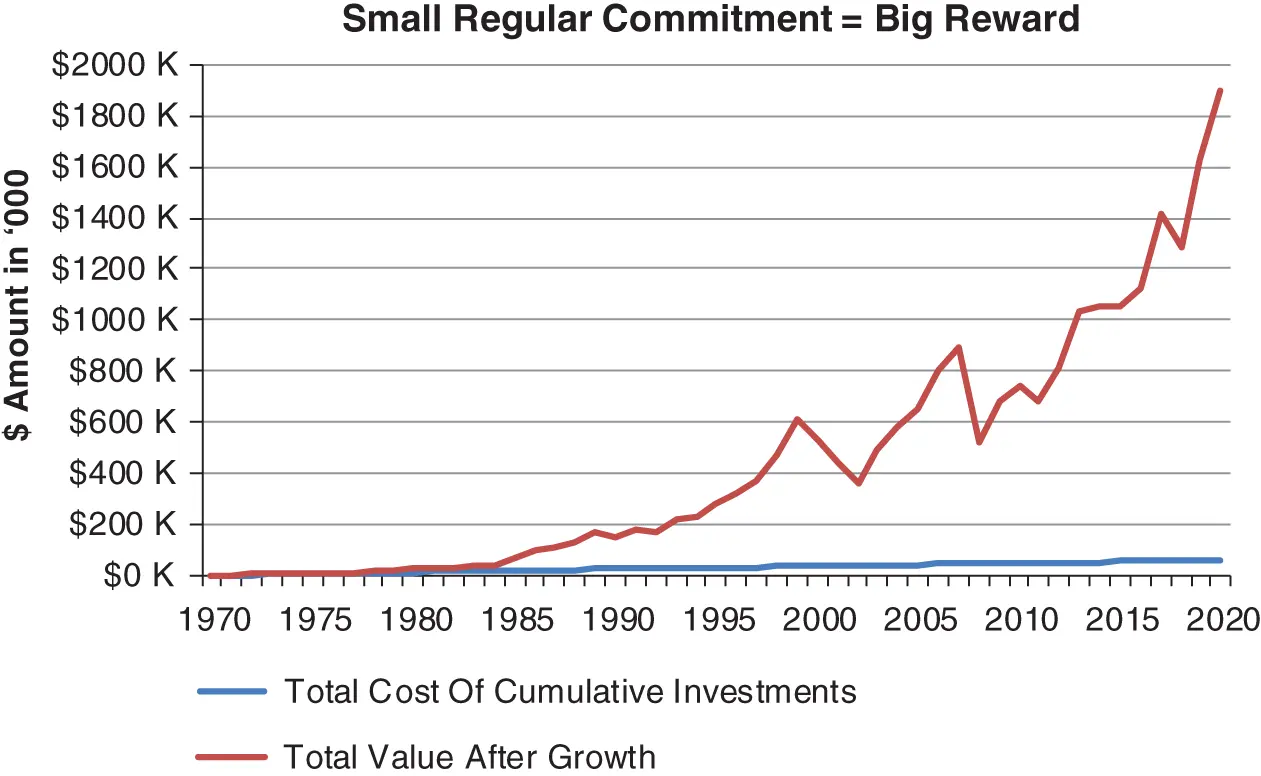

Imagine if someone had invested a lump sum of $1,200 in the global stock market, starting in 1970. They then saved an additional $3.29 per day, adding that amount to their investment at the beginning of each year. Between January 1970 and December 31, 2020, that person would have added a total of $61,200 (see Figure 1.1and Table 1.1). If they equaled the return of the global stock market index during those 51 years, that initial $1,200 investment—plus a further commitment equal to $3.29 per day—would have grown to more than $1.8 million. Between January 1970 and January 2021, global stocks averaged a compound annual return of 10.07 percent per year.

Figure 1.1 Global Stock Market Growth

SOURCE: Morningstar Direct.

Table 1.1 Global Stock Market Growth

| Year Ended Dec 31 |

Annual Return |

Total Cost of Cumulative Investments |

Total Value after Growth |

| 1970 |

−2.25% |

$1,200 |

$1,173 |

| 1971 |

18.52% |

$2,400 |

$2,812 |

| 1972 |

28.21% |

$3,600 |

$5,144 |

| 1973 |

−8.96% |

$4,800 |

$5,776 |

| 1974 |

−21.09% |

$6,000 |

$5,505 |

| 1975 |

32.44% |

$7,200 |

$8,880 |

| 1976 |

8.97% |

$8,400 |

$10,984 |

| 1977 |

3.32% |

$9,600 |

$12,588 |

| 1978 |

24.22% |

$10,800 |

$17,128 |

| 1979 |

12.33% |

$12,000 |

$20,588 |

| 1980 |

21.85% |

$13,200 |

$26,548 |

| 1981 |

−3.19% |

$14,400 |

$26,863 |

| 1982 |

6.61% |

$15,600 |

$29,918 |

| 1983 |

25.37% |

$16,800 |

$39,013 |

| 1984 |

6.47% |

$18,000 |

$42,815 |

| 1985 |

51.83% |

$19,200 |

$66,827 |

| 1986 |

45.35% |

$20,400 |

$98,878 |

| 1987 |

10.06% |

$21,600 |

$110,146 |

| 1988 |

20.56% |

$22,800 |

$134,238 |

| 1989 |

24.15% |

$24,000 |

$168,147 |

| 1990 |

−12.00% |

$25,200 |

$149,025 |

| 1991 |

18.42% |

$26,400 |

$177,897 |

| 1992 |

−4.10% |

$27,600 |

$171,754 |

| 1993 |

25.25% |

$28,800 |

$216,624 |

| 1994 |

6.19% |

$30,000 |

$231,308 |

| 1995 |

20.73% |

$31,200 |

$280,707 |

| 1996 |

13.73% |

$32,400 |

$320,612 |

| 1997 |

15.33% |

$33,600 |

$371,146 |

| 1998 |

27.58% |

$34,800 |

$475,039 |

| 1999 |

29.04% |

$36,000 |

$614,539 |

| 2000 |

−13.80% |

$37,200 |

$530,767 |

| 2001 |

−17.86% |

$38,400 |

$436,958 |

| 2002 |

−18.75% |

$39,600 |

$356,003 |

| 2003 |

38.08% |

$40,800 |

$493,226 |

| 2004 |

18.27% |

$42,000 |

$584,758 |

| 2005 |

11.52% |

$43,200 |

$653,460 |

| 2006 |

23.11% |

$44,400 |

$805,953 |

| 2007 |

11.16% |

$45,600 |

$897,231 |

| 2008 |

−41.72% |

$46,800 |

$523,605 |

| 2009 |

30.40% |

$48,000 |

$684,346 |

| 2010 |

8.62% |

$49,200 |

$744,640 |

| 2011 |

−7.99% |

$50,400 |

$686,248 |

| 2012 |

18.34% |

$51,600 |

$813,526 |

| 2013 |

26.59% |

$52,800 |

$1,031,361 |

| 2014 |

2.02% |

$54,000 |

$1,053,419 |

| 2015 |

−0.44% |

$55,200 |

$1,049,979 |

| 2016 |

6.53% |

$56,400 |

$1,119,821 |

| 2017 |

−2.25% |

$57,600 |

$1,394,068 |

| 2018 |

18.52% |

$58,800 |

$1,258,000 |

| 2019 |

28.21% |

$60,000 |

$1,595,348 |

| 2020 |

16.61% |

$61,200 |

$1,895,913 |

SOURCE: Morningstar Direct.

Читать дальше