As city states, locations like Berlin, Hamburg and Bremen largely benefit from their metropolitan areas, accumulating startup activities within their vicinity. With highly attractive industry sectors such as media and IT as well as related creative industries, Hamburg has a disproportionately high rate of freelancers among new entrepreneurs (2014: 46%) compared to other locations in Germany (Metzger 2015).

Apart from freelance entrepreneurs, Hamburg also has a considerable history of high-growth ventures. Many Hamburg based startups have become well established, international corporations such as Innogames, Bigpoint, Coremedia, Facelift, Goodgame Studios, Jimdo, mytaxi, Parship, Statista or XING. Recently funded startups of note include Dreamlines, Kreditech, Protonet and Sonormed. Many international internet corporations subsequently chose Hamburg for their German headquarters over the years, such as AOL, Google, Facebook, Twitter, Hootsuite and Yelp (nextMedia.Hamburg 2016c). Just recently, hyped U.S. based startups such as Airbnb and Dropbox chose Hamburg for new office locations as well (Tracey 2016).

In accordance with the strong growth of the local startup economy over the past years, the City of Hamburg wants to position the metropolitan area as a leading region for innovation in Europe until 2020.

Among other actions, the city plans to invest more than EUR 100 million into a “Smart-City” and the local startup economy (Tangermann 2016), although concrete implementation strategies for this plan remain to be announced as of November 2016.

Evidently, Hamburg has been a vibrant location for innovative startup activities over the past decades. Not only was Hamburg at the epicentre of the dot-com era in Germany, it provides an attractive entrepreneurial ecosystem to aspiring founders that has strong ties with the media industry.

3.1 Media Industry in Hamburg

According to the nextMedia.Hamburg initiative, Hamburg has more than 23.000 companies within the media/IT industry and therefore is one of the leading content locations in Europe. The vast majority of Germany’s top 25 printed publications is produced in Hamburg.

With 150 companies, the region is also positioning itself as a Gamecity, serving games to more than 760 million users worldwide. Additionally, around 34% of 96.000 companies within the service sector are offering information and communication services, such as advertising or marketing (nextMedia.Hamburg 2016b) and can be considered part of the media industry as well.

Hamburg’s creative workforce generates more than EUR 10 billion in revenues every year with an added value of EUR 2.8 billion. The diverse portfolio of companies at all levels of the media and digital economy’s value chain is considered to be of utmost importance for the economically relevant combination of content & technology and Hamburg’s success as a “media city” (nextMedia.Hamburg 2016c).

According to Hamburg Chamber of Commerce (2015b), the City of Hamburg is seizing emerging business opportunities during the digital transformation and media convergence. It states effective networks between politics and industry as important facilitators in this regard, listing nextMedia.Hamburg, an initiative for the media/IT industries in Hamburg created by the Senate of the Free and Hanseatic City of Hamburg, the Hamburg@Work e.V. association and the Hamburgische Gesellschaft für Wirtschaftsförderung (Hamburg Business Development Corporation), among many other initiatives, associations and public-private partnerships.

