$465 million in government loans went to Tesla Motors to build an electric car. Steve Westly, the venture capitalist, sat on the board of Tesla at the time, and his firm owned more than 2.5 million shares in the company. (He also personally owns an undisclosed number of shares.) Tesla founder Elon Musk was a major DNC contributor and in 2011 donated $35,800 to the Obama Victory Fund. (Steve Spinner was an adviser to Tesla before he joined the Obama campaign.) Tesla received its taxpayer loan in 2009 and went public in 2010. The IPO, made possible because of taxpayer money, made the initial investors even richer: the stock price surged 40%. Steve Westly made $1.2 million, and Musk $15 million. Since the IPO, Tesla's stock price has dropped and the company continues to lose money. Tesla's other major investors include Nicholas Pritzker, brother of Penny Pritzker, who was the Obama campaign's finance committee chair, and Sergei Brin and Larry Page, the founders of Google. The company's CEO at the time, Eric Schmidt, served as an informal adviser to President Obama. Dan Reicher, director of climate and energy initiatives at Google, was one of the founders of Cleantech and Green Business Leaders for Obama. When the administration proposed, in February 2011, to stimulate electric car sales by offering consumers a $7,500 rebate, stock in Tesla rose 6% on the news. 34Google's billionaires were also investors in Brightsource, which won the large loan guarantee mentioned earlier. $275 million went to Solar City, to install solar panels on military bases. Solar City is headed by Elon Musk, and Google is a large investor.

The Obama administration also gave $529 million in government-backed loans to Fisker Automotive. Fisker is building a high-end hybrid-electric sports coupe called the Karma, which will cost $89,000. Fisker's top investors include John Doerr and former Vice President Al Gore. Fisker continues to lose money and is heavily in debt.

Tesla and Fisker were in rare company. Only 5 of 130 applicants for the Advanced Technology Vehicles Manufacturing Program received funding. (Other recipients in the program were big automakers like Ford and Nissan.) Many of the rejected applicants complained of unfair treatment. In a letter to Secretary of Energy Steve Chu, electric car maker XP Vehicles complained that the company was never contacted by the Department of Energy. "DOE reviewers never even talked to the founder, inventor, engineers, project leads or primary contractors to obtain additional information. Why was staff at DOE during the course of the year positive about the outcome and never asked for additional information?" Other companies that were not politically connected and were shut out—Amp Electric Vehicles was one—expressed similar frustration. 35

Overall, John Doerr was one of the biggest winners in the taxpayer sweepstakes. A billionaire Silicon Valley venture capitalist, Doerr has donated almost $2 million to Democrats over the past twenty years. 36His firm, Kleiner Perkins Caufield & Byers (where Al Gore is now a partner), gave more than $1 million to Democrats since 2005. Doerr was an early Obama supporter who opened doors in Silicon Valley and was named as an outside economic adviser and a member of the President's Economic Recovery Advisory Board. As a member of that board he called for increasing fines for carbon pollution and pushing for rules to encourage electric utilities to move to a smart-grid system. As Doerr put it, "God bless the Obama Administration and the U.S. government. We have really got the A-team now working on green innovation in our country." That A-team was busy, of course, rewarding some of Doerr's own investments.

Of the companies listed on Doerr's website as part of his Greentech venture-capital portfolio, well over 50% of them received taxpayer grants or loan guarantees through Obama's stimulus program. Of the 27 listed, at least 16 received direct taxpayer support in the form of loans, grants, or stimulus work: Altarock, Amonix, Amyris, Aquion Energy, Ausra (which was acquired by Areva), MiaSole, OSIsoft, Primus Power, Transphorm, Recyclebank, Silver Spring, Great Point Energy, Hara, Harvest Power, Lilliputian Systems, and Mascoma. Considering that the acceptance rate in most of the Department of Energy programs was often 10% or less, this is a stunning record. That $2 million Doerr had invested in politics may have provided the best return on investment he had ever seen. Among the results:

Solar panel maker MiaSole received $102 million in special clean-tech manufacturing credits.

$24 million went to another Doerr company, Amyris Biotechnologies. The DOE grant was to build a pilot plant to use altered yeast to turn sugar into hydrocarbons. (Steve Westly was also a major shareholder.) Just weeks before the grant was announced, on December 4, 2009, Senator Dianne Feinstein and her husband bought $1 million of equity in the company (November 18). It was their only transaction of the entire year.

