What Hinchey didn't mention was that he owned a quarter of the land that sits under the Partition Street project, which calls for the development of a three-story, thirty-room boutique hotel with a restaurant and catering hall.

Hinchey had bought two lots there in 2004 for a combined value of between $30,000 and $100,000. As the earmarked project got under way, the value of his properties surged to more than five times their original value. By the time of his 2009 financial disclosure, he listed their value as between $250,000 and $500,000. Incredulously, when asked about the project and the earmark, Hinchey said it was not a conflict of interest. He merely owns the land, he said, and has no direct involvement in the development of the property. 18Okay. That explains it.

Sometimes members of the Permanent Political Class can enhance the value of their real estate by using a third party. Congressman Jerry Lewis of California has served in the House since 1979, representing three different Southern California districts in the course of three decades (thanks to redistricting). The Republican was chairman of the House Appropriations Committee and is now a senior member of that committee.

Over the past ten years, Lewis has pushed earmarks for a private company called Environmental Systems Research Institute, to the tune of tens of millions of dollars. The firm is based in Redlands, California, and was founded by Jack and Laura Dangermond, who are campaign contributors of Lewis's. In 2001, after receiving the benefits of numerous earmarks from Lewis, the Dangermonds decided to donate 41 pristine acres of land directly across from Lewis's house as part of a scenic canyon. The donation was made to the city of Redlands, and was contingent on its never being developed. Naturally, that gift increased the property value of Lewis's home. 19In another instance, Lewis secured a $500,000 earmark to upgrade the Barracks Row section of Capitol Hill in Washington. (Some of that money was used to plant flowers.) On the House floor, Lewis explained that he was a firm supporter of beautifying that area. What he never mentioned was that he and his wife owned a $1 million house four blocks away. 20