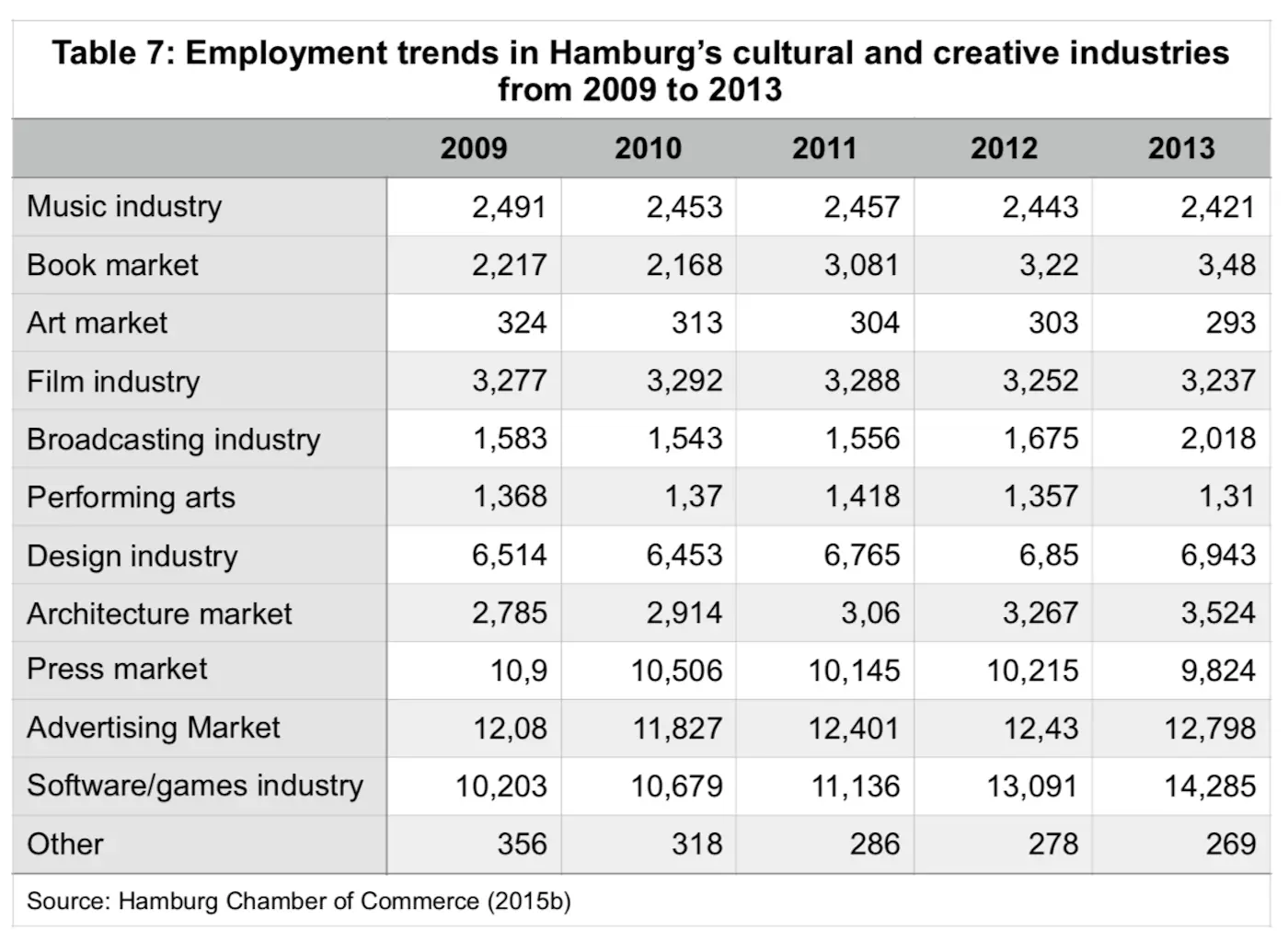

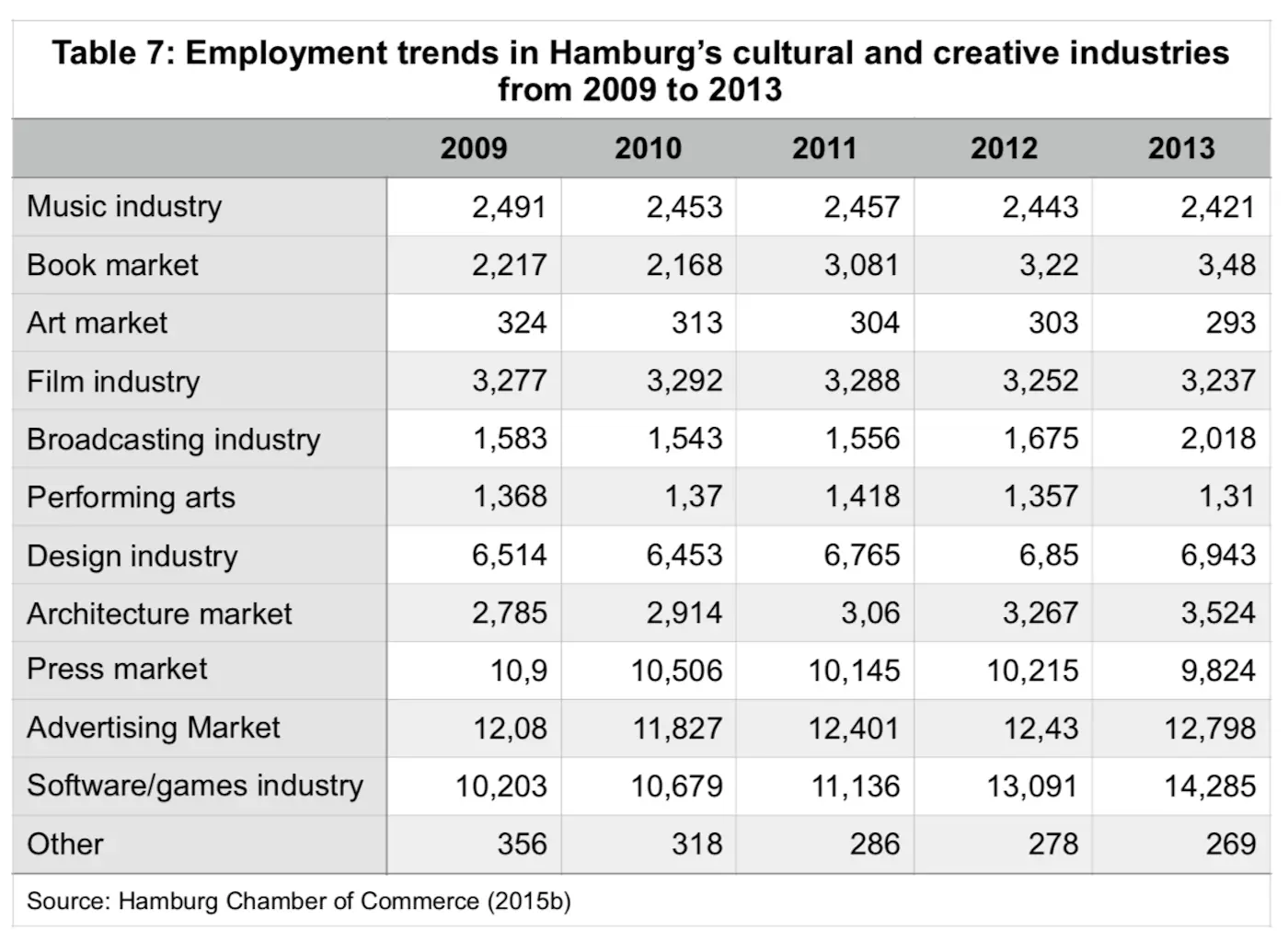

The top 5 cultural and creative industries in terms of employment are software/games, advertising, press, design and architecture in 2013 (Hamburg Chamber of Commerce 2015b). The most significant job growth occurred in the software/games industry which gained 4,082 jobs since 2009. Hamburg’s traditional advertising industry only grew slightly during this period and the press industry declined moderately with 1,076 jobs lost (see table 7).