With federal money in hand, Amyris went public with an IPO the following year, raising $85 million. John Doerr's firm, Kleiner Perkins, did very well, more than tripling its investment. A $16 million investment was now worth $69 million. It's not clear how Steve Westly or Senator Feinstein did, but it's safe to assume that they did well too. Meanwhile, Amyris continues to lose money, and the grant created forty jobs. 37

Curiously, in 2011 Senators Tom Coburn and Ben Cardin introduced legislation to immediately repeal the ethanol tax credit. This would threaten biofuel makers such as Amyris. So Senator Feinstein introduced her own bill that would repeal the ethanol tax credit for corn-based ethanol only. That would leave the credit in place for Amyris and actually benefit the company by making competing forms of ethanol more expensive. 38

One of the biggest winners for Doerr was Silver Spring Networks, which provides "smart-grid projects." In 2008, Doerr and his partners invested $75 million in the company. Silver Spring doesn't receive grants from the federal government directly; it's a contractor for utilities and other companies that obtained grants to develop a smart grid. Close to 60% of Silver Spring's customers were winners of government grants, totaling more than $560 million. 39

Silver Spring Networks won a lot of smart-grid projects because of how the stimulus bill was written. It was Al Gore, a partner with John Doerr at Kleiner Perkins, who inspired President-elect Obama not only to invest in clean energy but to put "billions more in the stimulus for construction of the so-called smart grid." Whether Gore revealed to Obama that he had his own money invested in Silver Spring Networks is not known. 40

Gore was closely wedded to the Obama administration's alternative energy initiative, both directly and indirectly. President Obama asked Gore to serve as his "climate change czar," but the former vice president declined. In his place, Carol Browner, a Gore protégée, got the nod. Rahm Emanuel wondered openly whether Browner would work for Gore or Obama. "When Gore comes and chains himself to the White House gate, it will be Carol's problem," he told colleagues. 41

The question of Silver Spring's success in the smart-grid business is particularly interesting. The stimulus bill was vague on the protocols and technical standards required. The bill simply read:

