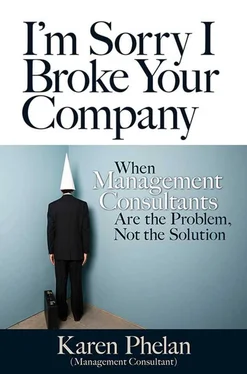

Karen Phelan - I'm Sorry I broke Your Company

Здесь есть возможность читать онлайн «Karen Phelan - I'm Sorry I broke Your Company» весь текст электронной книги совершенно бесплатно (целиком полную версию без сокращений). В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Город: San Francisco, Год выпуска: 2013, ISBN: 2013, Издательство: Berrett-Koehler Publishers, Жанр: management, popular_business, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:I'm Sorry I broke Your Company

- Автор:

- Издательство:Berrett-Koehler Publishers

- Жанр:

- Год:2013

- Город:San Francisco

- ISBN:978-1-60994-740-8; 978-1-60994-741-5

- Рейтинг книги:3 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 60

- 1

- 2

- 3

- 4

- 5

I'm Sorry I broke Your Company: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «I'm Sorry I broke Your Company»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

I'm Sorry I broke Your Company — читать онлайн бесплатно полную книгу (весь текст) целиком

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «I'm Sorry I broke Your Company», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

For example, one stock market predictor is the Super Bowl Index (SBI). The SBI states that the stock market will rise in years in which the NFC (National Football Conference) team wins the Super Bowl, and it has an 80 percent correlation. Statistically, that's a very high correlation, so make sure you buy stocks whenever the NFC wins! However, when you examine the SBI more closely, you realize that there is no relationship between the variables at all. The NFC teams win the Super Bowl more often than the AFC (American Football Conference), and the stock market has more bull years (it goes up over time) than bear years. Any randomly chosen year should see a bull market and an NFC win. The two highly correlated variables have no actual relationship to each other.

Not too long ago, I had a phone conversation with a representative from a large talent management consultancy on It's menu of leadership assessments. The woman assured me that using her firms leadership assessments was highly correlated with business success. When I asked her to explain this, she said that statistical analyses showed that clients who used these assessments performed above the industry average in revenue growth.

Therefore, using these assessments would make a company successful, at least in terms of revenue growth. However, a much more plausible explanation is that successful companies, those with money, are more likely to buy leadership assessments than those without money. Another more plausible hypothesis is that companies that invest in employee development are likely to outperform those that don’t. Making the conclusion that company success was due to the use of leadership assessments is more a leap of faith than an evidence-based result. The only conclusion you can reach from two highly correlated variables is that you need to do more research.

Resource C: Bibliography

Akpose, Wole. «A History of Six Sigma.» IEEE-US Todays Engineer. December 2010. http://www.todaysengineer.org/2010/Dec/six— sigma.asp.

Alicke, Mark, and Oleysa Govorun. «The Better-Than-Average Effect.» In The Self in Social Judgment , edited by Mark Alicke, David Dunning, and Joachim Krueger, 94-116. New York: Psychology Press, 2005.

Alter, Adam. «Why It’s Dangerous to Label People.» Psychology Today. May 17,2010. http://www.psychologytoday.com/blog/alternative-truths/201005/why-its-dangerous-label-people.

Amabile, Teresa and Steven Kramer. The Progress Principle: Using Small Wins to Ignite Joy yEngagement, and Creativity at Work. Boston: Harvard Business Review Press, 2011.

Bassi, Laurie J., and Daniel P. McMurrer. «Investing in Companies That Invest in People.» Bassi Investments. January 2002. http://www.bassi-investments.com/downloads/Article_hr.com.pdf.

Bennis, Warren. On Becoming a Leader. Reading, MA: Addison-Wesley, 1989.

Bercovici, Jeff. «Why (Some) Psychopaths Make Great CEOs.» Forbes. June 14,2011. http://www.forbes.com/sites/jeffbercovici/2011/06/14/why-some-psychopaths-make-great-ceos/.

Blanchard, Ken, Patricia Zigarmi, and Drea Zigarmi. Leadership and the One Minute Manager. New York: William Morrow, 1985.

Biography.com. «Albert Einstein Biography.» Accessed April 14,2012. http://www.biography.com/people/albert-einstein-9285408. -. «Ulysses S. Grant Biography.» Accessed April 14, 2012. http:// www.biography.com/people/ulysses-s-grant-9318285.

Bodanis, David. «Einstein the Nobody.» Nova. October 11,2005. http:// www.pbs.org/wgbh/nova/physics/einstein-the-nobody.html/.

Borjas, Thomas. «Welch, Jack, 1935 —International Directory of Business Biographies. 2005. Encyclopedia.com. http://www.encyclopedia.com/topic/Jack_Welch.aspx.