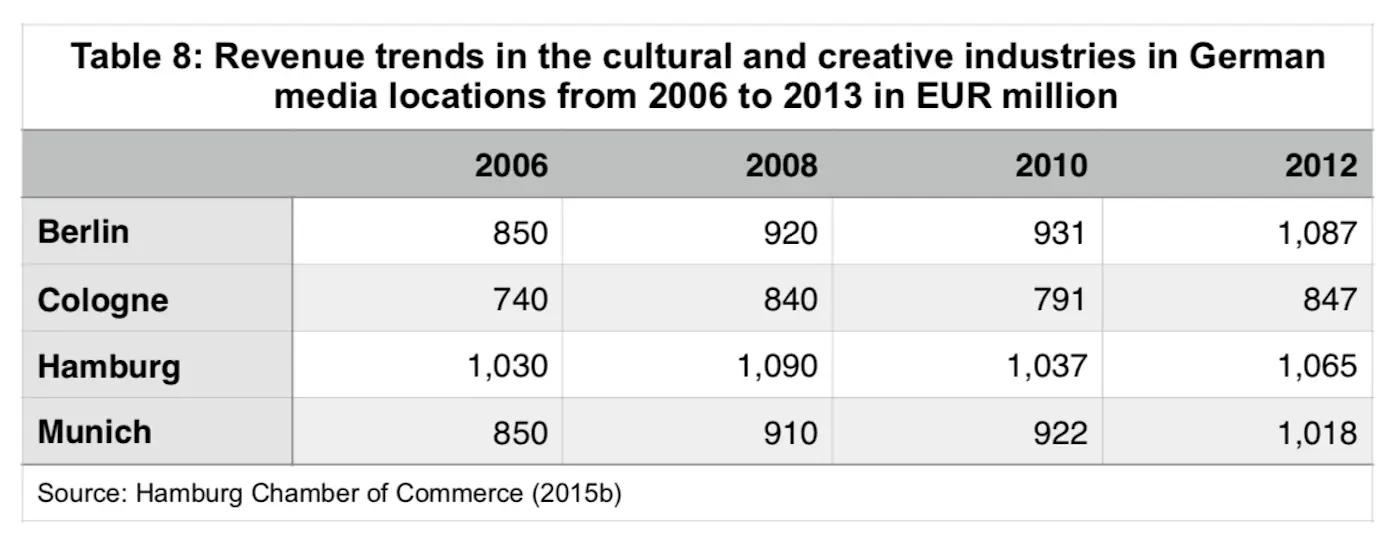

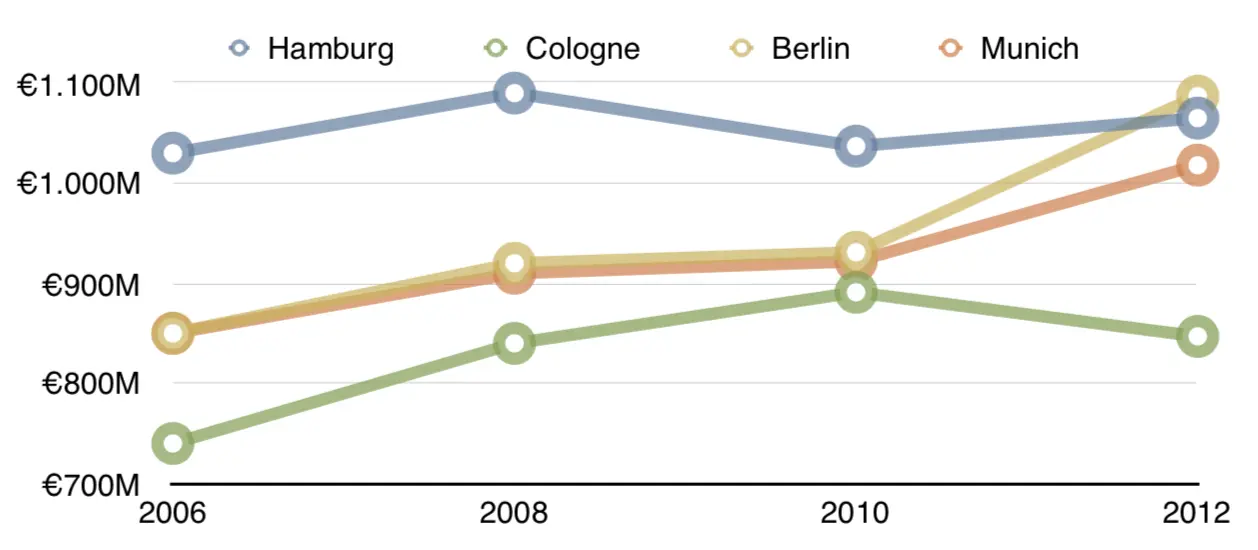

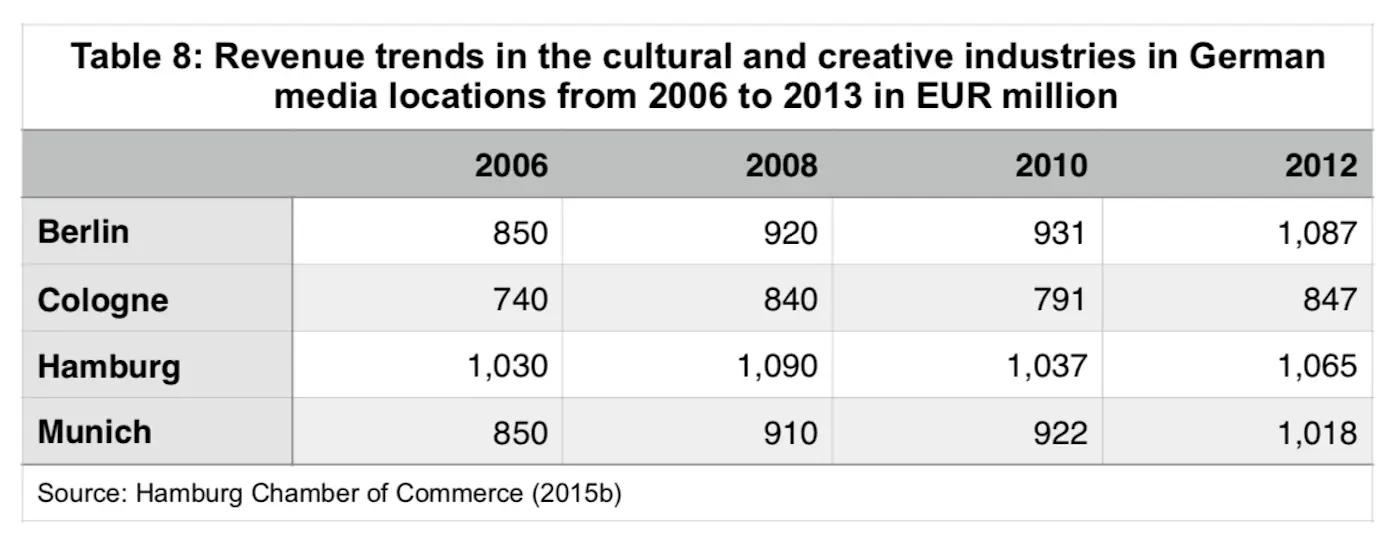

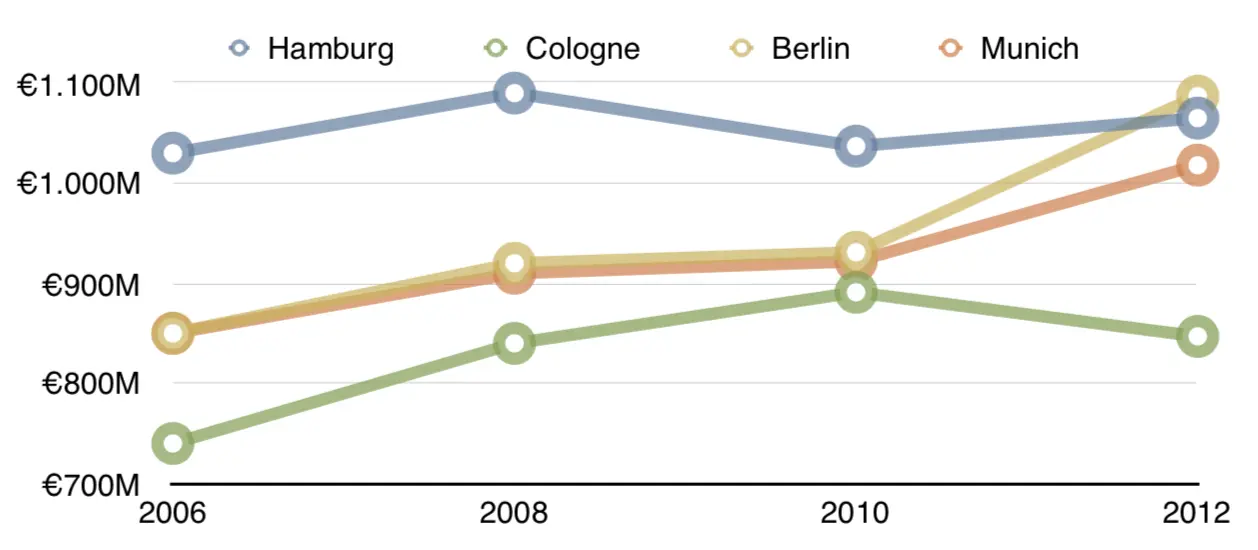

According to Hamburg Chamber of Commerce (2105b) data, Hamburg is ranking fourth among Berlin, Cologne and Munich as “media cities” in terms of employees working in creative industries. In terms of revenue however, Hamburg only lost its leading position to Berlin in 2012, underlining Hamburg’s valid strategic alignment as a “media city” (see table 8 and fig. 8).

Figure 8: Revenue trends in the cultural and creative industries in German media locations from 2006 to 2013 in EUR million

The strength of Hamburg creative industries is also reflected in training opportunities and perspectives in higher education at local universities. Both public and private universities offer various fields of study that are related to the media industry. According to Hamburg Chamber of Commerce (2015b) the number of people training for creative careers at local universities is equal or even larger than in Berlin, the arguably largest city in Germany.

