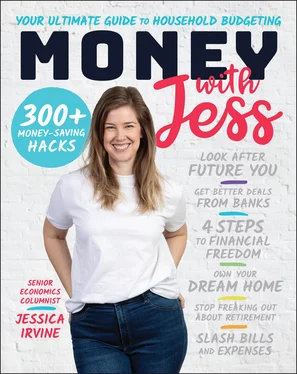

I didn't buy any clothes for an entire year. I cut my own hair. I gave up getting blonde foils (you can just see the remnant of my former colour on the tips of my hair in the cover photo for this book).

I began meticulously tracking my spending and in one article published the details of every single dollar I spent in one financial year (I know you'll want to know: it was $88 379.84 in 2020–21).

Bigger picture: I embarked on an epic hunt for the best mortgage deal, locking in my interest rate in for two years at 1.84 per cent and scoring a $4000 ‘cash back’ for my efforts.

I began making regular voluntary contributions to my retirement savings account.

And finally, in May 2021, I did something I had never previously dreamed of. I began investing directly in the share market for the first time — something I continue to do on a regular monthly basis and will tell you about in chapter 10.

How I found financial freedom

Underpinning all my progress, I believe, is a budgeting system I created to sort, organise and track my money: the system this book is ultimately designed to teach you to use yourself.

I've divided this book into three parts that roughly correlate to the personal journey I've been on with my money.

Part Iis all about getting you in the right ‘money mindset’ to succeed. I share some of the details of my own therapy journey, where I learned about the critical role of emotions and thoughts in ultimately driving your behaviours and outcomes. Getting into a healthy ‘money mindset’ requires ridding yourself of some unhelpful beliefs you've probably picked up about money, namely that it's too boring or too complex. To assist, I've outlined seven ‘money myths’ you'll need to ditch.

In part II, we put together an annual budget to show you where your money is going. Whether it's planning for retirement, applying for a loan or deciding what size emergency fund you need, having an idea of your individual spending is critical.

When I first attempted to do this for myself, I quickly realised how useful it would be to have a comprehensive checklist to work through of all the things people can spend money on.

Being the self‐confessed ‘numbers nerd’ that I am, I began trawling through statistical surveys of household expenditure from Australia and other advanced nations — a search that would lead me all the way to the United Nations — to find the ultimate budget categories system.

None suited my purposes, however. So I decided to create my own. In chapter 6, I run you through what I believe to be a complete checklist of all the purchases you will ever make in life, sorted neatly into my unique 10 budget categories.

Dog treats, garden hoses, charity donations — I know where they all go! I truly believe I have identified every possible expense you need to consider when putting together a household budget. I found the process so satisfying and I hope you do too.

Of course, once you begin to become aware of where all your money is going, you'll want to begin trimming and saving where you can. So I've sprinkled part IIof this book with over 300 money‐saving hacks to help you (you'll find them in green boxes throughout). You're so welcome!

Finally, part IIIof this book is all about the system I personally use to regularly budget and track my money. It contains information about how to access and use all my free, downloadable resources, including my Annual Budget worksheet, Spending Tracker, Monthly Budget worksheet and Future Fund worksheet. I am regularly asked to explain how they all work, so this has been my chance to explain in full!

My deepest desire is that the information you're about to read will help alleviate some of the suffering so many people feel when they think about money. Undeniably, many people suffer real, actual financial deprivation, unable to make ends meet on meagre incomes, with severe repercussions for their mental and even physical health and wellbeing.

But I'm also talking about a different kind of suffering — one that is perhaps even more widespread.

It's the suffering people endure when they simply don't feel in control of the money they do have; when they lack the confidence to make empowered decisions about money on a daily basis, let alone save for their future selves.

Studies have shown that, beyond a certain point, a person's level of income is a much less important driver of their wellbeing than the sense that they have of being in control of their financial situation.

For two decades, the authors of the Australian Unity Wellbeing Index survey have asked Australians to rate, on a scale of 1 to 10, how satisfied they are with their life. Their clear conclusion is that it's not money, per se, but ‘financial control’ that matters most. ‘People with lower income can actually achieve higher wellbeing than those on higher incomes, so long as they have a higher perceived control over their financial position’, the study authors conclude.

Indeed, financial control forms one part of a ‘golden triangle of happiness’ that predominantly determines our wellbeing, alongside ‘personal relationships’ and a ‘sense of purpose’.

As I sit down to write this introduction, I feel quite emotional at how far I've come. And because I'm a big fan of giving precise labels to emotions — as you'll soon discover — specifically, I feel proud, hopeful and optimistic for both myself and for you, as you embark on your own budgeting journey.

From a place of fear and despair, I have arrived at a sense of calm and joy when it comes to managing my money.

On a daily basis, I spend my money with confidence, and in ways that align with my own personal values and desires. When I say ‘yes’ to spending, it's a ‘hell yes’. I cherish the things I buy because I have done the inner work to know what really does — or does not — bring me pleasure. And I don't waste money on the latter.

It is my deepest desire to share with you the same sense of peace and calm I now feel when I look at my finances. I want you to know it's possible to have a happier and more stress‐free relationship with your money.

One last thing before we begin.

I'd like to take a moment to acknowledge what I feel is an elephant in the room.

You've seen the cover of this book. I don't look like your typical personal finance expert. I'm not particularly old. And I'm not a man (although, if you want to see a fun picture of what that would look like, you can quickly flick to page 35). I think it's useful to share that writing this book has been one of the greatest challenges of my life. In addition to the usual struggles of writing a book, I've faced an uphill battle against ‘imposter syndrome’: an uncomfortable feeling of ‘Who am I to be telling people what to do with their money?’

Despite almost two decades of writing about economics and finance, I have still, at times, struggled internally to picture myself as a person who can and should sit down and write an authoritative book about money — one that both men and women can benefit from reading. It's hard to be what you don't often see.

Because, unlike my colleague's original suggestion, this is not a book aimed specifically at women. Yes, I am a woman. And yes, ladies, that retirement savings gap is very real. And yes, as it turns out, a man is not a financial plan.

But I hate the way personal finance books and advice are universally clad in ‘pink’ to target women and ‘blue’ for men (something my publisher can affirm, after all the grief I gave over wanting a ‘gender‐neutral’ cover and design for this book: ‘Too girly; try again!’ was my repeated refrain).

If you've got a head and a heart, and some money to manage, you will benefit from reading this book. It's taken me considerable internal effort to arrive at a place where I can say that with confidence. But it's true. So, I'll say it again:

Читать дальше