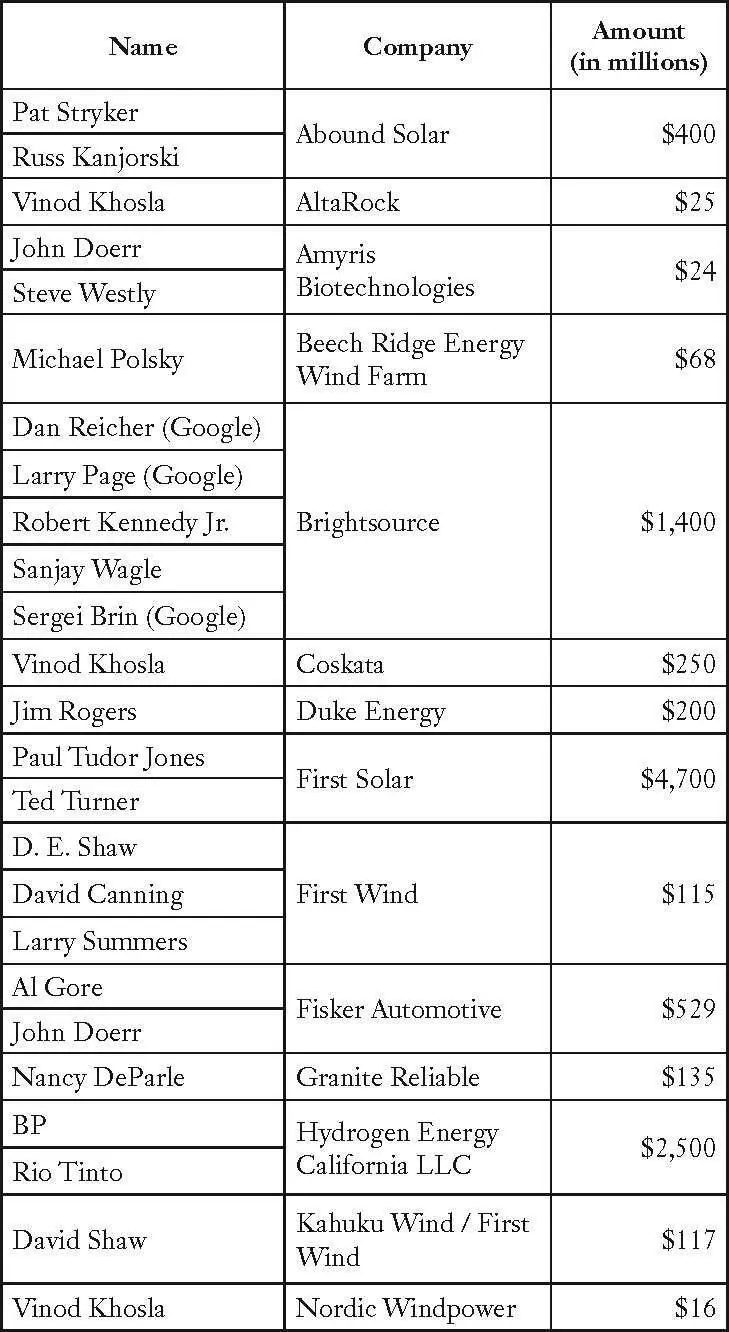

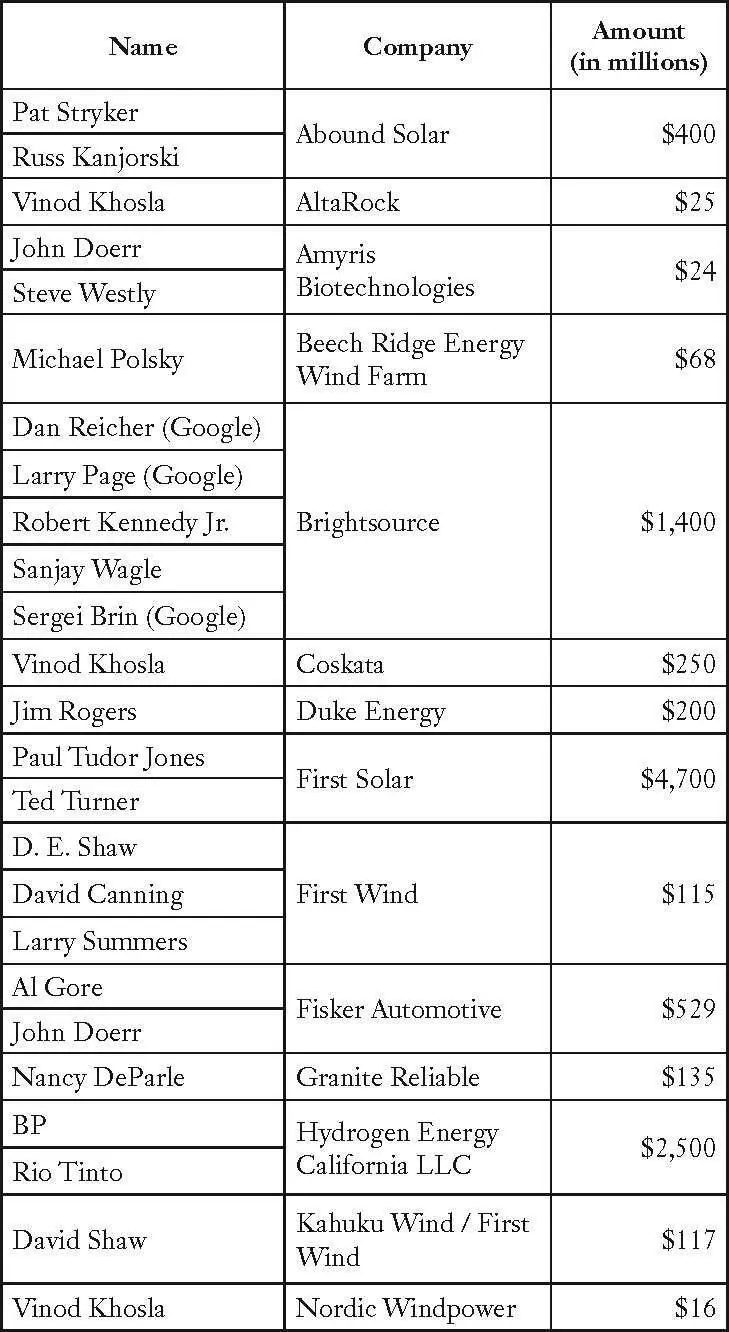

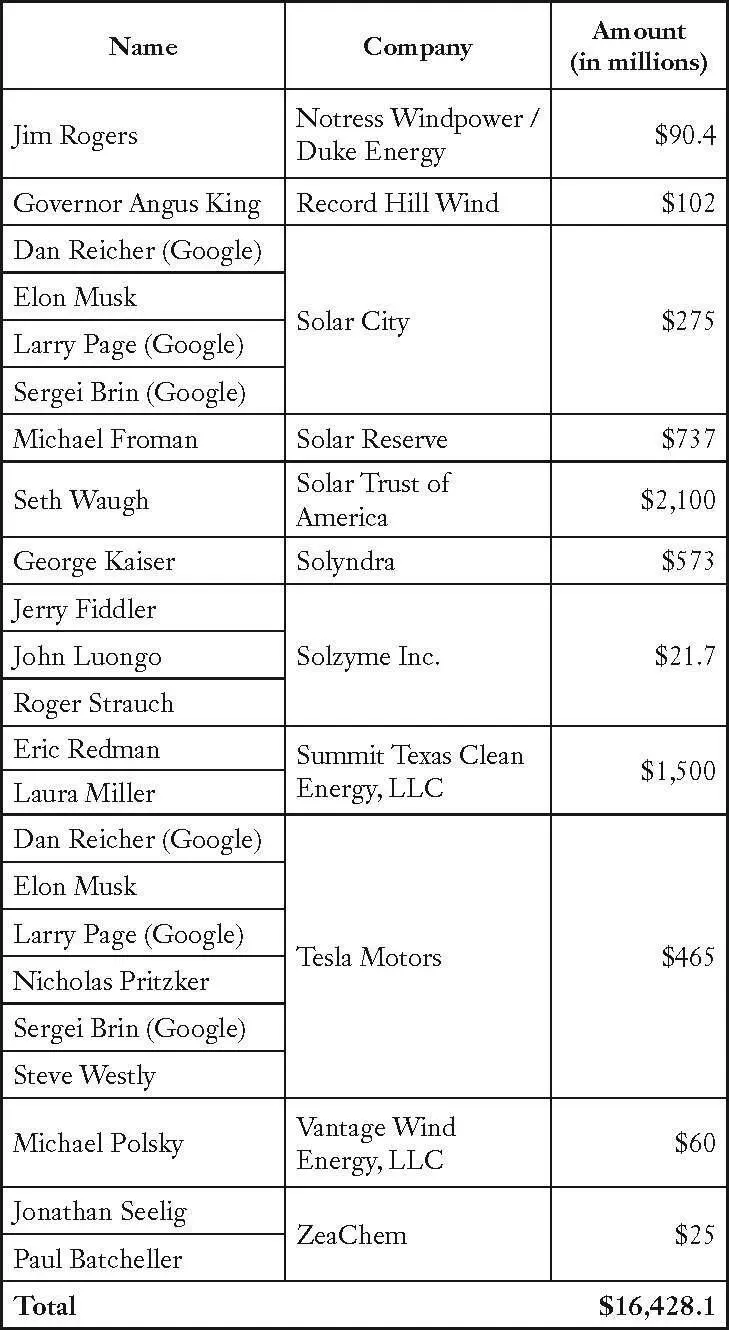

Obama Bundlers, Large Donors, and Supporters

(as of September 15, 2011)

"The Secretary shall require as a condition of receiving funding under this subsection that demonstration projects utilize open protocols and standards if available and appropriate." 42This language had several Silver Spring competitors crying foul. According to Ed Gray, vice president of regulatory affairs for the smart-meter competitor Elster, the insistence on "open protocols" gave a leg up to Silver Spring at the expense of other providers. Some smart-grid companies rely on other types of standards or use proprietary technology in parts of their smart-grid networks. Silver Spring does not. And Silver Spring seemed not at all defensive about the move. "There's going to be a lot of people complaining," one executive told USA Today. "Leadership is helping people adapt to uncomfortable realities." 43

Читать дальше