Bryant, Adam. «Google’s Quest to Build a Better Boss.» New York Times. March 13,2011, BUI.

Byrne, John A. «How Jack Welch Runs GE У BusinessWeek. June 6,1998. http://www.businessweek.com/1998/23/b3581001.htm.

«Inside McKinsey.» BusinessWeek. July 8,2002. http://www.businessweek.com/magazine/content/02_27/b3790001.htm.

Businessballs.com. «Six Sigma.» Accessed April 14,2012. http://www.businessballs.com/sixsigma.htm.

Champy, James, and Michael Hammer. Reengineering the Corporation. New York: Harper Collins, 2001.

Christensen, Clayton M. The Innovators Dilemma. New York: Harper Business, 2000.

Christensen, Clayton, Richard Alton, Curtis Rising, and Andrew Waldeck. «The New M&A Playbook.» Harvard Business Review. March 2011. http://hbr.org/2011/03/the-big-idea-the-new-ma— playbook/ar/1.

Coens, Tom, and Mary Jenkins. Abolishing Performance Appraisals.

San Francisco: Berrett-Koehler, 2000.

Cohen, Shoshanah, and Joseph Roussel. Strategic Supply Chain Management. New York: McGraw-Hill, 2005.

Collins, James, and Jerry Porras. «Building Your Company’s Vision.» Harvard Business Review. September 1996. http://hbr.org/1996/09/building-your-companys-vision/аг/1.

Collins, Jim. Good to Great. New York: HarperCollins, 2001.

Cooper, Michael J., Huseyin Gulen, and P. Raghavendra Rau.

«Performance for Pay? The Relationship Between CEO Incentive Compensation and Future Stock Price Performance.» Wall Street Journal. December 2009. http://online.wsj.com/public/resources/documents/CEOperformancel22509.pdf.

Coutu, Diane L. «Putting Leaders on the Couch: A Conversation with Manfred F. R. Kets de Vries.» Harvard Business Review. January 2004,64–71.

Covey, Stephen R. The 7 Habits of Highly Effective People. New York: Fireside, 1989.

Craighead, Jon. «A Brief History of Business Strategy Consulting.» June 2011. http://www.craigheadassociates.com/History_of_Strategy_Consulting.pdf.

Creveling, Clyde, Lynne Hambleton, and Burke McCarthy. Six Sigma for Marketing Processes. Upper Saddle River, NJ: Prentice Hall, 2006.

Culbert, Samuel. Get Rid of the Performance Review. New York: Business Plus, 2010.

Dodd, Dominic, and Ken Favarro. «Managing the Right Tension.» Harvard Business Review. December 2006,15.

Economist. «The House That Jack Built.» September 16,1999. http:// www.economist.com/node/239557.

«The Jack Welch MBA.» June 23,2009. http://www.economist.com/node/13892633.

Ederer, Florian, and Gustavo Manso. «Is Pay-for-Performance Detrimental to Innovation?» Working paper, Haas School of Business, University of California, Berkeley. July 14,2012. http:// faculty.haas.berkeley.edu/manso/em.pdf.

Eldritch Press. «Frederick Winslow Taylor.» Accessed May 27,2012. http://www.eldritchpress.org/fwt/taylor.html.

Elmerraji, Jonas. «Debunking the Super Bowl Indicator.» Penny Sleuth . February 6,2012. http://pennysleuth.com/debunking-the-super— bowl-indicator/.

Emmons, Garry. «The Lords of Strategy .» HBS Alumni Bulletin. March 2010. http://www.alumni.hbs.edu/bulletin/2010/march/strategy.html.

Fisher, Lawrence M. «Sears Auto Centers Halt Commissions After Flap.» New York Times. June 23,1992. http://www.nytimes.com/1992/06/23/business/sears-auto-centers-halt-commissions-after-flap.html.

Gardner, John W. On Leadership. New York: Free Press, 1990.

GE. «Past Leaders: John F. Welch, Jr.» Accessed March 12,2012. http://www.ge.com/company/history/bios/john_welch.html.

Gebelein, Susan, Lisa Stevens, Carol Skube, David Lee, Brian Davis, and Lowell Hellervik. Successful Manager's Handbook. Minneapolis: Personnel Decisions International, 1992.

George, Michael, David Rowlands, Mark Price, and John Maxey. Lean Six Sigma Pocket Toolbook. New York: McGraw-Hill, 2005.

Gladwell, Malcolm. «The Talent Myth.» New Yorker. July 22,2002. http:// www.newyorker.com/archive/2002/07/22/020722fa_factPcurrentPage=all.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «I'm Sorry I broke Your Company»

Представляем Вашему вниманию похожие книги на «I'm Sorry I broke Your Company» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «I'm Sorry I broke Your Company» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.