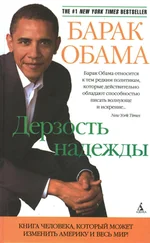

Барак Обама - The Audacity of Hope

Здесь есть возможность читать онлайн «Барак Обама - The Audacity of Hope» весь текст электронной книги совершенно бесплатно (целиком полную версию без сокращений). В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: Политика, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:The Audacity of Hope

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:5 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 100

- 1

- 2

- 3

- 4

- 5

The Audacity of Hope: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «The Audacity of Hope»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

The Audacity of Hope — читать онлайн бесплатно полную книгу (весь текст) целиком

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «The Audacity of Hope», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

To further drive down costs, we would require that insurers and providers who participate in Medicare, Medicaid, or the new health plans have electronic claims, electronic records, and up-to-date patient error reporting systems — all of which would dramatically cut down on administrative costs, and the number of medical errors and adverse events (which in turn would reduce costly medical malpractice lawsuits). This simple step alone could cut overall health-care costs by up to 10 percent, with some experts pointing to even greater savings.

With the money we save through increased preventive care and lower administrative and malpractice costs, we would provide a subsidy to low-income families who wanted to purchase the model plan through their state pool, and immediately mandate coverage for all uninsured children. If necessary, we could also help pay for these subsidies by restructuring the tax break that employers use to provide health care to their employees: They would continue to get a tax break for the plans typically offered to workers, but we could examine a tax break for fancy, gold-plated executive health-care plans that fail to provide any additional health benefits.

The point of this exercise is not to suggest that there’s an easy formula for fixing our health-care system — there isn’t. Many details would have to be addressed before we moved forward on a plan like the one outlined above; in particular, we would have to make sure that the creation of a new state pool does not cause employers to drop the health-care plans that they are already providing their employees. And, there may be other more cost-effective and elegant ways to improve the health-care system.

The point is that if we commit ourselves to making sure everybody has decent health care, there are ways to accomplish it without breaking the federal treasury or resorting to rationing.

If we want Americans to accept the rigors of globalization, then we will need to make that commitment. One night five years ago, Michelle and I were awakened by the sound of our younger daughter, Sasha, crying in her room. Sasha was only three months old at the time, so it wasn’t unusual for her to wake up in the middle of the night. But there was something about the way she was crying, and her refusal to be comforted, that concerned us. Eventually we called our pediatrician, who agreed to meet us at his office at the crack of dawn. After examining her, he told us that she might have meningitis and sent us immediately to the emergency room.

It turned out that Sasha did have meningitis, although a form that responded to intravenous antibiotics. Had she not been diagnosed in time, she could have lost her hearing or possibly even died. As it was, Michelle and I spent three days with our baby in the hospital, watching nurses hold her down while a doctor performed a spinal tap, listening to her scream, praying she didn’t take a turn for the worse.

Sasha is fine now, as healthy and happy as a five-year-old should be. But I still shudder when I think of those three days; how my world narrowed to a single point, and how I was not interested in anything or anybody outside the four walls of that hospital room — not my work, not my schedule, not my future. And I am reminded that unlike Tim Wheeler, the steelworker I met in Galesburg whose son needed a liver transplant, unlike millions of Americans who’ve gone through a similar ordeal, I had a job and insurance at the time.

Americans are willing to compete with the world. We work harder than the people of any other wealthy nation. We are willing to tolerate more economic instability and are willing to take more personal risks to get ahead. But we can only compete if our government makes the investments that give us a fighting chance — and if we know that our families have some net beneath which they cannot fall.

That’s a bargain with the American people worth making.

INVESTMENTS TO MAKE America more competitive, and a new American social compact — if pursued in concert, these broad concepts point the way to a better future for our children and grandchildren. But there’s one last piece to the puzzle, a lingering question that presents itself in every single policy debate in Washington.

How do we pay for it?

At the end of Bill Clinton’s presidency, we had an answer. For the first time in almost thirty years, we enjoyed big budget surpluses and a rapidly declining national debt. In fact, Federal Reserve Chairman Alan Greenspan expressed concern that the debt might get paid down too fast, thereby limiting the Reserve System’s ability to manage monetary policy. Even after the dot-com bubble burst and the economy was forced to absorb the shock of 9/11, we had the chance to make a down payment on sustained economic growth and broader opportunity for all Americans.

But that’s not the path we chose. Instead, we were told by our President that we could fight two wars, increase our military budget by 74 percent, protect the homeland, spend more on education, initiate a new prescription drug plan for seniors, and initiate successive rounds of massive tax cuts, all at the same time. We were told by our congressional leaders that they could make up for lost revenue by cutting out government waste and fraud, even as the number of pork barrel projects increased by an astonishing 64 percent.

The result of this collective denial is the most precarious budget situation that we’ve seen in years. We now have an annual budget deficit of almost $300 billion, not counting more than $180 billion we borrow every year from the Social Security Trust Fund, all of which adds directly to our national debt. That debt now stands at $9 trillion — approximately $30,000 for every man, woman, and child in the country.

It’s not the debt itself that’s most troubling. Some debt might have been justified if we had spent the money investing in those things that would make us more competitive — overhauling our schools, or increasing the reach of our broadband system, or installing E85 pumps in gas stations across the country. We might have used the surplus to shore up Social Security or restructure our health-care system. Instead, the bulk of the debt is a direct result of the President’s tax cuts, 47.4 percent of which went to the top 5 percent of the income bracket, 36.7 percent of which went to the top 1 percent, and 15 percent of which went to the top one-tenth of 1 percent, typically people making $1.6 million a year or more.

In other words, we ran up the national credit card so that the biggest beneficiaries of the global economy could keep an even bigger share of the take.

So far we’ve been able to get away with this mountain of debt because foreign central banks — particularly China’s — want us to keep buying their exports. But this easy credit won’t continue forever. At some point, foreigners will stop lending us money, interest rates will go up, and we will spend most of our nation’s output paying them back.

If we’re serious about avoiding such a future, then we’ll have to start digging ourselves out of this hole. On paper, at least, we know what to do. We can cut and consolidate nonessential programs. We can rein in spending on health-care costs. We can eliminate tax credits that have outlived their usefulness and close loopholes that let corporations get away without paying taxes. And we can restore a law that was in place during the Clinton presidency — called Paygo — that prohibits money from leaving the federal treasury, either in the form of new spending or tax cuts, without some way of compensating for the lost revenue.

If we take all of these steps, emerging from this fiscal situation will still be difficult. We will probably have to postpone some investments that we know are needed to improve our competitive position in the world, and we will have to prioritize the help that we give to struggling American families.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «The Audacity of Hope»

Представляем Вашему вниманию похожие книги на «The Audacity of Hope» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «The Audacity of Hope» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.

![Барак Обама - Дерзость надежды. Мысли об возрождении американской мечты [The Audacity of Hope]](/books/26630/barak-obama-derzost-nadezhdy-mysli-ob-vozrozhdenii-thumb.webp)