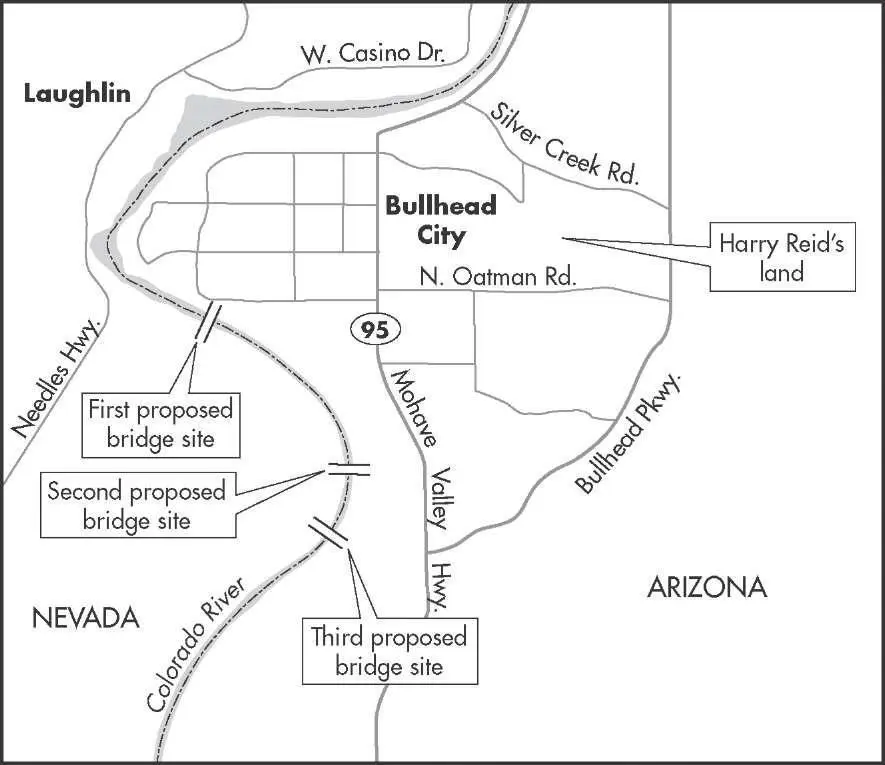

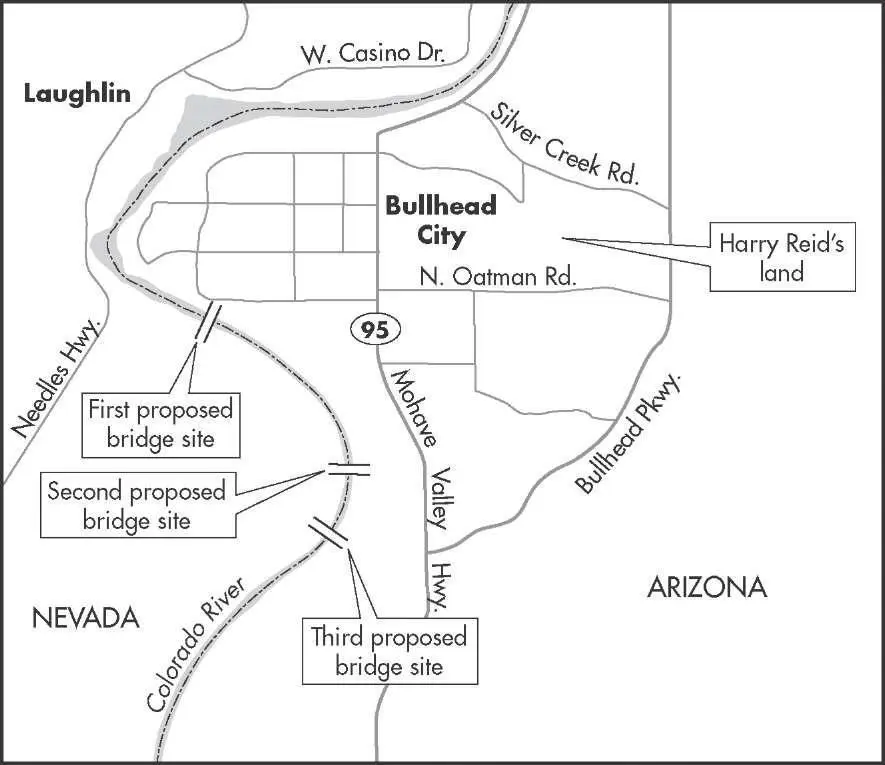

Another one of those politicians who has seen his wealth rise in recent years is Senate Majority Leader Harry Reid of Nevada. Reid doesn't trade a lot of stocks, but he does buy and trade land. And he is often able to boost the profits from his investments by the use of the power of his office. In 2005, Senator Reid sponsored an $18 million earmark to build a bridge over the Colorado River to connect Laughlin, Nevada, with Bullhead City, Arizona. (There was already one bridge connecting the two places.) Neighboring Arizona's two senators denounced the earmark as pork, and a completely unnecessary expenditure.

As it happened, a few miles from the proposed bridge there was a 160-acre parcel of land owned by, well, Harry Reid. Local officials predicted that the bridge would "undoubtedly hike land values in an already-booming commuter town, where speculators are snapping up undeveloped land for housing developments and other projects." Reid's office insisted that "Senator Reid's support for the bridge had absolutely nothing to do with property he owns." 21Of course.

LOCATION, LOCATION, LOCATION

Reid has done very well with land deals over the years. In 1998, he bought undeveloped residential property just outside Las Vegas for about $400,000. In 2001, he sold it to a friend (Jay Brown, a longtime casino lawyer) for a stake in a limited liability company that held the property. Reid never reported the transaction on his financial disclosure form. By moving the property to the LLC, he could effectively shield it from future disclosures, because now the LLC was technically the owner, not him. All he had to disclose was that he had a stake in the company.

The LLC tried to get the land rezoned from residential to commercial, which would make it far more valuable, submitting its request to the appropriate subcommittee of the Clark County Zoning Commission. The answer was no: rezoning would be "inconsistent" with the Clark County Master Development Plan. (The subcommittee's no vote was 4 to 1.) Brown and Reid then took it to the full Clark County Commission. Reid's name even came up at the hearings. "Mr. Brown's partner is Harry Reid," commissioners were told.

Did I mention that at this time Clark County commissioners were trying to obtain federal earmarks for a variety of projects through Harry Reid's office? Or that Reid had funneled tens of millions of dollars in earmarks to Clark County over the years?

The commission granted the rezoning. Shortly thereafter, Reid and Brown sold the land to a shopping center developer for $1.6 million. Reid's personal take was $1.1 million. 22

Leveraging your power for a land deal is one of the best paths to honest graft. It's difficult to determine the actual market price of most properties, so disclosure statements can be murky. And when an earmarked project improves the value of the property, it can be hard to calculate just how much that new road, transit stop, or beautification added to it. But there can be little doubt that the political class is the only group of people in America who can get away with using taxpayer money to increase the value of their real estate, while declaring they are doing it in the public's interest.

Part Two

CAPITALIST CRONIES

In Part One we looked at the various ways politicians use their power to get rich, or richer than they were when they entered office. The temptation to seize an opportunity—a stock tip, or the power of legislation—is pervasive. But there is a broader, more subtle motivation as well: politicians are surrounded by wealthy friends and donors who use their access to power to enrich themselves. If all of your friends are using you to get rich, wouldn't you want a piece of the action?

In Part Two we will look at the semiprivate sector: businessmen and investors who get rich through their political connections, tilting the playing field of the free market by lobbying for handouts. Just as with the insider trading and land deals in Part One, there is nothing illegal about this aspect of crony capitalism. Unfair, perhaps unethical, perhaps immoral—but not illegal. It would take a revolution in the mindset and the rules of the game in Washington to put a stop to it. But the least we can do is pull back the curtain and bring some sunlight into the dark rooms of the crony game.

5. SPREADING THE WEALTH ... TO BILLIONAIRES

God bless the Obama Administration and the U.S. government. We have really got the A-team now working on green innovation in our country.

—JOHN DOERR, Obama contributor and billionaire investor, who owns a large stake in sixteen companies that have received government loans or grants

IN THE AUDACITY OF HOPE, Barack Obama tells a story about visiting Los Angeles in 2000: His credit card was declined by a rental car company. It was a "very dry period" for his law firm, and he was devoting most of his energy to his work as a state senator. Then suddenly a wealthy political donor named Robert Blackwell agreed to pay him a $112,000 legal retainer over a fourteen-month period.

But here's what Obama failed to note in his book, and what came to light only later, thanks to investigative reporting: State Senator Obama subsequently helped Blackwell's table tennis company receive $320,000 in Illinois tourism grants to subsidize a state Ping-Pong tournament. 1

Читать дальше