For a more detailed look into Hamburg’s media industry, the largest 3 sectors - software/games, advertising and press - provide ample insights that separates Hamburg from other locations in Germany.

Based on Hamburg Chamber of Commerce (2015b) data, Hamburg has grown significantly in the software/games sector over the past years. However, in terms of employment the region still remains far behind other “media cities” in Germany with around 14,000 employees in 2013 compared to Munich (28,455), Berlin (25,180) and Cologne (22,181). Despite the strong growth in employees of 40% since 2009, Hamburg remains outpaced by Berlin’s growth of 80% in the same period.

Although Munich is dominant in the traditional software industry, Berlin and Hamburg are the centres for the games industry in Germany. Hamburg has gained the reputation as Germany’s leading city for game development over the past years, which can largely be attributed to the “Gamecity:Hamburg” initiative founded in 2003, a public-private partnership facilitating the development of this industry sector in Hamburg (Hamburg Chamber of Commerce 2015b).

Based on number of employees, 4 of the top 10 game development companies in Germany are based in Hamburg (Games Wirtschaft 2016a). Evidently, Hamburg based browser game startups excelled over the past years, clearly outpacing other industry competitors. Goodgame Studios, Bigpoint and Innogames alone employ more personal (2,050) than the rest of the top 10 combined, of which Gamigo also has offices in Hamburg (see table 9). In addition some of the top 20 ranking game companies have offices in Hamburg as well (e.g. Kalypso Media).

Despite latest turmoils in the German game industry - during which Goodgame Studios radically reduced its staff by 500 people to 700 employees in Summer 2016 (Games Wirtschaft 2016c) - the sector itself remains strong with many open positions at Bigpoint and other companies in Hamburg and Berlin (Games Wirtschaft 2016b).

Interestingly, it is difficult to gather detailed software/game industry revenue data for the City of Hamburg. Other than in the advertising or press sector, performance data is not shared as transparently.

Читать дальше