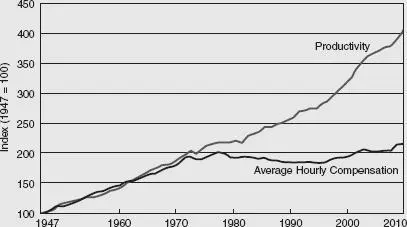

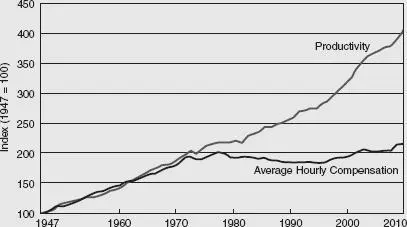

The reason why the Leisure Society could be imagined by TIME magazine is because, ever since 1900, working people’s wages tracked evenly with working people’s productivity.

PRODUCTIVITY VS. WAGE GROWTH, 1947–2010 66

Source: Economic Policy Institute analysis of Bureau of Economic Analysis and Bureau of Labor Statistics data.

So, as productivity continued to rise, which was likely, due to increasing automation and better technology, so, too, would everyone’s wages. And the glue holding this logic together was the current top marginal income tax rate.

In 1966, when the TIME article was written, the top marginal income tax rate was 70 percent. And what that effectively did was encourage CEOs to keep more money in their businesses, to invest in new technology, to pay their workers more, to hire new workers and expand.

After all, what’s the point of sucking millions and millions of dollars out of your business if it’s going to be taxed at 70 percent?

According to this line of reasoning, if businesses were to suddenly become way more profitable and efficient thanks to automation, then that money would flow throughout the business—raising everyone’s standard of living, increasing everyone’s leisure time.

But when Reagan dropped that top tax rate down to 28 percent, everything changed. Now as businesses became far more profitable, there was a far greater incentive for CEOs to pull those profits out of the company and pocket them, because they were suddenly paying an incredibly low tax rate.

And that’s exactly what they did.

All those new profits, thanks to automation, that were supposed to go to everyone, giving us all higher paychecks and more time off, went to the top—to the Economic Royalists.

Suddenly, the symmetry in the productivity/wages chart broke down. Productivity continued increasing since technology continued improving.

But wages stayed flat.

And, again, since higher and higher profits could be sucked out of the company and taxed at lower levels, there was no incentive to reduce the number of hours everyone had to work.

In the 1950s, before that TIME magazine article predicting the Leisure Society was written, the average American working in manufacturing put in about forty-two hours of work a week.

Today, the average American working in manufacturing puts in about forty hours of work a week. This means that despite the fact that productivity has increased 400 percent since 1950, Americans are working, on average, only two fewer hours a week.

If productivity is four times higher today than in 1950, then Americans should be able to work four times less, or just ten hours a week, to afford the same 1950s lifestyle when a family of four could get by on just one paycheck, own a home, own a car, put their kids through school, take a vacation every now and then, and retire comfortably.

That’s the definition of the Leisure Society: ten hours of work a week, and the rest of the time spent with family, with travel, with creativity, with whatever you want.

But all of this was washed away by the Reagan tax cuts.

Combine this with Reagan’s brutal crackdown on striking PATCO (Professional Air Traffic Controllers Organization) members that kicked off a three-decades-long assault on another substantial pillar of the middle class—organized labor—and life has been anything but “leisurely” for working people in America.

Instead of leisure, working people got feudalism.

As a result of the Reagan tax cuts, that era from 1947 to 1979, in which all classes of Americans saw their incomes grow together, ended. A new era, in which only the wealthiest among us got rich off a booming economy, commenced.

According to census data, the typical hourly wage for an American worker increased a mere $1.23 over the past thirty-six years, after accounting for inflation. From 1979 to 2008, the middle 20 percent of Americans saw their incomes grow only 11 percent. That’s compared with a 111 percent growth in the thirty years prior.

The poorest 20 percent of Americans, meanwhile, saw their incomes actually decrease by 7 percent between 1979 and 2008. In the thirty years prior, their incomes had grown by 118 percent.

Meanwhile, with the wonders of automation and Reagan’s tax cuts, the top 1 percent have seen their incomes increase by 275 percent since Reagan’s election (and it’s much higher for the top 0.1 percent and massively higher for the top 0.01 percent).

Today, workers’ wages as a percentage of GDP are at an all-time low. Yet, corporate profits as a percentage of GDP are at an all-time high.

The top 1 percent of Americans own 40 percent of the nation’s wealth. In fact, just 400 Americans own more wealth than 150 million other Americans combined.

Wal-Mart Stores, the world’s largest private employer, personifies this inequality best. It’s a corporation that in 2011 brought in more revenue than any other corporation in America. It raked in $16.4 billion in profits. It pays its employees minimum wage.

And the Wal-Mart heirs, the Walton family, occupy positions 6 through 9 on the Forbes 400 Richest People in America list, own roughly $100 billion in wealth, which is more than the bottom 40 percent of Americans combined. The average Wal-Mart employee would have to work 76 million forty-hour weeks to have as much wealth as one Wal-Mart heir.

Through some interesting historical analysis, historians Walter Schiedel and Steven Friesen calculated that inequality in America today is worse than what was seen during the Roman era.

So the Royalists, just like the Roman emperors, got their Leisure Society.

But there was an extra benefit for the Royalists buried in the politics of the Reagan tax cuts.

In his First Inaugural Address in 1981, Ronald Reagan warned of a debt crisis.

“For decades, we have piled deficit upon deficit, mortgaging our future and our children’s future for the temporary convenience of the present,” he said. 67

“To continue this long trend is to guarantee tremendous social, cultural, political, and economic upheavals.”

At the time, the national debt was a bit under $1 trillion. As a result primarily of his tax cuts, he tripled the national debt to about $3 trillion. He added more to our national debt than every single president before him, from George Washington to Jimmy Carter, combined.

In his Farewell Address to the nation in 1989, Ronald Reagan said the high deficits throughout his administration were one of his regrets. But no Republican since has regretted adding more and more debt.

Reagan’s successor, President George H. W. Bush, added more than a trillion dollars more. And his son, George W. Bush, added more than $6 trillion.

Since Reagan, Republican presidents have combined to add nearly $10 trillion to our national debt.

And yet, each devoted their inaugural addresses to promising to lower deficits and reduce the national debt. Republican politicians, in the spirit of Reagan, have even resorted to alarmism, talking about a “debt crisis,” while at the same time pushing for budget-busting tax cuts for the rich.

This could be written off as run-of-the-mill political flip-flopping and pandering. But it’s not. There’s a cunning political strategy behind it.

Starting with FDR’s big win in 1936, with the lone exception of the two-year “Do-Nothing Congress” elected in 1946, Republicans never held a majority in the House of Representatives until 1995. This period coincided with the banishment of the Economic Royalists as well.

Читать дальше